UiPath Stock: A Deep Dive Into Analyst Perspectives (13 Ratings)

Across the recent three months, 13 analysts have shared their insights on UiPath (NYSE:PATH), expressing a variety of opinions spanning from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 10 | 1 | 1 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 9 | 1 | 1 |

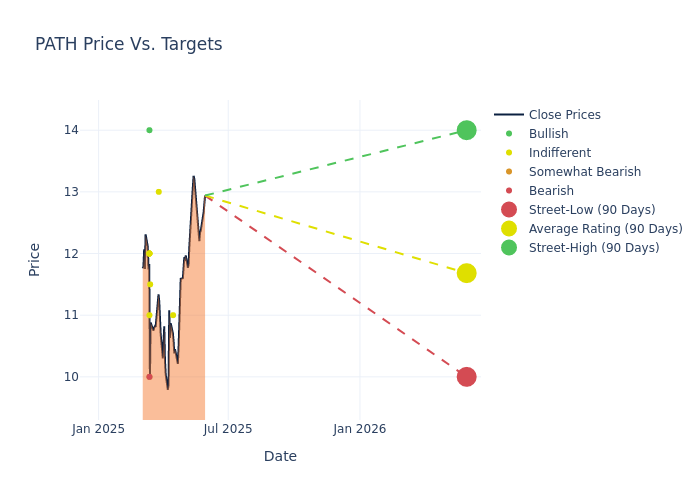

Analysts have recently evaluated UiPath and provided 12-month price targets. The average target is $11.81, accompanied by a high estimate of $14.00 and a low estimate of $10.00. This current average represents a 22.05% decrease from the previous average price target of $15.15.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of UiPath by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Siti Panigrahi | Mizuho | Lowers | Neutral | $11.00 | $12.00 |

| Matthew Hedberg | RBC Capital | Maintains | Sector Perform | $13.00 | $13.00 |

| Keith Bachman | BMO Capital | Lowers | Market Perform | $11.50 | $16.00 |

| Matthew Hedberg | RBC Capital | Lowers | Sector Perform | $13.00 | $16.00 |

| Kingsley Crane | Canaccord Genuity | Lowers | Buy | $14.00 | $19.00 |

| Kirk Materne | Evercore ISI Group | Lowers | In-Line | $12.00 | $16.00 |

| Nick Altmann | Scotiabank | Lowers | Sector Perform | $12.00 | $15.00 |

| Jeff Hickey | UBS | Lowers | Sell | $10.00 | $14.00 |

| Michael Turrin | Wells Fargo | Lowers | Equal-Weight | $11.00 | $13.00 |

| Raimo Lenschow | Barclays | Lowers | Equal-Weight | $12.00 | $15.00 |

| Siti Panigrahi | Mizuho | Lowers | Neutral | $12.00 | $14.00 |

| Sanjit Singh | Morgan Stanley | Lowers | Equal-Weight | $12.00 | $16.00 |

| Brad Sills | B of A Securities | Lowers | Underperform | $10.00 | $18.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to UiPath. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of UiPath compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for UiPath's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of UiPath's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on UiPath analyst ratings.

Delving into UiPath's Background

UiPath Inc offers an end-to-end cross-application enterprise automation platform principally with computer vision technology and user interface automations in its initial RPA offering, which remains the foundation of the platform. The platform leverages a range of automation technologies including robotic process automation, application programming interface, and artificial intelligence. UiPath's solution can automate a broad range of repetitive tasks across industries including claims processing, employee onboarding, invoice to cash, loan applications, and customer service.

Understanding the Numbers: UiPath's Finances

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3M period, UiPath showcased positive performance, achieving a revenue growth rate of 4.54% as of 31 January, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: UiPath's net margin excels beyond industry benchmarks, reaching 12.23%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): UiPath's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.9%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): UiPath's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.87%, the company showcases efficient use of assets and strong financial health.

Debt Management: UiPath's debt-to-equity ratio is below the industry average at 0.04, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal