Waters (NYSE:WAT) Enhances Credit Facility to $1.8 Billion Removing $200 Million Term Loan

Waters (NYSE:WAT) recently amended its credit agreement to enhance flexibility, removing a $200 million term loan facility while maintaining a $1.8 billion revolving credit facility. Over the past month, the company's shares moved up 4%, which coincides with broader market gains despite some economic uncertainties such as renewed tariff concerns. Additionally, Waters's performance aligns with ongoing market trends, where significant earnings growth and favorable economic indicators have supported overall market strength. While specific company events, such as the credit agreement, may have provided some substance to its rise, this movement also mirrors general market trends.

Be aware that Waters is showing 1 warning sign in our investment analysis.

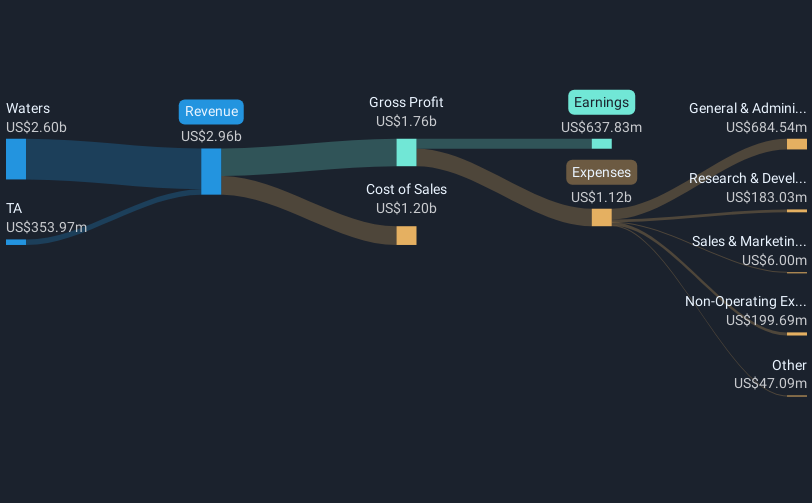

Waters Corporation's recent amendment to its credit agreement could enhance financial agility, potentially improving its ability to navigate external economic pressures such as tariffs and regulatory changes. This move may align strategically with Waters's focus on innovative product launches, like the new LC-MS systems, which aim to solidify its presence in the pharmaceutical application segment. However, this financial restructuring must be balanced against broader concerns, including market competition and evolving regulatory landscapes, which could affect revenue growth and profit margins.

Over the past five years, Waters's total shareholder return, which includes share price appreciation and dividends, reached 75.55%, demonstrating robust long-term performance. In contrast, over the last year alone, Waters exceeded the US Market, which had an 11.5% return, and the Life Sciences industry, which experienced a 28.1% decline. This underlines the company's resilience and its capability to perform well in the face of industry challenges.

While the market has positively reacted in the short term with a 4% share price increase last month, Waters's current share price of US$345.38 reflects a discount of about 10.8% to the average analyst price target of US$387.19. This implies that investors might see potential for further upside if Waters achieves expected revenue growth to US$3.6 billion and earnings of US$872.1 million by 2028. However, exposure to potential tariff impacts and competitive pressures could mediate these forecasts.

Click to explore a detailed breakdown of our findings in Waters' financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal