learnd SE (ETR:LRND) Stock's 34% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the learnd SE (ETR:LRND) share price has dived 34% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

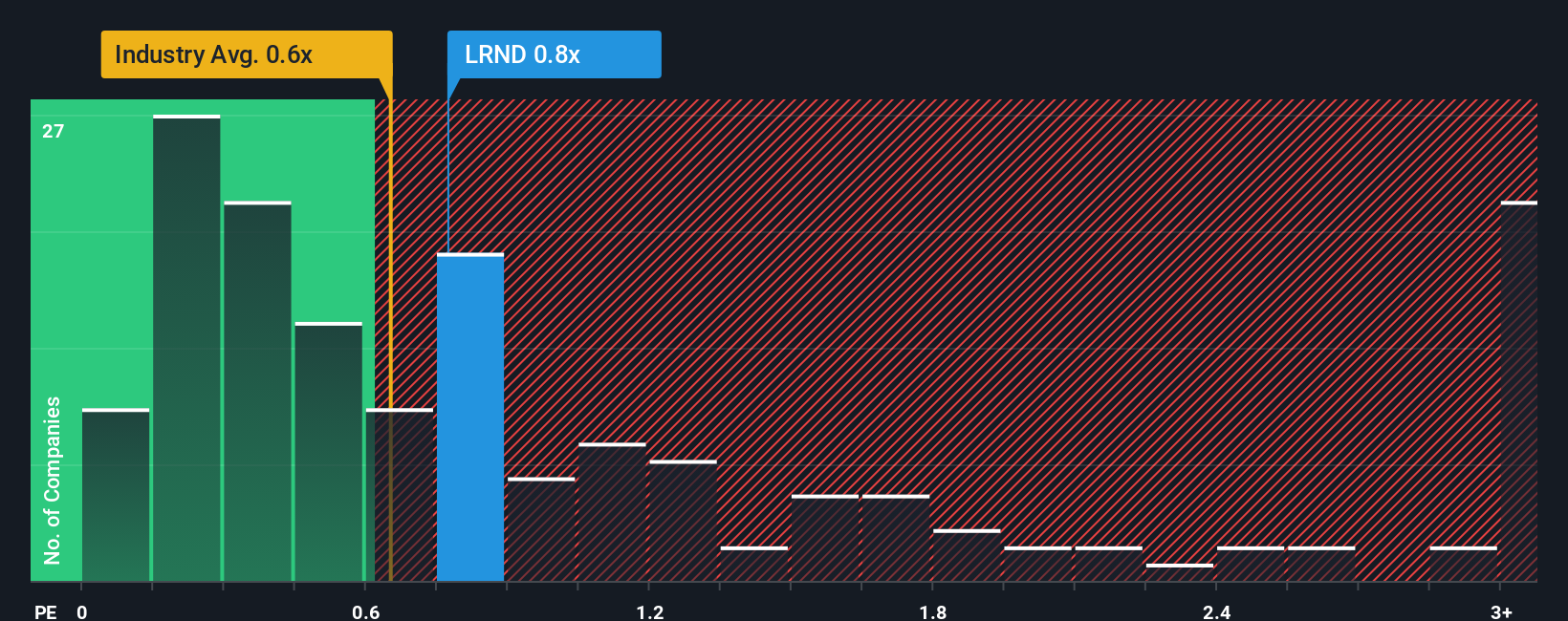

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about learnd's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Germany is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for learnd

What Does learnd's Recent Performance Look Like?

Recent revenue growth for learnd has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on learnd.How Is learnd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like learnd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 68% last year. Pleasingly, revenue has also lifted 104% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 4.5% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that learnd's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From learnd's P/S?

learnd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that learnd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 6 warning signs for learnd (of which 5 can't be ignored!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal