AbCellera Biologics And 2 Other Promising Penny Stocks To Watch

The market has climbed by 2.0% over the past week, with every sector up, and in the last year, it has risen by 12%, showcasing a robust performance. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer intriguing opportunities for growth. With strong financial foundations, these stocks have the potential to outperform and provide stability; here we explore three such promising options that stand out as hidden gems in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.81 | $185.36M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.02 | $174.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.37 | $55.78M | ✅ 1 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NYSE:NRT) | $5.00 | $46.69M | ✅ 2 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.80 | $98.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $5.00 | $22.04M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.83536 | $5.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.15 | $74.64M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $1.03 | $33.27M | ✅ 4 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $1.98 | $34.27M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 725 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

AbCellera Biologics (NasdaqGS:ABCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AbCellera Biologics Inc. focuses on discovering and developing antibody-based medicines for unmet medical needs in the United States, with a market cap of approximately $602.94 million.

Operations: The company generates its revenue from the discovery and development of antibodies, amounting to $23.11 million.

Market Cap: $602.94M

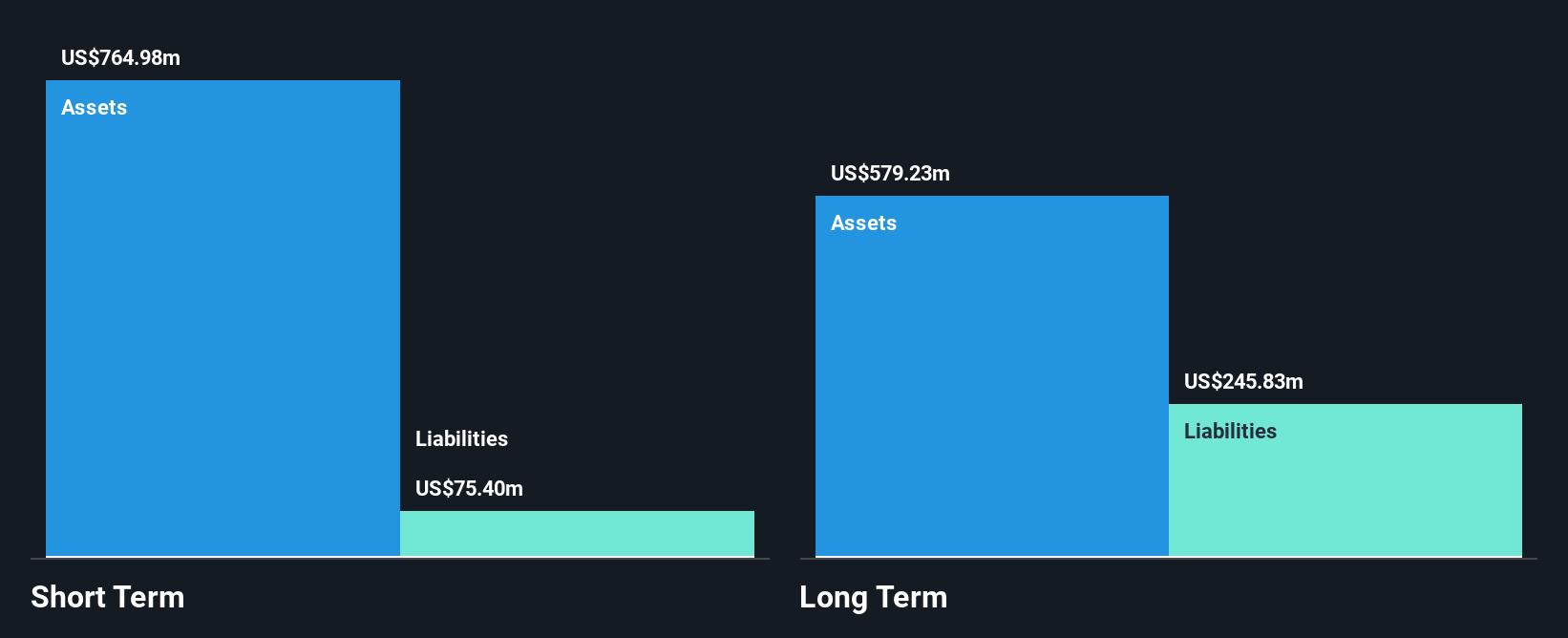

AbCellera Biologics, with a market cap of US$602.94 million, is navigating the biotech landscape by advancing its pipeline despite current unprofitability and increasing losses over the past five years. Recent product-related announcements highlight its progress in developing antibody-based treatments for conditions such as atopic dermatitis and menopause-related vasomotor symptoms, with Phase 1 trials set to commence soon. The company remains debt-free, with substantial short-term assets exceeding liabilities, providing financial stability amidst ongoing R&D efforts. Legal victories affirming patent validity further strengthen its intellectual property position in the competitive biotech sector.

- Jump into the full analysis health report here for a deeper understanding of AbCellera Biologics.

- Assess AbCellera Biologics' future earnings estimates with our detailed growth reports.

Conduent (NasdaqGS:CNDT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conduent Incorporated offers digital business solutions and services across the commercial, government, and transportation sectors globally, with a market cap of approximately $362.50 million.

Operations: The company's revenue is derived from three main segments: Commercial ($1.59 billion), Government ($942 million), and Transportation ($575 million).

Market Cap: $362.5M

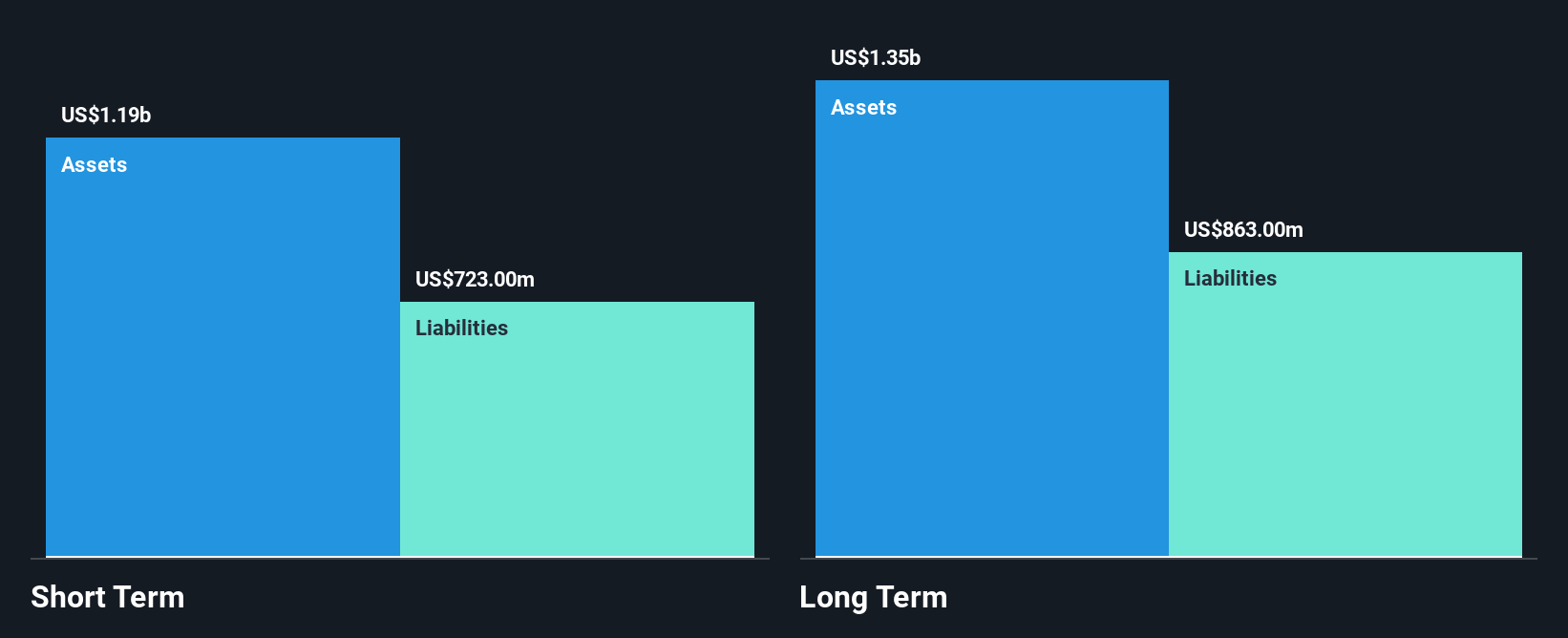

Conduent Incorporated, with a market cap of US$362.50 million, has recently become profitable but faces challenges as earnings are forecast to decline significantly over the next three years. Despite this, the company maintains a satisfactory net debt to equity ratio and its short-term assets exceed both short and long-term liabilities. Recent contracts, such as those with NJ TRANSIT and Ireland's Health Service Executive, highlight Conduent's strategic partnerships in transportation and public health sectors. However, recent earnings reports show a decline in sales and profitability compared to the previous year, reflecting ongoing financial volatility.

- Dive into the specifics of Conduent here with our thorough balance sheet health report.

- Understand Conduent's earnings outlook by examining our growth report.

GoodRx Holdings (NasdaqGS:GDRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoodRx Holdings, Inc. operates in the United States providing tools for consumers to compare prices and save on prescription drugs, with a market cap of approximately $1.50 billion.

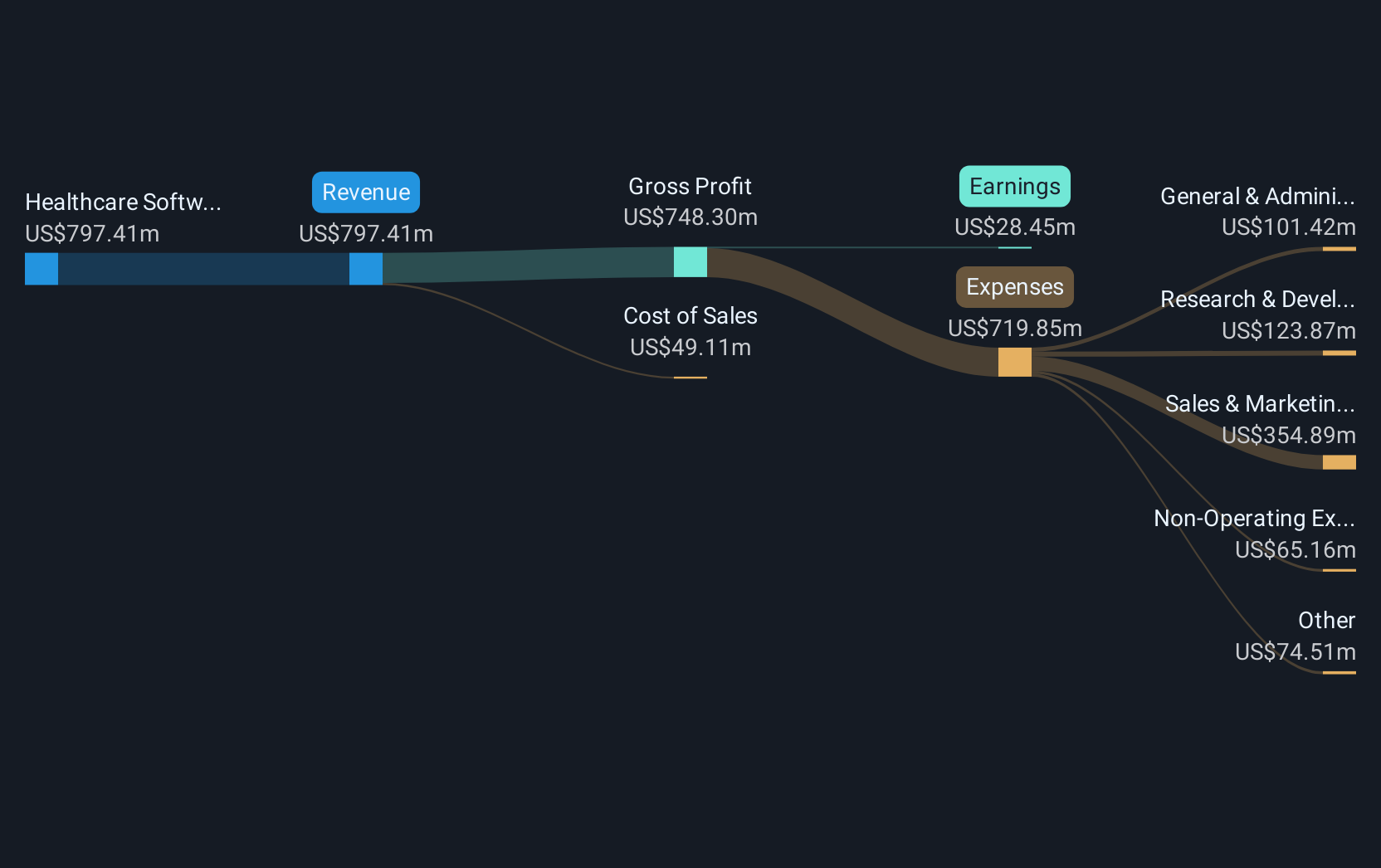

Operations: The company's revenue is primarily derived from its Healthcare Software segment, which generated $797.41 million.

Market Cap: $1.5B

GoodRx Holdings, with a market cap of US$1.50 billion, has recently achieved profitability and reported Q1 2025 sales of US$202.97 million, up from the previous year. The company maintains a satisfactory net debt to equity ratio and its short-term assets cover both short and long-term liabilities. Recent initiatives like GoodRx Community Link aim to enhance partnerships with independent pharmacies through direct pricing control, while new e-commerce solutions streamline prescription fulfillment processes for consumers and retail partners alike. Despite a one-off loss impacting recent results, GoodRx's strategic moves indicate ongoing efforts to strengthen its market position.

- Click to explore a detailed breakdown of our findings in GoodRx Holdings' financial health report.

- Learn about GoodRx Holdings' future growth trajectory here.

Summing It All Up

- Reveal the 725 hidden gems among our US Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal