Undiscovered Gems in the US Market for June 2025

The United States market has shown a steady upward trend, climbing by 2.0% over the past week and achieving a 12% increase over the last year, with earnings forecasted to grow by 14% annually. In this environment, identifying stocks that are not only positioned for growth but also remain under the radar can offer unique opportunities for investors seeking to capitalize on emerging potential within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

World Acceptance (NasdaqGS:WRLD)

Simply Wall St Value Rating: ★★★★★☆

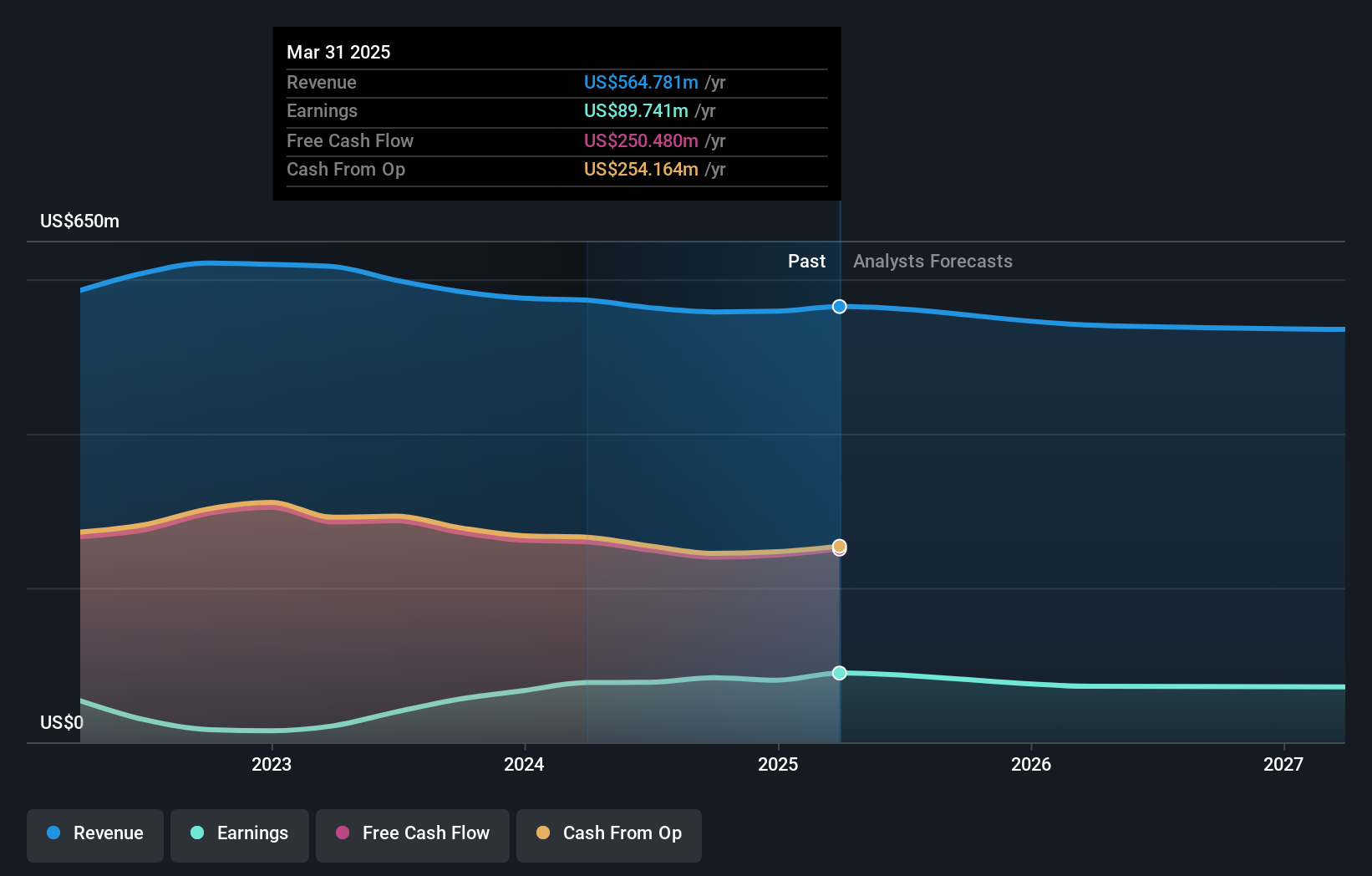

Overview: World Acceptance Corporation operates in the consumer finance sector within the United States and has a market capitalization of $795.20 million.

Operations: World Acceptance generates revenue primarily from its consumer finance operations, totaling $564.78 million. The company's financial performance is influenced by various operational costs and expenses that affect its profitability metrics such as net profit margin.

World Acceptance, a smaller player in consumer finance, has shown resilience with earnings up 16% over the past year and a debt-to-equity ratio reduced to 101.7%. With its interest payments well covered by EBIT at 3.6x, the company is also generating positive free cash flow. Recent strategic moves include a credit card pilot and focus on smaller loans for higher yields, which could boost earnings per share (EPS). However, insider selling and high debt levels remain concerns. The firm’s recent buyback of shares worth $24.6 million reflects confidence in its valuation amid these dynamics.

Alexander & Baldwin (NYSE:ALEX)

Simply Wall St Value Rating: ★★★★☆☆

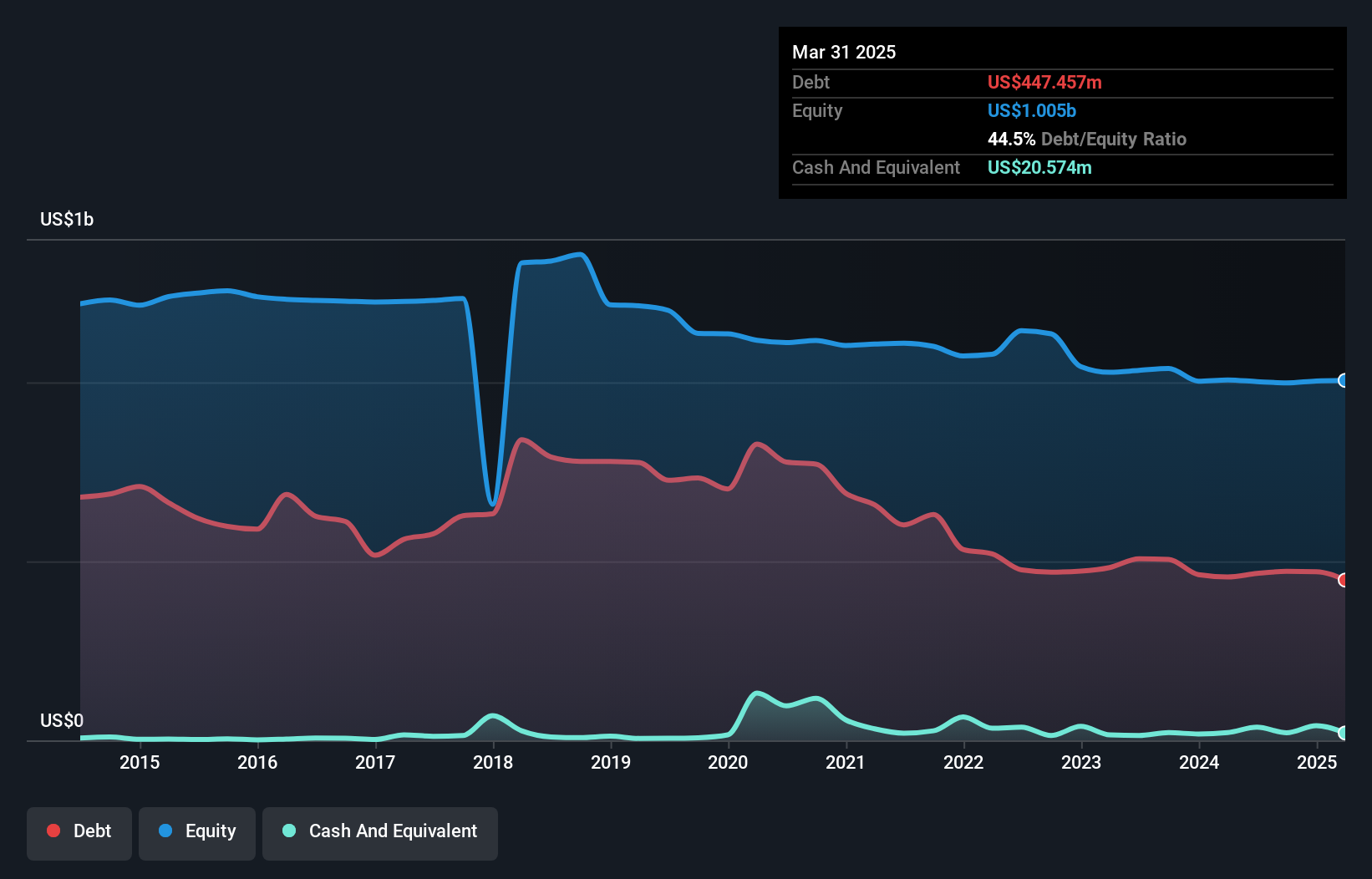

Overview: Alexander & Baldwin, Inc. (NYSE: ALEX) is a real estate investment trust specializing in Hawai'i commercial real estate, with a market cap of approximately $1.30 billion.

Operations: A&B generates revenue primarily from its Commercial Real Estate segment, which accounts for $199.54 million, complemented by Land Operations contributing $29.66 million.

Alexander & Baldwin, a key player in Hawaii's commercial real estate scene, is making strategic moves with a focus on enhancing rental income and equity investments. Over the past year, earnings surged by 26%, outpacing the REIT industry average of 4%. The company's debt to equity ratio has improved significantly from 74% to 45% over five years. Despite challenges like macroeconomic uncertainties and tenant lease contingencies, Alexander & Baldwin's interest payments are well-covered by EBIT at 3.8 times. Trading at about 41% below estimated fair value, it offers potential upside despite projected revenue declines of around 8% annually for three years.

Build-A-Bear Workshop (NYSE:BBW)

Simply Wall St Value Rating: ★★★★★★

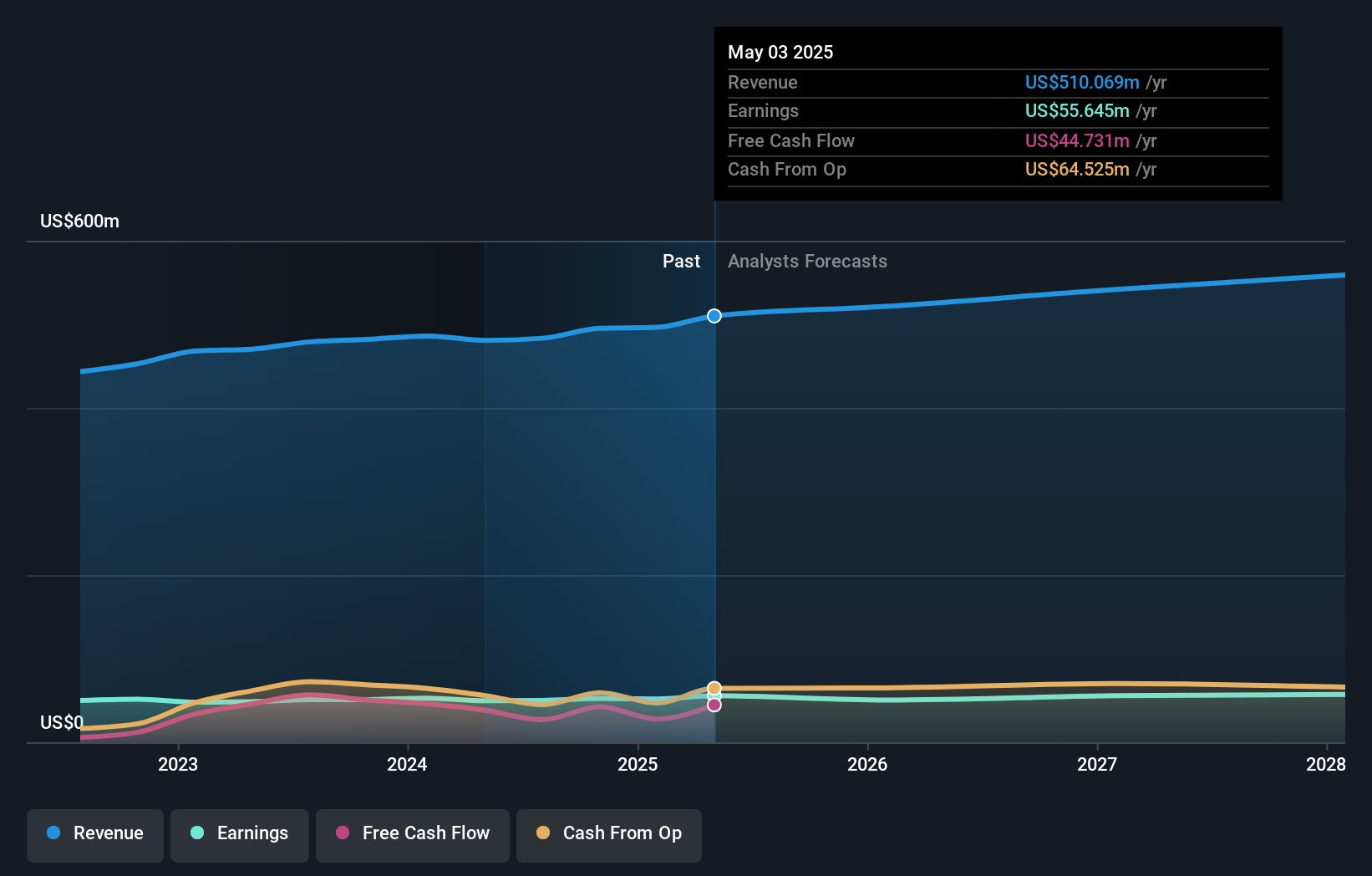

Overview: Build-A-Bear Workshop, Inc. is a multi-channel retailer specializing in plush animals and related products across the United States, Canada, the United Kingdom, Ireland, and other international markets with a market capitalization of $659.19 million.

Operations: The company generates revenue primarily from its Retail segment, which accounts for $472.05 million, followed by Commercial at $33.03 million and International Franchising at $5 million.

Build-A-Bear Workshop, a player in experiential retail, is making strides with its international expansion and digital transformation. The company plans to open 50 new stores this year, primarily through partnerships, which could bolster its global footprint. Recent earnings showed a revenue increase to US$128.4 million from US$114.73 million last year, while net income rose to US$15.32 million from US$11.46 million. Additionally, the company repurchased 108,502 shares for $4.2 million in the past quarter as part of a broader buyback strategy initiated in late 2024. Despite inflationary pressures and potential e-commerce slowdowns posing challenges to profit margins—currently at 10%—Build-A-Bear's strategic initiatives and share repurchase efforts suggest confidence in its growth trajectory amidst an evolving retail landscape.

Turning Ideas Into Actions

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 286 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal