European Dividend Stocks To Watch In June 2025

As European markets navigate a landscape marked by easing inflation and the potential for interest rate cuts, investors are closely monitoring opportunities in dividend stocks. In such an environment, stocks that offer consistent dividend payouts can provide a measure of stability and income, making them appealing to those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.29% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.82% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.37% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.98% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.18% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.91% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.79% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.35% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.61% | ★★★★★★ |

Click here to see the full list of 238 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

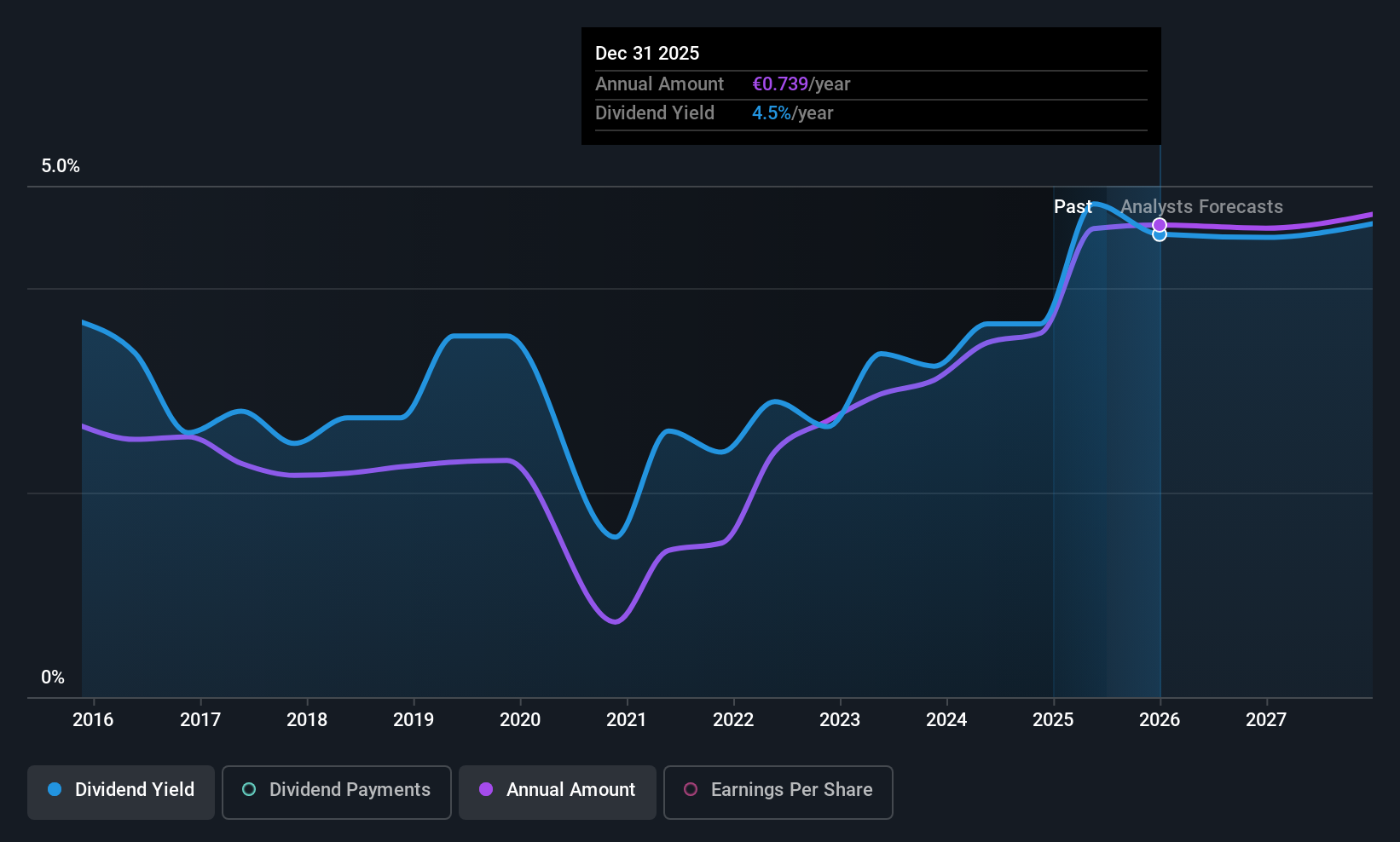

Tenaris (BIT:TEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tenaris S.A. is a global manufacturer and supplier of steel pipe products and related services for the energy industry and other industrial applications, with a market cap of €16.62 billion.

Operations: Tenaris generates its revenue primarily from its Tubes segment, which accounted for $11.38 billion.

Dividend Yield: 4.7%

Tenaris offers a mixed dividend profile with payments well covered by earnings and cash flows, evidenced by payout ratios of 50.9% and 42.5%, respectively. Despite a recent dividend increase to US$0.83 per share, its yield is lower than the top tier in Italy, and its track record remains volatile over the past decade. Recent financials show declining earnings, but strategic buybacks totaling US$1.89 billion may support shareholder value amidst capital restructuring efforts.

- Click here and access our complete dividend analysis report to understand the dynamics of Tenaris.

- In light of our recent valuation report, it seems possible that Tenaris is trading behind its estimated value.

Fleury Michon (ENXTPA:ALFLE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleury Michon SA produces and sells food products in France and internationally, with a market cap of €109.87 million.

Operations: Fleury Michon's revenue is primarily derived from its Division GMS France segment at €677.94 million and its International Division at €100.62 million.

Dividend Yield: 5.1%

Fleury Michon's dividend profile shows potential, with a recent increase to €1.33 per share and strong coverage by earnings (41.6% payout ratio) and cash flows (23.6% cash payout ratio). However, its dividends have been volatile over the past decade, lacking reliability despite a low price-to-earnings ratio of 8.2x compared to the French market average of 15.5x. Recent financials highlight improved net income (€47.8 million), yet sales declined slightly to €807 million from €836.2 million last year.

- Navigate through the intricacies of Fleury Michon with our comprehensive dividend report here.

- The analysis detailed in our Fleury Michon valuation report hints at an deflated share price compared to its estimated value.

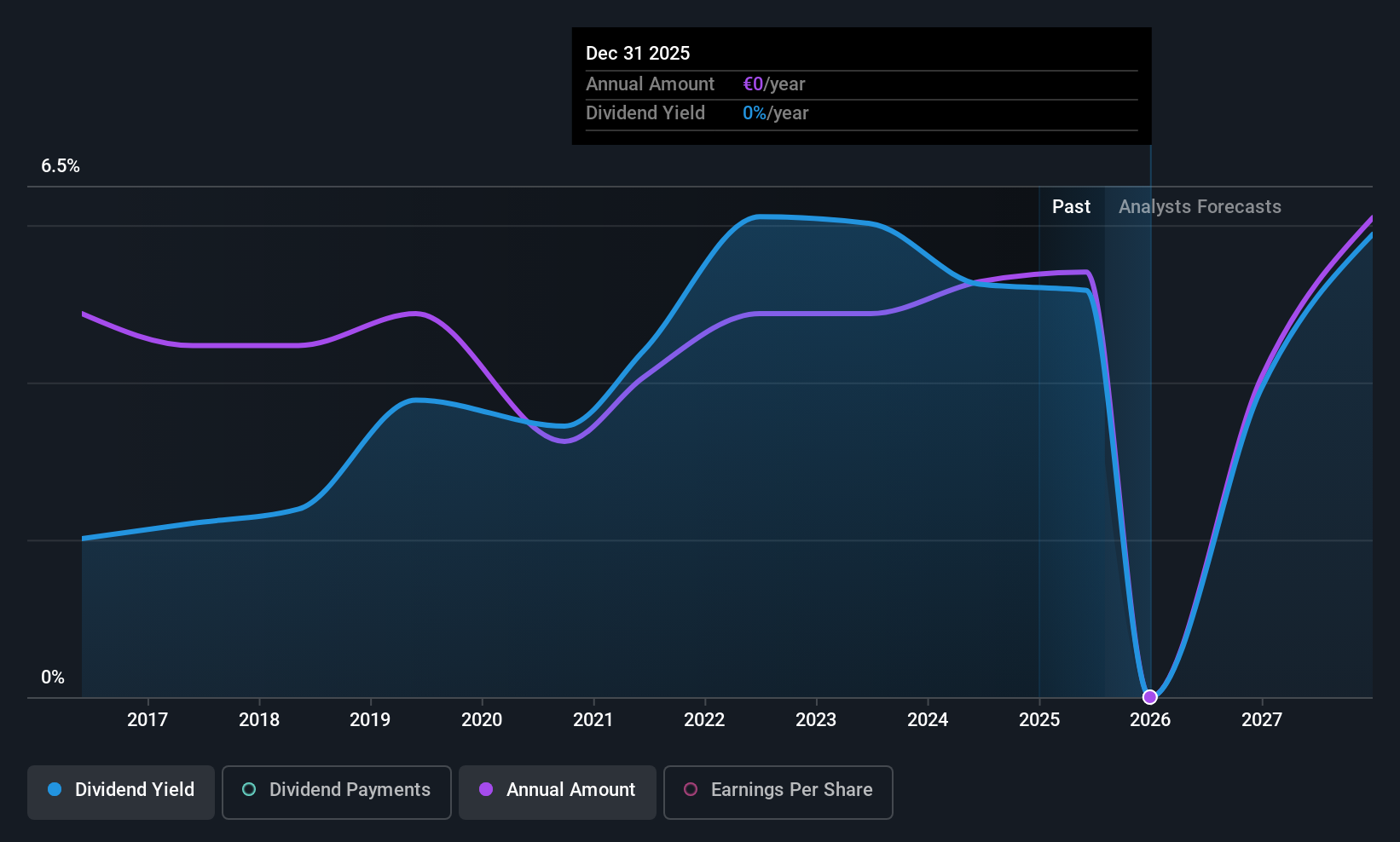

Sparebanken Møre (OB:MORG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sparebanken Møre, with a market cap of NOK5.30 billion, offers banking services to both retail and corporate customers in Norway through its subsidiaries.

Operations: Sparebanken Møre generates its revenue primarily from retail banking (NOK1.06 billion), corporate banking (NOK877 million), and real estate brokerage (NOK51 million) segments in Norway.

Dividend Yield: 5.9%

Sparebanken Møre's dividend profile is mixed, with recent earnings showing a decline in net income to NOK 232 million. Despite trading 37.5% below estimated fair value and having a sustainable payout ratio of 63.3%, its dividends have been volatile over the past decade, lacking reliability. Future dividends are expected to remain covered by earnings, though its low allowance for bad loans (64%) and lower-than-top-tier yield (5.85%) may concern investors seeking stability.

- Delve into the full analysis dividend report here for a deeper understanding of Sparebanken Møre.

- Our expertly prepared valuation report Sparebanken Møre implies its share price may be lower than expected.

Key Takeaways

- Click here to access our complete index of 238 Top European Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal