Danaher (NYSE:DHR) Partners With AstraZeneca To Advance Precision Medicine Diagnostics

Danaher (NYSE:DHR) recently announced a collaboration with AstraZeneca to develop innovative diagnostic tools, possibly adding momentum to its 1.59% share price increase over the past week. However, this uptick aligns with the broader market gain of 1.2%, suggesting the partnership likely provided additional support rather than being a sole driver. Broader market sentiment was influenced by global trade developments and economic data indicating moderated inflation. Despite Danaher's ongoing risk acknowledgments, including economic and regulatory challenges, its strategic endeavors continue to bolster investor confidence alongside parallel positive market trends.

We've discovered 1 possible red flag for Danaher that you should be aware of before investing here.

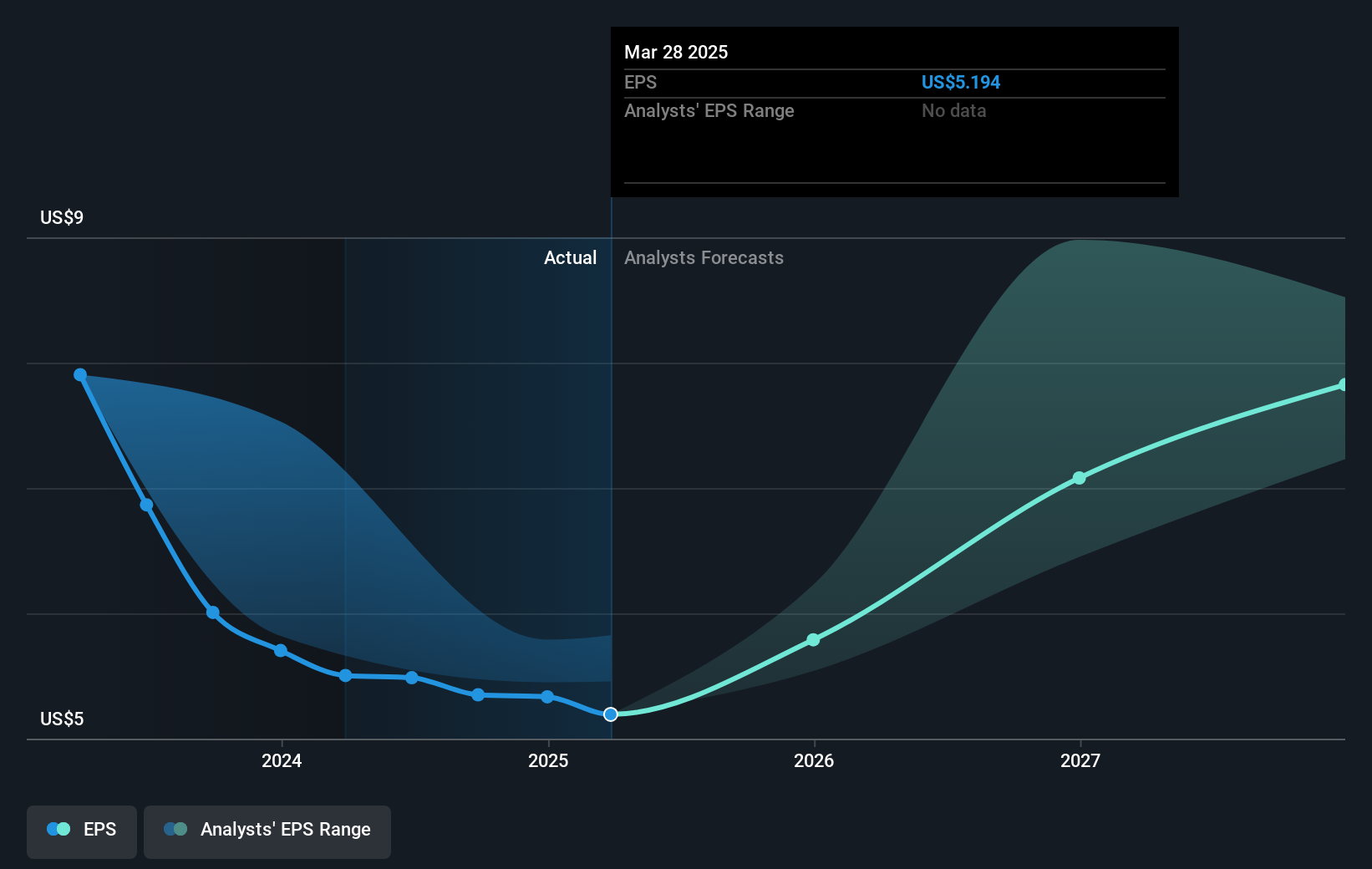

The collaboration between Danaher and AstraZeneca could enhance both companies' market positions, potentially driving long-term revenue growth and strengthening earnings forecasts. The initiative aligns with Danaher's investment strategy in advanced bioprocessing technologies, which is anticipated to bolster the company's innovative offerings and meet rising industry demand. Analysts forecast Danaher's revenue to grow at 6% annually, with earnings rising 12.89% per year, bolstered by strong recurring revenue streams. While geopolitical uncertainties and potential trade tensions could impact these projections, the partnership might offer a resilience buffer, supporting Danaher's earnings expansion plans.

Over a five-year period, Danaher's total shareholder return, including share price and dividends, increased by 29.87%, reflecting steady investor confidence. However, over the past year, the company's performance lagged behind the broader US market, which saw a 12.5% rise. As of now, Danaher's shares trade at US$190.05, presenting a discount to the analysts' consensus price target of US$247.17, which points to a potential upside. The collaboration news might influence future valuations positively, aligning with expectations for increased revenue from new diagnostic tools.

Our expertly prepared valuation report Danaher implies its share price may be lower than expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal