Here's Why Babcock International Group (LON:BAB) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Babcock International Group (LON:BAB). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Babcock International Group's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Babcock International Group to have grown EPS from UK£0.065 to UK£0.38 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

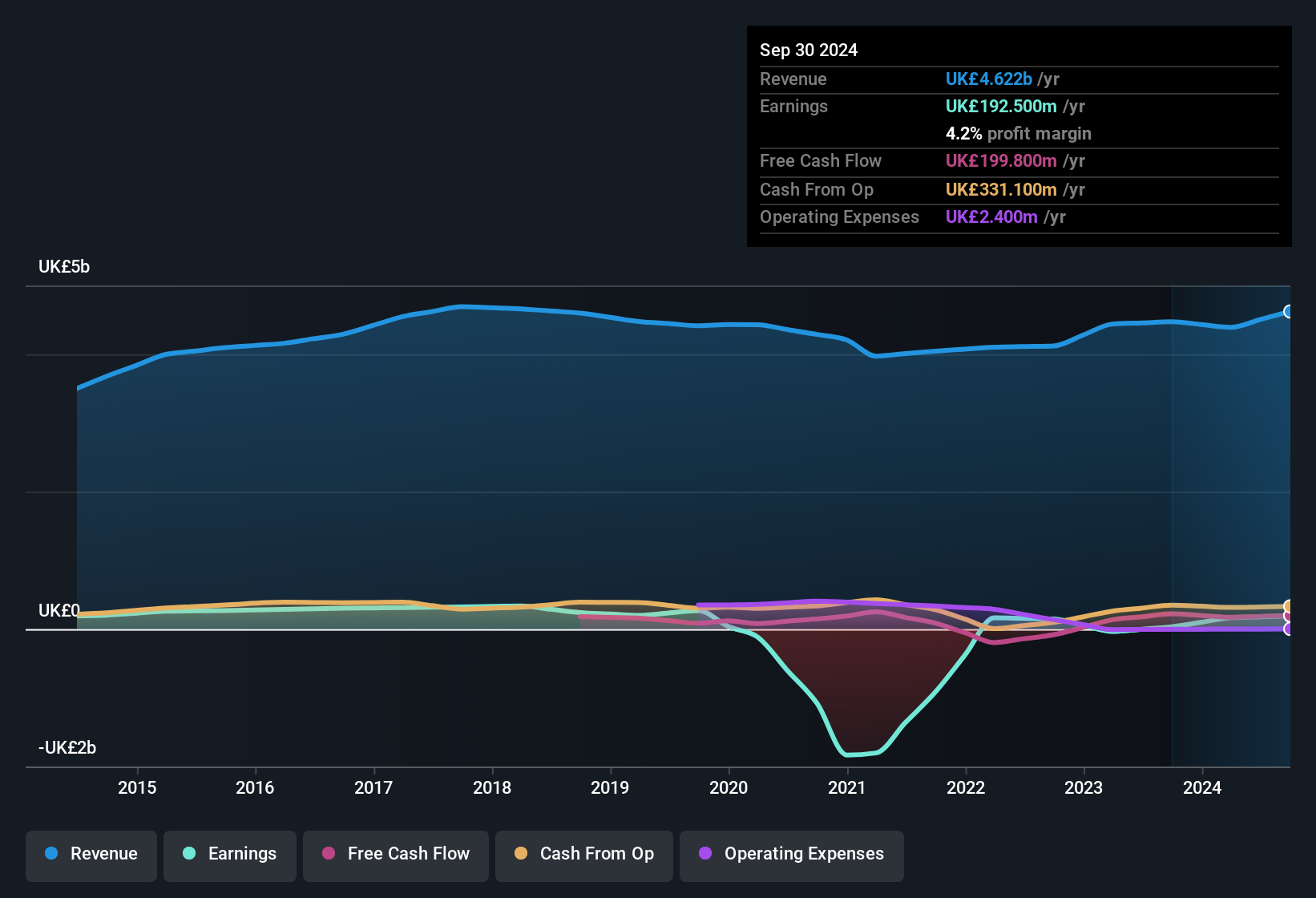

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Babcock International Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.4% to UK£4.6b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Check out our latest analysis for Babcock International Group

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Babcock International Group's future profits.

Are Babcock International Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Babcock International Group top brass are certainly in sync, not having sold any shares, over the last year. But the real excitement comes from the UK£50k that Independent Non-Executive Director John Ramsay spent buying shares (at an average price of about UK£4.96). Purchases like this clue us in to the to the faith management has in the business' future.

On top of the insider buying, it's good to see that Babcock International Group insiders have a valuable investment in the business. As a matter of fact, their holding is valued at UK£13m. This considerable investment should help drive long-term value in the business. Despite being just 0.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Babcock International Group Deserve A Spot On Your Watchlist?

Babcock International Group's earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Babcock International Group belongs near the top of your watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Babcock International Group.

The good news is that Babcock International Group is not the only stock with insider buying. Here's a list of small cap, undervalued companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal