Goldman Sachs warns: Turkey's lira depreciates, and the world's best arbitrage deals are under threat

The Zhitong Finance App learned that Goldman Sachs said that because the Turkish central bank allowed the lira to depreciate, the world's most successful arbitrage deal now seems to be at risk. Goldman Sachs economists Clemens Grafe and Basak Edizgil said in a report on Wednesday that the Turkish central bank is allowing the lira to depreciate more rapidly than normal. This move may be aimed at limiting the inflow of hot money and responding to exporters' complaints that the local currency is overvalued.

Goldman Sachs said, “It is possible that the central bank has decided that it is no longer committed to dealing with foreign exchange inflows driven by capital inflows by increasing reserves. Therefore, devaluing the lira may be partly to stop these inflows.”

The Wall Street bank's report shows that investors are still trying to predict how Turkey's central bank will adjust its policies to deal with the impact of Turkey's domestic political crisis since March. Turkey arrested Istanbul Mayor Ekrem Imamoglu (a popular presidential candidate). This move damaged the value of the Turkish lira and exacerbated the inflation situation, prompting the monetary administration to end the cycle of interest rate cuts that began in December last year.

Even so, the current rate of depreciation of the lira is contrary to the expectations of policy makers. The goal is to reduce the monthly inflation rate from about 38% last month to 24% by the end of this year, and to 12% by 2026.

Goldman Sachs said, “We believe that the Turkish central bank will abandon its current foreign exchange policy when it restarts the interest rate cut cycle at the July meeting at the latest. We believe that the current foreign exchange policy is for the central bank to implement devaluation measures ahead of schedule to avoid obvious actual appreciation.”

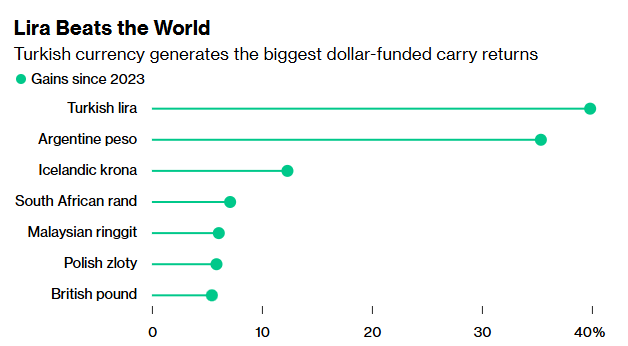

The lira's exchange rate against the US dollar fell by around 1.6% in May, while it fell 1.4% last month. Over the past two years, high interest rates and the strong performance of the lira adjusted for consumer inflation have led to large inflows of capital in the form of arbitrage transactions. This is an investment strategy where traders borrow low-yield currencies to invest in other areas.

But this complicates the Turkish central bank's liquidity management, as it uses these funds to increase reserves while injecting billions of liras into the financial system. Turkey's central bank once faced an oversupply situation of over 1 trillion lira, which threatened its strict monetary policy. Furthermore, this excessive reliance on external markets ultimately became a negative factor. After Imam Oulu's arrest, international investors have been selling off their lira assets, further exacerbating the collapse of the market.

Wall Street Journal

Wall Street Journal