Jones Lang LaSalle Incorporated (NYSE:JLL) Might Not Be As Mispriced As It Looks

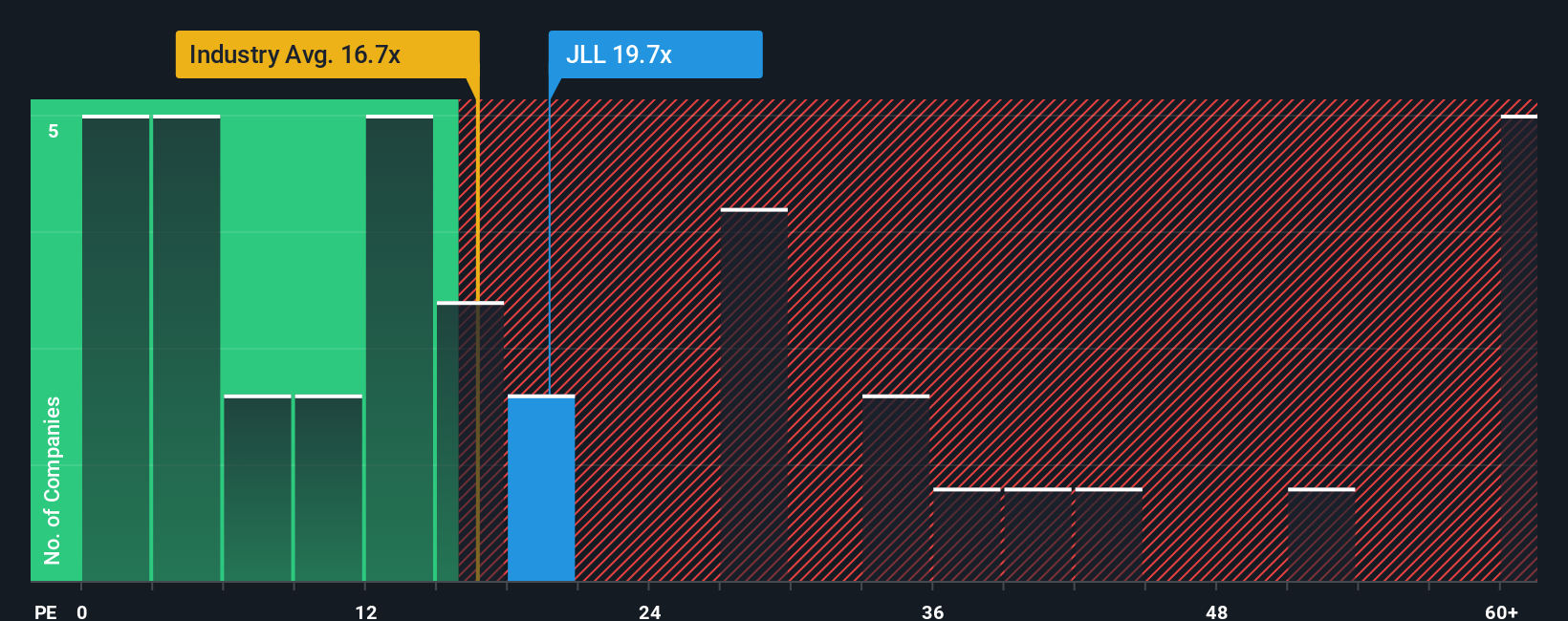

With a median price-to-earnings (or "P/E") ratio of close to 18x in the United States, you could be forgiven for feeling indifferent about Jones Lang LaSalle Incorporated's (NYSE:JLL) P/E ratio of 19.7x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Jones Lang LaSalle has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Jones Lang LaSalle

Is There Some Growth For Jones Lang LaSalle?

There's an inherent assumption that a company should be matching the market for P/E ratios like Jones Lang LaSalle's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 79%. However, this wasn't enough as the latest three year period has seen a very unpleasant 43% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 24% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 10% each year, which is noticeably less attractive.

In light of this, it's curious that Jones Lang LaSalle's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Jones Lang LaSalle's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jones Lang LaSalle currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Jones Lang LaSalle with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal