Top Penny Stock Picks For May 2025

As the U.S. stock market navigates mixed signals from strong tech earnings and evolving trade policies, investors are keenly evaluating opportunities across various sectors. Penny stocks, though often seen as a relic of past trading eras, continue to offer intriguing possibilities for those seeking affordability paired with growth potential. Typically associated with smaller or newer companies, these stocks can surprise with their financial strength and resilience in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.83 | $180.27M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.04 | $178.27M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.361 | $53.75M | ✅ 1 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.70 | $368.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.85 | $97.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.74 | $20.92M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.83025 | $5.89M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.17 | $76.43M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.979 | $26.99M | ✅ 3 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.00 | $36.01M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 731 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

374Water (NasdaqCM:SCWO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 374Water Inc. offers a technology that converts wet wastes into recoverable resources in the United States, with a market cap of $50.54 million.

Operations: The company's revenue is derived entirely from its Pollution and Treatment Control Products segment, totaling $0.67 million.

Market Cap: $50.54M

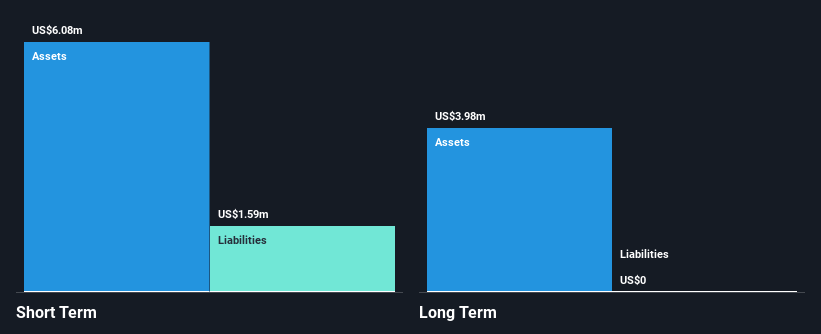

374Water Inc., with a market cap of US$50.54 million, remains pre-revenue, generating only US$0.67 million from its Pollution and Treatment Control Products segment. Recent earnings show a net loss of US$3.7 million for Q1 2025, highlighting ongoing financial challenges despite securing a contract with North Carolina for PFAS disposal efforts. The company faces liquidity concerns with less than one year of cash runway and has been flagged by auditors as having doubts about its ability to continue as a going concern. Leadership changes include appointing Stephen J. Jones to the board, enhancing expertise in environmental services.

- Jump into the full analysis health report here for a deeper understanding of 374Water.

- Explore historical data to track 374Water's performance over time in our past results report.

NET Power (NYSE:NPWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NET Power Inc. is an energy technology company based in the United States with a market cap of approximately $354.89 million.

Operations: Currently, there are no reported revenue segments for this energy technology company.

Market Cap: $354.89M

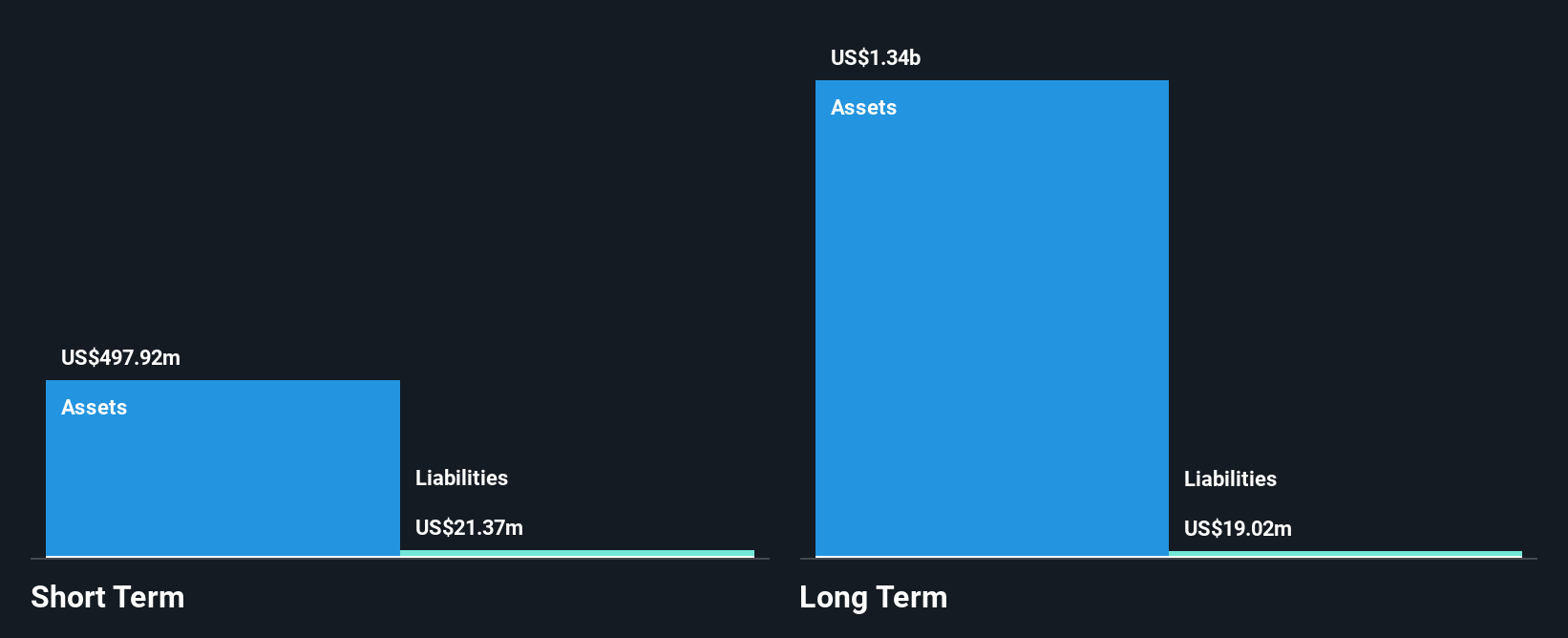

NET Power Inc., with a market cap of US$354.89 million, is currently pre-revenue, reporting only US$0.25 million in sales for 2024. The company faces significant challenges including a class action lawsuit alleging misleading statements about Project Permian's timeline and costs, which have ballooned to an estimated US$1.7-2 billion and delayed operations to 2029 at the earliest. Recent executive changes see Danny Rice taking on dual roles as CEO and interim CFO amid financial strain highlighted by a Q1 2025 net loss of US$119.35 million, underscoring the volatility typical of penny stocks in this sector.

- Dive into the specifics of NET Power here with our thorough balance sheet health report.

- Learn about NET Power's future growth trajectory here.

Qudian (NYSE:QD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Qudian Inc. is a consumer-oriented technology company operating in the People's Republic of China, with a market cap of approximately $478.87 million.

Operations: The company generates revenue from its Installment Credit Services segment, which amounted to CN¥216.43 million.

Market Cap: $478.87M

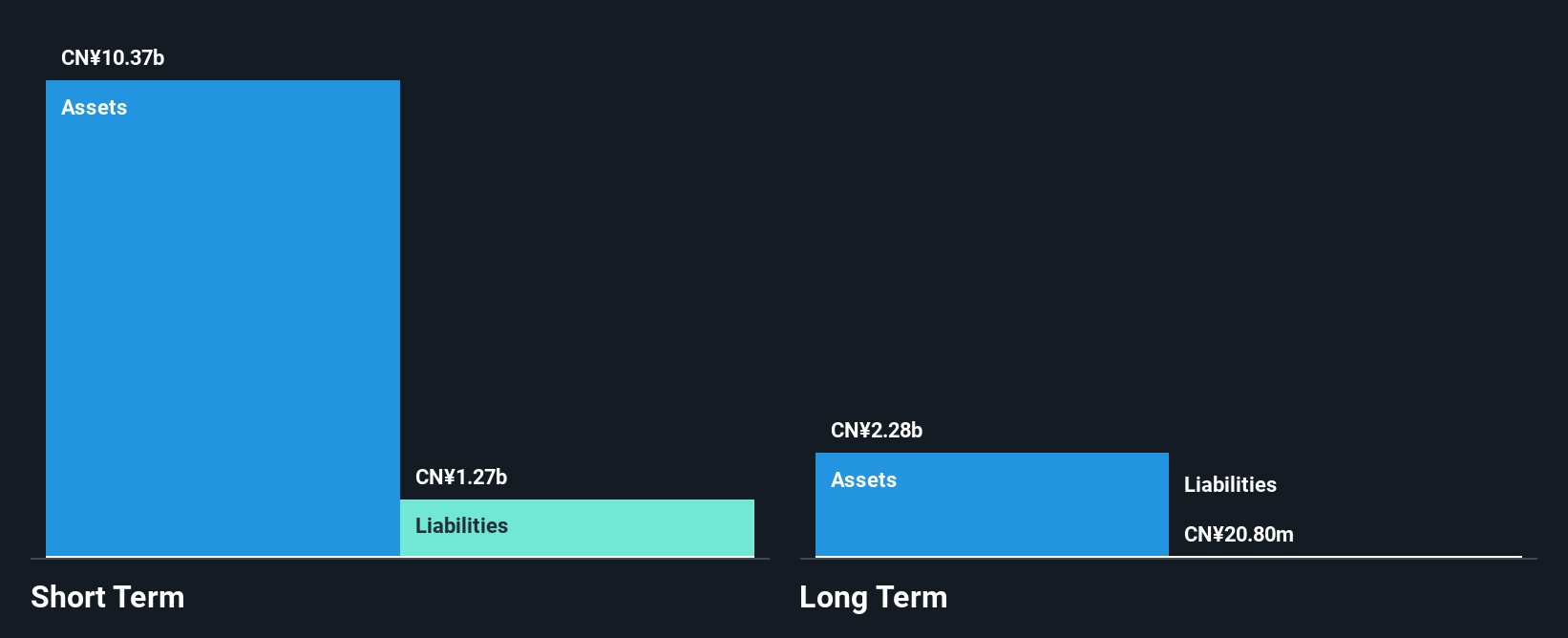

Qudian Inc., with a market cap of approximately $478.87 million, has shown mixed performance typical of penny stocks. The company's recent earnings report indicated a decline in revenue to CN¥52.24 million for Q4 2024, down from CN¥63.79 million the previous year, though net loss improved from CN¥117.07 million to CN¥66.36 million year-over-year. Despite this, Qudian's earnings grew significantly by 134.4% over the past year compared to its five-year average decline of 57.5% per annum, highlighting potential volatility and opportunity in its financials amidst ongoing share buybacks totaling $41.2 million for 9.15% of outstanding shares.

- Get an in-depth perspective on Qudian's performance by reading our balance sheet health report here.

- Evaluate Qudian's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock more gems! Our US Penny Stocks screener has unearthed 728 more companies for you to explore.Click here to unveil our expertly curated list of 731 US Penny Stocks.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal