Symbotic (NasdaqGM:SYM) Reports Revenue Growth in Latest Earnings

Symbotic (NasdaqGM:SYM) experienced a prominent 35% increase in its share price last month. The election of Eric Branderiz, with his extensive finance and accounting experience, to the company's Board of Directors, could have positively influenced investor sentiment. Additionally, the company's latest earnings report, showing revenue growth and reduced net losses, may have strengthened market confidence. These developments perfectly coincided with a market environment characterized by robust technology stock performances propelled by strong earnings from leading companies such as Nvidia. Symbotic's guidance for future revenue growth also potentially fortified its positioning, amplifying its share value rise amidst favorable market conditions.

Buy, Hold or Sell Symbotic? View our complete analysis and fair value estimate and you decide.

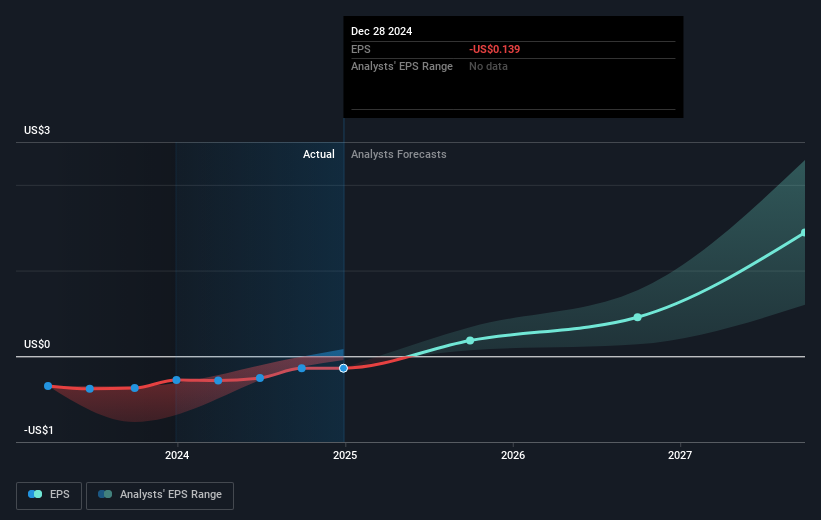

The introduction of Eric Branderiz to Symbotic's Board and the recent positive earnings report appear to have significantly shaped investor sentiment, aligning with the broader technology market surge. These developments are critical in enhancing perception and could influence the company’s narrative moving forward. The integration of his extensive financial expertise may help guide the company toward consistent revenue growth, potentially reinforcing the revenue of $2.07 billion and reducing the loss of $9.25 million, as stated. This progress could be encouraging for analysts projecting a fair value of US$31.95, especially considering the current trading price laying a 33.3% underestimation.

In terms of long-term performance, Symbotic's shares recorded a total return of 224.32% over a three-year period, highlighting a robust growth trajectory. Nevertheless, when considering a more recent timeframe, the company underperformed compared to the US Market and Machinery Industry benchmarks over the past year, with the market returning a positive outcome. Despite the promising longer-term gains, these short-term results suggest a more cautious approach to forecasting future performance.

Analyzing these factors in conjunction with the company’s investments and acquisitions, including Walmart's robotics business, suggests potential revenue and earnings enhancements. These strategic moves could play a role in achieving the projected earnings increase by 2028, indicating potential alignment with the analysts’ price target. However, the current share price of US$21.98 remains below the consensus, indicating market skepticism or potential undervaluation, requiring a closer examination of future execution risks and integration success. The backdrop of 7.05% discount rate application further underscores these financial forecasts, emphasizing the importance of investor confidence moving forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal