3 European Dividend Stocks Offering Up To 8.1% Yield

As European markets navigate the complexities of trade negotiations and shifting inflation expectations, investors are increasingly focusing on dividend stocks as a potential source of income amid economic uncertainties. In such an environment, selecting dividend stocks with strong fundamentals and attractive yields can provide a stable income stream while potentially offering some protection against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.29% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.82% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.37% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.98% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.18% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.91% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.79% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.35% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.61% | ★★★★★★ |

Click here to see the full list of 238 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

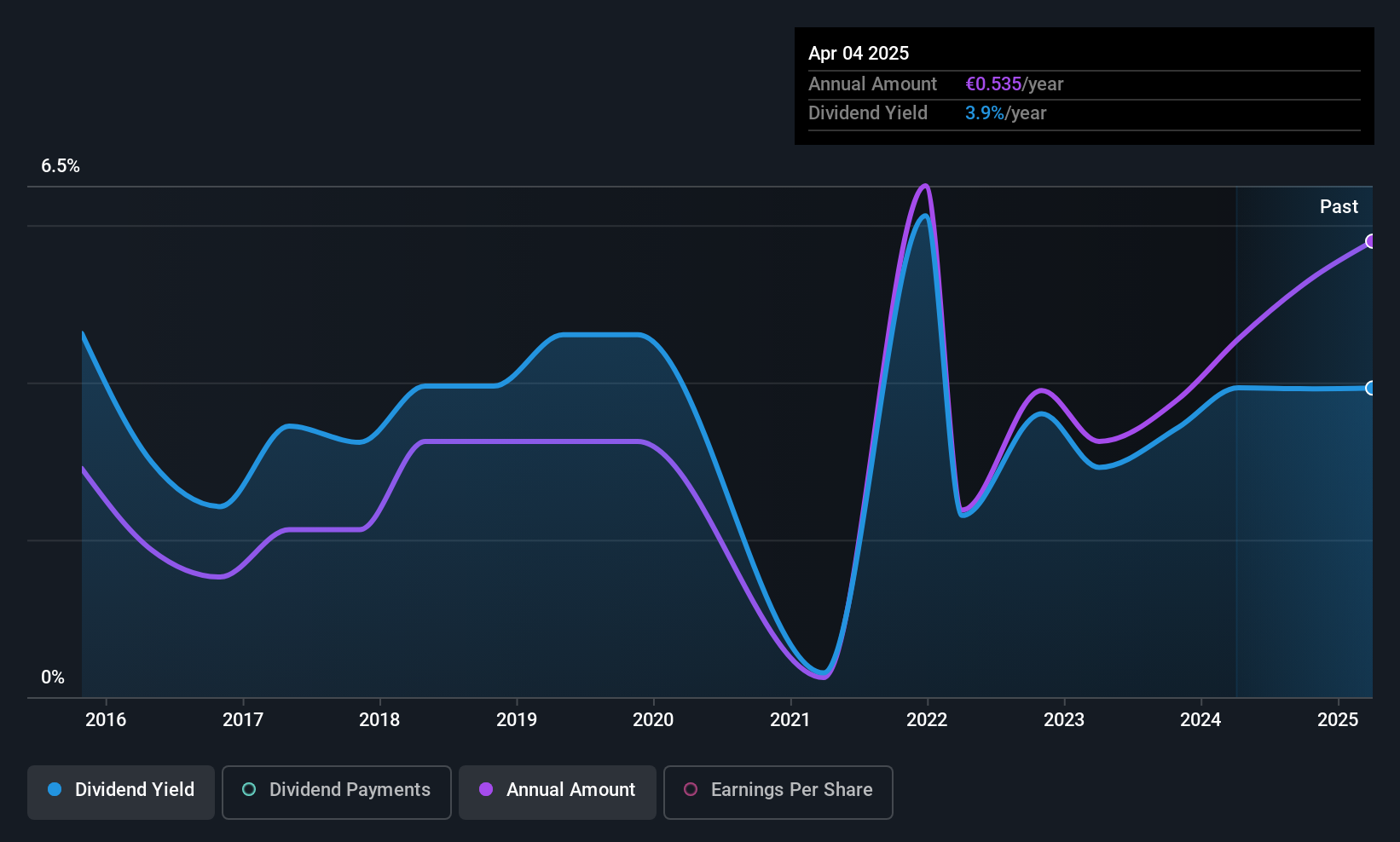

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe, with a market cap of €658.92 million.

Operations: Clínica Baviera, S.A. generates its revenue primarily from its ophthalmology segment, which accounts for €265.72 million.

Dividend Yield: 3.8%

Clínica Baviera's dividend payments are covered by both earnings and cash flows, with payout ratios of 63.6% and 69.3%, respectively, indicating sustainability despite a historically volatile dividend track record. Recent earnings growth of 22.1% per year over five years supports future payouts, although the current yield of 3.81% is below Spain's top quartile for dividends. The stock trades at a discount to its estimated fair value, which may appeal to value-focused investors.

- Click here to discover the nuances of Clínica Baviera with our detailed analytical dividend report.

- Our valuation report unveils the possibility Clínica Baviera's shares may be trading at a discount.

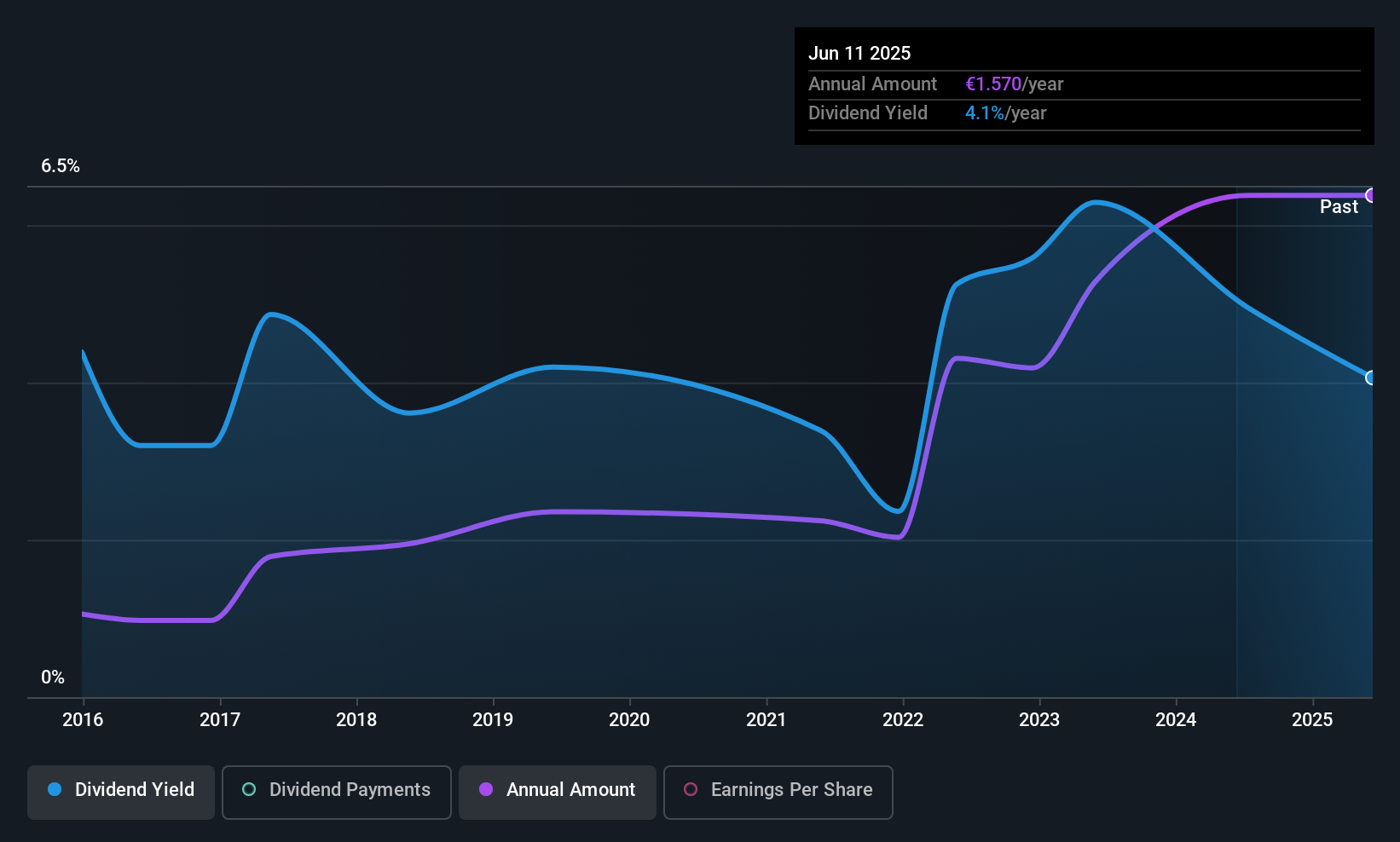

Renta 4 Banco (BME:R4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Renta 4 Banco, S.A. operates in wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market capitalization of €577.84 million.

Operations: Renta 4 Banco, S.A. generates revenue through its wealth management, brokerage, and corporate advisory services across Spain and international markets.

Dividend Yield: 3.8%

Renta 4 Banco's dividend payments are supported by earnings and cash flows, with payout ratios of 67.7% and 4.6%, respectively, suggesting sustainability despite a history of volatility over the past decade. While dividends have grown, their reliability remains questionable due to past fluctuations. The dividend yield of 3.77% is lower than the top quartile in Spain, but the stock's price-to-earnings ratio (18x) is below the Spanish market average, offering potential value for investors.

- Take a closer look at Renta 4 Banco's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Renta 4 Banco is trading beyond its estimated value.

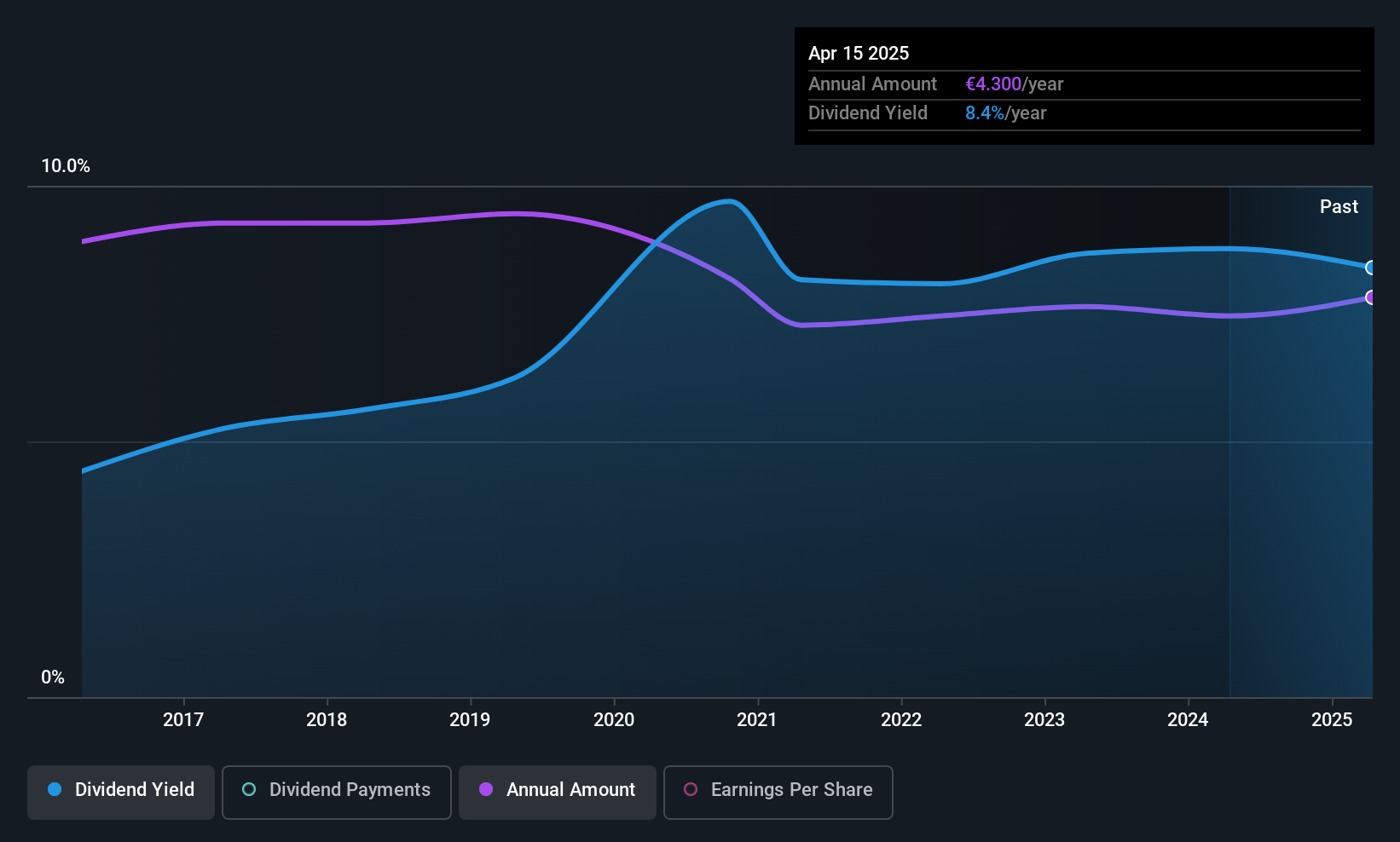

Wereldhave Belgium (ENXTBR:WEHB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wereldhave Belgium is a public regulated real estate company specializing in commercial property within Belgium, with a market cap of €492.08 million.

Operations: Wereldhave Belgium generates its revenue from two main segments: Retail, which contributes €62.55 million, and Offices, which adds €5.66 million.

Dividend Yield: 8.2%

Wereldhave Belgium offers a high dividend yield of 8.17%, placing it among the top 25% in Belgium, although its dividend history has been unreliable over the past decade. The company's dividends are covered by both earnings and cash flows, with payout ratios of 64% and 70.7%, respectively, indicating sustainability. Despite stable dividends per share recently, past payments have declined. Currently trading at a significant discount to estimated fair value, WEHB may present an attractive opportunity for dividend-focused investors.

- Navigate through the intricacies of Wereldhave Belgium with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Wereldhave Belgium is priced lower than what may be justified by its financials.

Taking Advantage

- Click this link to deep-dive into the 238 companies within our Top European Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal