Top UK Penny Stocks To Watch In June 2025

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies heavily reliant on the Chinese economy. Despite these broader market pressures, certain investment opportunities remain attractive, particularly within the realm of penny stocks. Although "penny stocks" may seem like an outdated term, they continue to represent smaller or newer companies that can offer significant growth potential at lower price points when backed by strong fundamentals and solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.77 | £285.64M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.35 | £170.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £4.75 | £383.74M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.98 | £448.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.385 | £422.77M | ✅ 2 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.86 | £1.16B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.982 | £156.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 398 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

dotdigital Group (AIM:DOTD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: dotdigital Group Plc provides intuitive software as a service (SaaS) and managed services for digital marketing professionals globally, with a market cap of £257.75 million.

Operations: The company's revenue is derived entirely from its data-driven omni-channel marketing automation services, totaling £82.59 million.

Market Cap: £257.75M

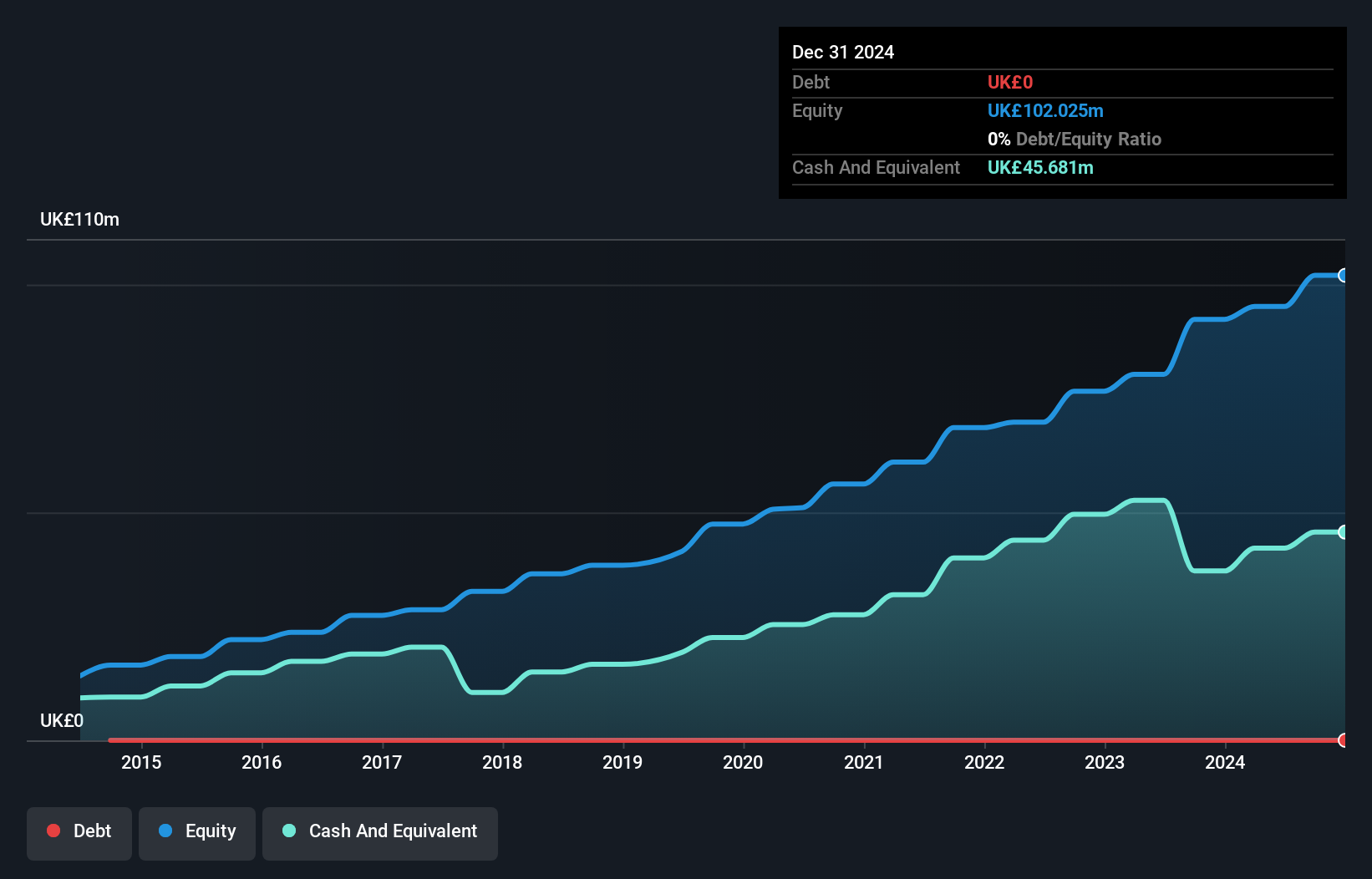

Dotdigital Group, with a market cap of £257.75 million, offers data-driven omni-channel marketing automation services generating £82.59 million in revenue. Despite its low Return on Equity (11.1%), the company boasts high-quality earnings and stable weekly volatility (6%). It trades at good value compared to peers and is debt-free, with short-term assets exceeding liabilities significantly. However, recent negative earnings growth (-6.7%) contrasts with industry trends, though forecasts suggest a 10.98% annual profit growth rate. A new CFO appointment brings extensive experience in SaaS business model evolution and international expansion, potentially steering future strategic direction positively.

- Get an in-depth perspective on dotdigital Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into dotdigital Group's future.

Eleco (AIM:ELCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eleco plc offers software and related services across the United Kingdom, Scandinavia, Germany, other parts of Europe, the United States, and internationally with a market cap of £134.97 million.

Operations: The company generates revenue of £32.39 million from its software segment.

Market Cap: £134.97M

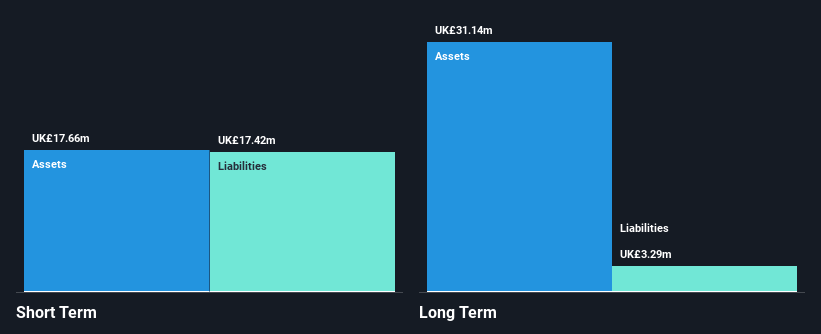

Eleco plc, with a market cap of £134.97 million, has demonstrated robust financial health by maintaining a debt-free status and achieving significant earnings growth of 25.6% over the past year, outpacing both its five-year average and industry performance. Its short-term assets comfortably cover both short and long-term liabilities, underscoring strong liquidity. The company reported sales of £32.39 million for 2024, with net income rising to £3.33 million from the previous year’s £2.66 million. Eleco's board is experienced with an average tenure of 3.2 years, supporting strategic stability amid increasing dividend payouts by 25%.

- Unlock comprehensive insights into our analysis of Eleco stock in this financial health report.

- Evaluate Eleco's prospects by accessing our earnings growth report.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, along with its subsidiaries, specializes in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China, with a market capitalization of approximately £1.21 billion.

Operations: The company's revenue is primarily derived from the United Kingdom at £1.95 billion, with additional contributions from the United States at £227.7 million and China at £116.5 million.

Market Cap: £1.21B

Bakkavor Group, with a market cap of £1.21 billion, has shown steady financial performance despite some challenges. The company reported revenue of £2.29 billion for 2024, primarily from the UK market. Its earnings have grown by 7.7% annually over five years but recently slowed to 4.2%. Although Bakkavor's debt is well-covered by operating cash flow and interest payments are manageable, short-term assets do not cover liabilities fully, indicating liquidity concerns. A proposed acquisition by Greencore Group highlights potential strategic shifts; however, Bakkavor rejected initial offers due to valuation disagreements before agreeing on terms in May 2025 for potential completion in early 2026.

- Take a closer look at Bakkavor Group's potential here in our financial health report.

- Gain insights into Bakkavor Group's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Dive into all 398 of the UK Penny Stocks we have identified here.

- Want To Explore Some Alternatives? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal