ProFrac Holding Corp.'s (NASDAQ:ACDC) 59% Share Price Surge Not Quite Adding Up

ProFrac Holding Corp. (NASDAQ:ACDC) shareholders would be excited to see that the share price has had a great month, posting a 59% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

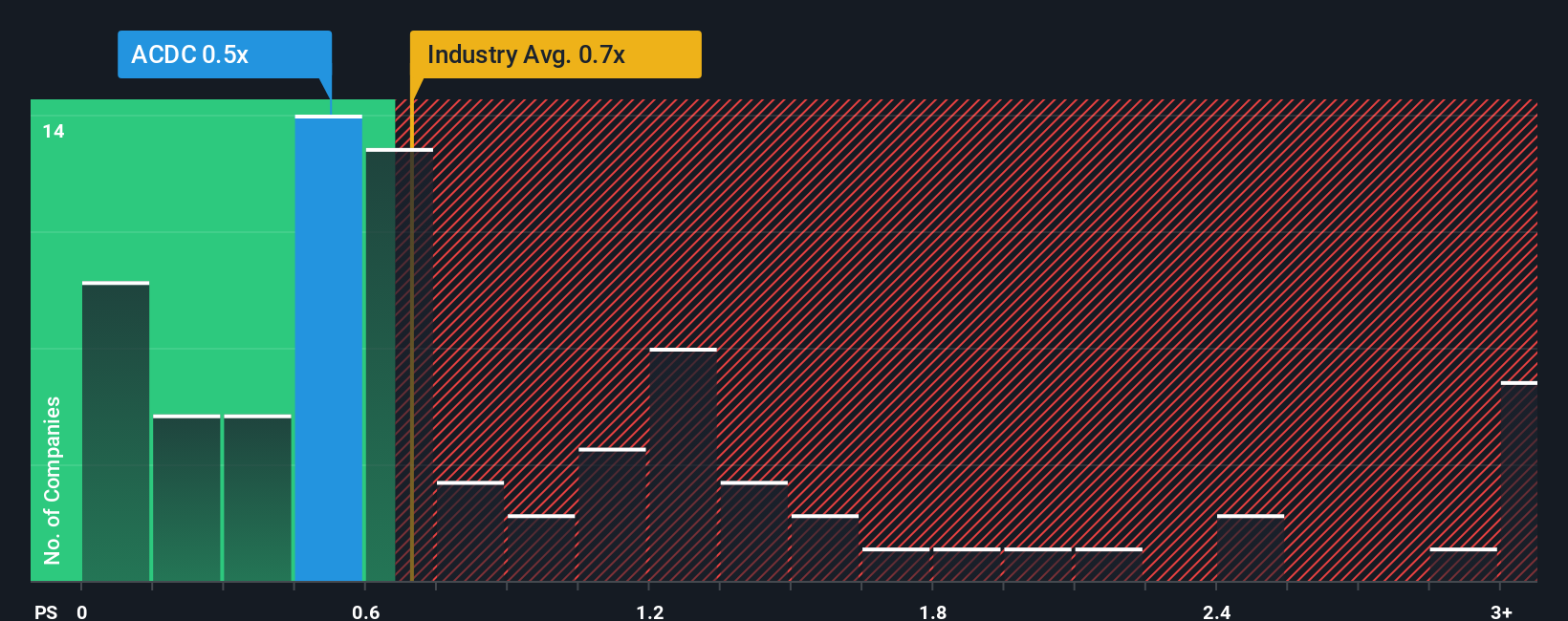

In spite of the firm bounce in price, there still wouldn't be many who think ProFrac Holding's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in the United States' Energy Services industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for ProFrac Holding

What Does ProFrac Holding's Recent Performance Look Like?

ProFrac Holding could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on ProFrac Holding will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For ProFrac Holding?

In order to justify its P/S ratio, ProFrac Holding would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 129% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 5.0% during the coming year according to the four analysts following the company. Meanwhile, the broader industry is forecast to expand by 1.6%, which paints a poor picture.

With this information, we find it concerning that ProFrac Holding is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Its shares have lifted substantially and now ProFrac Holding's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that ProFrac Holding currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Before you take the next step, you should know about the 2 warning signs for ProFrac Holding that we have uncovered.

If these risks are making you reconsider your opinion on ProFrac Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal