Spotlight On UK Penny Stocks: OPG Power Ventures And 2 More To Watch

The UK stock market has recently experienced turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic challenges. Despite these broader market fluctuations, certain investment opportunities remain intriguing, particularly in the realm of penny stocks. While the term 'penny stocks' might seem outdated, these smaller or newer companies can still present significant growth potential when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.88 | £296.98M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.25 | £163M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.36 | $209.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.795 | £427.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.20 | £404.93M | ✅ 2 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.902 | £1.18B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.978 | £156.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 400 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

OPG Power Ventures (AIM:OPG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OPG Power Ventures Plc, along with its subsidiaries, is involved in the development, ownership, operation, and maintenance of private sector power projects in India and has a market cap of £20.44 million.

Operations: The company's revenue is derived entirely from its Thermal Power segment, which generated £172.70 million.

Market Cap: £20.44M

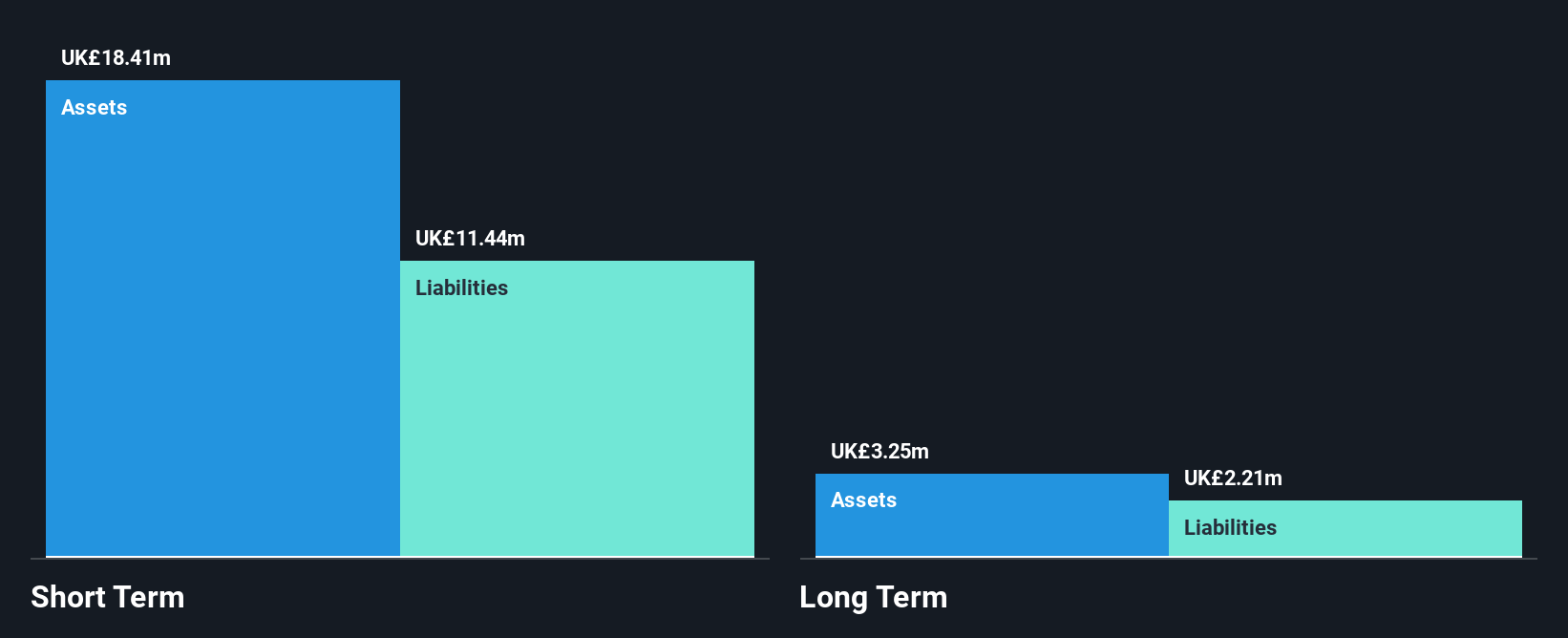

OPG Power Ventures has a market cap of £20.44 million, with its revenue entirely from the Thermal Power segment, generating £172.70 million. Despite stable operations and well-covered interest payments (7.7x EBIT coverage), earnings have declined by 21.4% annually over five years, with recent negative growth of -59.9%. The company's net profit margin decreased to 2.5% from last year's 10.7%. However, OPG's short-term assets exceed both short and long-term liabilities, and it maintains more cash than total debt while trading significantly below estimated fair value at 73.4% lower than fair value estimates.

- Jump into the full analysis health report here for a deeper understanding of OPG Power Ventures.

- Examine OPG Power Ventures' past performance report to understand how it has performed in prior years.

RTC Group (AIM:RTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RTC Group plc, with a market cap of £13.18 million, operates through its subsidiaries to provide recruitment services across the United Kingdom, the United States, and the Middle East.

Operations: The company's revenue is primarily derived from UK Recruitment (£88.94 million), complemented by UK Central Services (£2.23 million) and International Recruitment (£5.60 million).

Market Cap: £13.18M

RTC Group plc, with a market cap of £13.18 million, shows a mixed financial landscape. The company has experienced modest earnings growth of 1.5% over the past year, surpassing its industry peers' decline but lagging behind its five-year average growth rate of 20.4%. Its net profit margins remain stable at 1.9%, and it benefits from being debt-free with high-quality earnings and strong short-term asset coverage over liabilities (£18.4M vs £11.4M). Recent developments include a share buyback program and proposed dividend increases, highlighting efforts to enhance shareholder value amidst volatile sales performance (£96.76 million in 2024).

- Get an in-depth perspective on RTC Group's performance by reading our balance sheet health report here.

- Gain insights into RTC Group's past trends and performance with our report on the company's historical track record.

Cizzle Biotechnology Holdings (LSE:CIZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cizzle Biotechnology Holdings Plc, with a market cap of £8.13 million, develops an immunoassay test for CIZ1B, aimed at the early detection of lung cancer in the United Kingdom.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: £8.13M

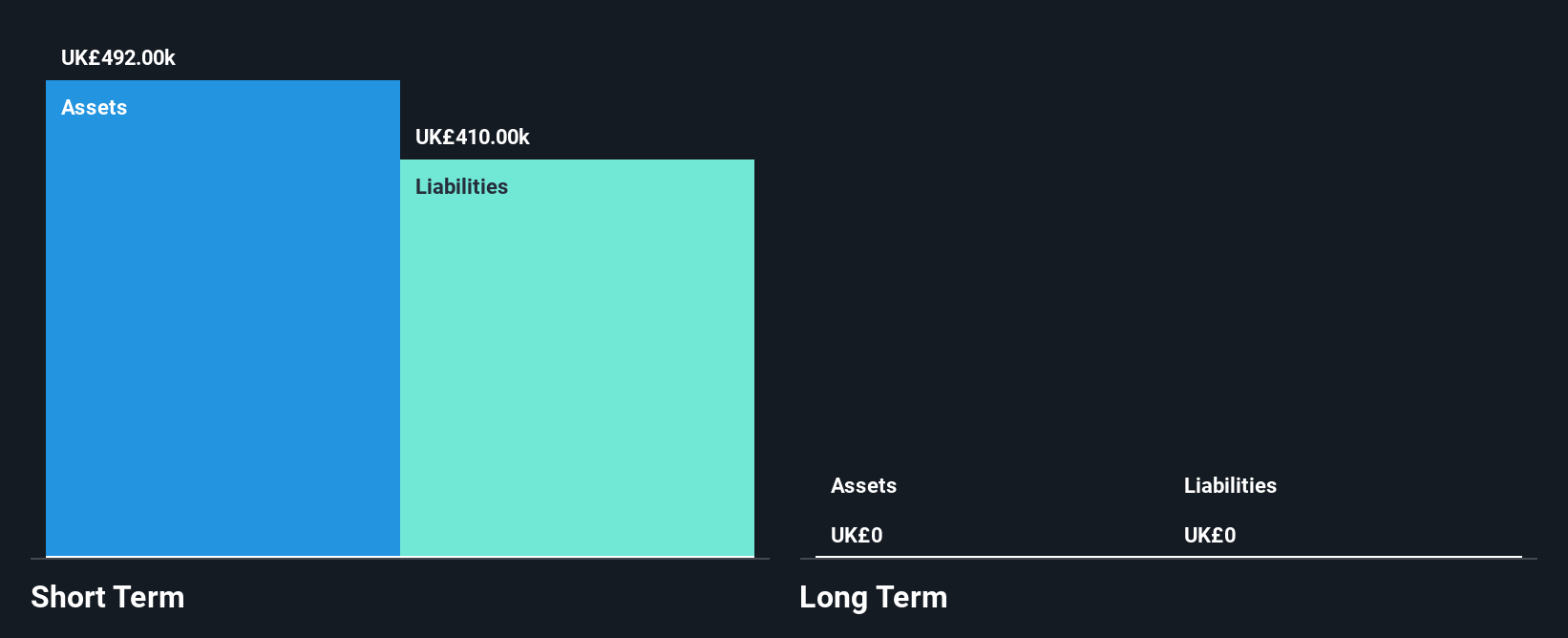

Cizzle Biotechnology Holdings Plc, with a market cap of £8.13 million, is pre-revenue and focuses on early lung cancer detection through its CIZ1B biomarker test. Despite being unprofitable with increasing losses over five years, the company has no debt and covers short-term liabilities with assets of £492K. Recent developments include a private placement raising £150K and securing early royalty payments from a licensing agreement in the Caribbean, expected to bring US$500K by September 2025. The management team is experienced, though share price volatility remains high compared to most UK stocks.

- Navigate through the intricacies of Cizzle Biotechnology Holdings with our comprehensive balance sheet health report here.

- Understand Cizzle Biotechnology Holdings' track record by examining our performance history report.

Turning Ideas Into Actions

- Unlock more gems! Our UK Penny Stocks screener has unearthed 397 more companies for you to explore.Click here to unveil our expertly curated list of 400 UK Penny Stocks.

- Contemplating Other Strategies? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal