Johnson & Johnson (NYSE:JNJ) Unveils Promising Prostate Cancer Data With Pasritamig

Johnson & Johnson (NYSE:JNJ) recently announced promising Phase 1 study results for Pasritamig, a novel antibody for advanced prostate cancer, which may have influenced its stock's 1.5% rise last week. The study highlights, including a favorable safety profile and potential efficacy in disease control, likely garnered positive investor sentiment. Nevertheless, the company's stock movement is congruent with broader market trends, as the market climbed 1.7% over the same period, likely minimizing singular impacts from the announcement. This aligns with an optimistic market environment, despite prevailing trade tensions affecting global stocks recently.

The recent progress in Johnson & Johnson's (NYSE:JNJ) Pasritamig antibody trial could potentially bolster the company's narrative of growth in immunology and oncology sectors. Although forming part of a broader market uptrend, the 1.5% share price increase may signal investor confidence in the company's R&D strength, which aligns with the US$55 billion investment in breakthrough therapies. Over the past five years, Johnson & Johnson has delivered a total shareholder return of 21.88%, showing robust long-term performance, though recent one-year performance has lagged compared to the wider US Pharmaceuticals industry downturn of 10.6%.

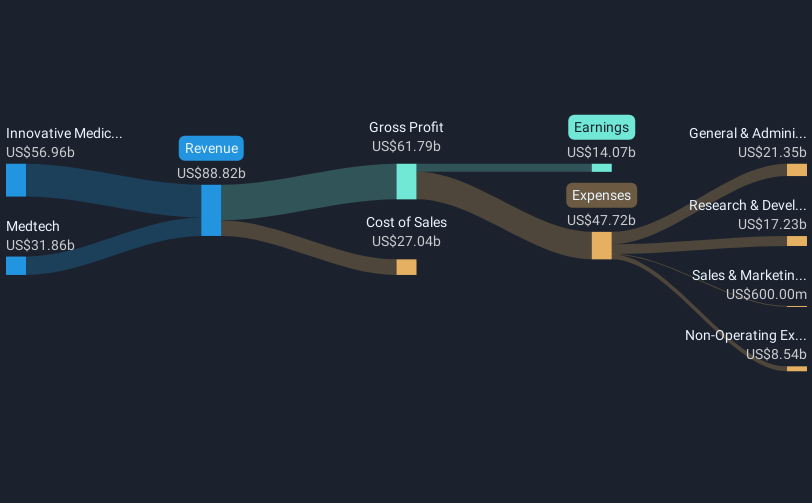

This new development could influence revenue and earnings forecasts, as success in advancing Pasritamig may solidify future growth projections, particularly as the company navigates potential revenue erosion from loss of drug exclusivity. Analysts anticipate revenue growth at 3.7% annually over the next three years, with earnings reaching US$22.9 billion by 2028. The stock's current price remains around US$154.47, reflecting a 9.1% discount to the analysts' consensus price target of US$169.98, indicating room for upside should growth materialize as expected.

Take a closer look at Johnson & Johnson's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal