IPO Preview | 5th largest digital retail solution provider Kaijie Electronics: Performance has declined year after year

The fifth largest digital retail solution provider in China continued to decline in the trillion dollar incremental market. Profits were not optimistic. Kaijie Electronics went public in Hong Kong with “weak” performance.

The Zhitong Finance App learned that Kaijie Electronics recently submitted a listing application to the main board of the Hong Kong Stock Exchange, with CITIC Construction Investment International as the sole sponsor. According to information, the company is committed to providing full-link and omni-channel digital retail solutions for high-quality global brands. According to GMV in 2024, the company is the fifth largest digital retail solution provider and the largest O2O digital retail solution provider in China.

Kaijie Electronics' performance was not good, showing a continuous downward trend. From 2022 to 2024, the compound revenue growth rate was -3.65%, and the compound profit growth rate during the year was -16.47%.

The revenue structure was adjusted, but the decline in performance was not reversed

The Zhitong Finance App learned that Kaijie Electronics was founded in 2010 to provide full-link solutions to high-quality global brands in various industries. Up to now, it has served more than 200 brands, including more than 100 international brands, covering food and beverage, beauty and personal care, baby, fashion, pets, health and outdoor sports industries and chain companies, and also provides retail chain brands and outdoor sports services.

The company sells products through To-C and To-B models. In 2024, To-C and To-B revenue were 974 million yuan and 582 million yuan respectively, with revenue shares of 57.3% and 34.3% respectively. Revenue from the To-C business has declined year after year, which has dragged down overall performance, mainly due to the slump in the infant sector, which was greatly affected by the decline in the birth rate. However, the To-B business grew. The compound revenue growth rate from 2022 to 2024 was 6.6%, and the revenue share increased by 6.3 percentage points.

It is worth noting that the company's customer concentration is relatively scattered, but suppliers are concentrated. In 2024, the top five customers contributed 26.6% of revenue, of which the largest customer contributed 21.7%, while the top five suppliers accounted for 52.6% of purchases, the largest supplier accounted for 23.8%, and showed an upward trend. In addition, there is some overlap between customers and suppliers, and supplier customers contributed 23.1% of revenue in 2024.

Due to declining performance, stagnant sales performance, and dependence on suppliers, including the double dependence of some suppliers as customers, the ability to price purchases and sales is relatively weak. This has also caused the profitability of Kaijie Electronics to continue to decline.

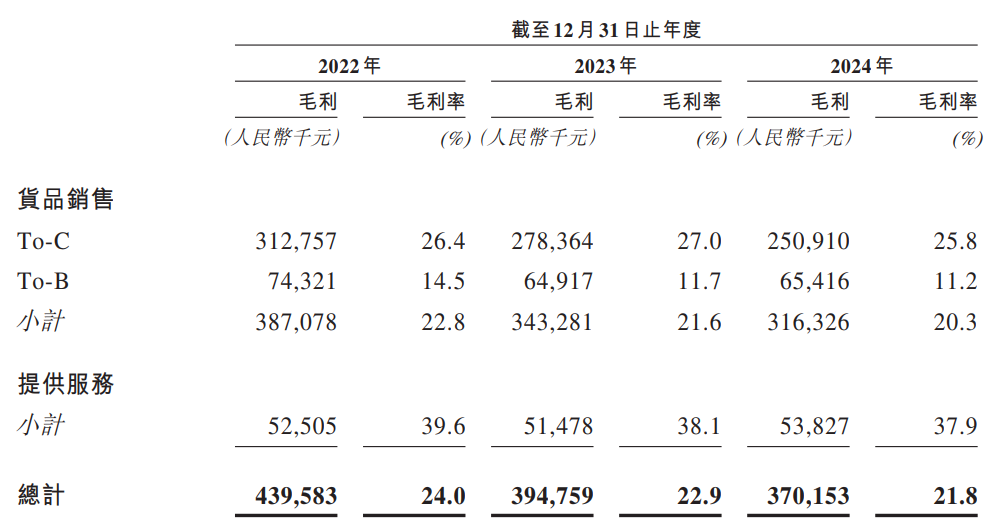

Judging from the data, whether it is the To-C and To-B business that sells products or the business that provides services, profitability is on a downward trend. The overall gross margin in 2024 was 21.8%, down 2.2 percentage points from 2022. Among them, To-C and To-B gross margins were 25.8% and 11.2% respectively, down 0.6 percentage points and 3.3 percentage points respectively; the cost ratio declined steadily during the period, 17.5%, down 1.1 percentage points. It can be seen that profitability was mainly affected by gross profit. Net during the period year Interest rates fell 1.1 percent to 3.6 percent.

Photo source: Company hearing materials

Obviously, the revenue restructuring has not improved the fundamentals of Kaijie Electronics, and the expected increase in performance depends more on the B-side. However, the biggest problem currently is that the B-side revenue growth rate is only in units, and the decline in profit is obvious. Judging from the dependence on brand cooperation, the current downward trend in performance is difficult to reverse in the short term.

In order to enhance the competitiveness of the industry, the company invests a large amount of resources in R&D plans, focusing on establishing a fully integrated smart e-commerce platform to expand our technical base and help brand partners achieve digital transformation. It also actively invests in AI construction and empowerment. Its solutions are integrated with self-developed business systems and internal OA systems to achieve differentiated AI application systems, thereby improving online digitalization and AI penetration and comprehensively enhancing digital intelligence capabilities.

Up to now, the company has 35 professionals responsible for the design, development and operation of technology platforms. R&D expenses are 11.3 million yuan, but there is a downward trend. It has 169 registered trademarks, 38 software copyrights, 20 copyrights, and 2 work patents in China. As of March 2025, the company had cash and equivalents of $281 million. Also affected by declining profitability, net operating cash flow decreased year by year, to 82 million yuan in 2024.

The industry is growing steadily, and Kaijie is not optimistic about going off track

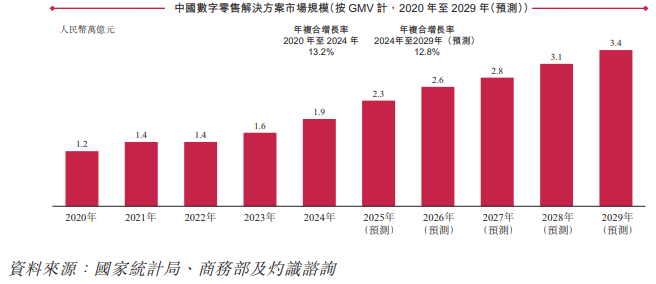

Kaijie Electronics' performance is far below the industry level. According to Insight Consulting, China's digital retail market size in 2024 was 13.9 trillion yuan, the compound growth rate in the past five years was 11.8%, and the last three years were 12.92%, while China's digital retail solutions market size was 1.9 trillion yuan. The compound growth rate for the past five years and 16.5% in the past three years was 13.2% and 16.5% respectively. Looking at the growth rate of the past three years, the growth rate of the above industries was 16.57 percentage points and 20.15 percentage points higher than that of the company.

According to the data, China's retail industry accounts for nearly 40% of the gross domestic product, and the industry space is huge. Among them, Insight Consulting predicts that China's digital retail solutions market will reach 34,000 yuan by 2029, which is equivalent to an increase of 1.5 trillion yuan in market size over 5 years.

However, not every participant can eat this huge market growth. China's digital retail solutions market is vast and highly fragmented, and competition is fierce. According to data from Insight Consulting, according to GMV, the top five market participants together account for about 10% of the total market share. Among them, Kaijie Electronics ranked fifth with a market share of 1%. The decline in the company's performance means that its market share is being lost.

In fact, Kaijie Electronics is transforming in the direction of an industrial platform, and changes in the C-side and B-side revenue structures can also be confirmed. This also reflects the company's business response strategy under current industry competition.

As mentioned above, the company has a certain dependence on the top five suppliers, especially overlapping customers with supplier characteristics. This weakens the company's right to take delivery. This may also be the main reason why the company's B-side profit margin continues to decline. However, the company increased investment in platform R&D and AI technology to improve the platform's service competitiveness, thereby attracting more brand partners. In 2024, it had 113 brand partners, an increase of 33 in three years.

Overall, although Kaijie Electronics ranks fifth in market share, the competitiveness of the industry is relatively weak under a highly fragmented industry competition pattern. Revenue restructuring has failed to effectively reverse the downward trend in performance, and the high dependency of suppliers may further limit the room for future profit growth. However, the prospects for the industry are very promising. There are opportunities for participants in the trillion-dollar incremental market, but it will also lead to increased competition and accelerated industry clearance.

Kaijie Electronics actively integrates into the AI era, integrates self-developed systems to create competitive advantages for differentiated AI applications, and is trying to fully empower the business to reverse performance and market competitiveness, but the results will still take time to verify.

Wall Street Journal

Wall Street Journal