Market Still Lacking Some Conviction On Paysafe Limited (NYSE:PSFE)

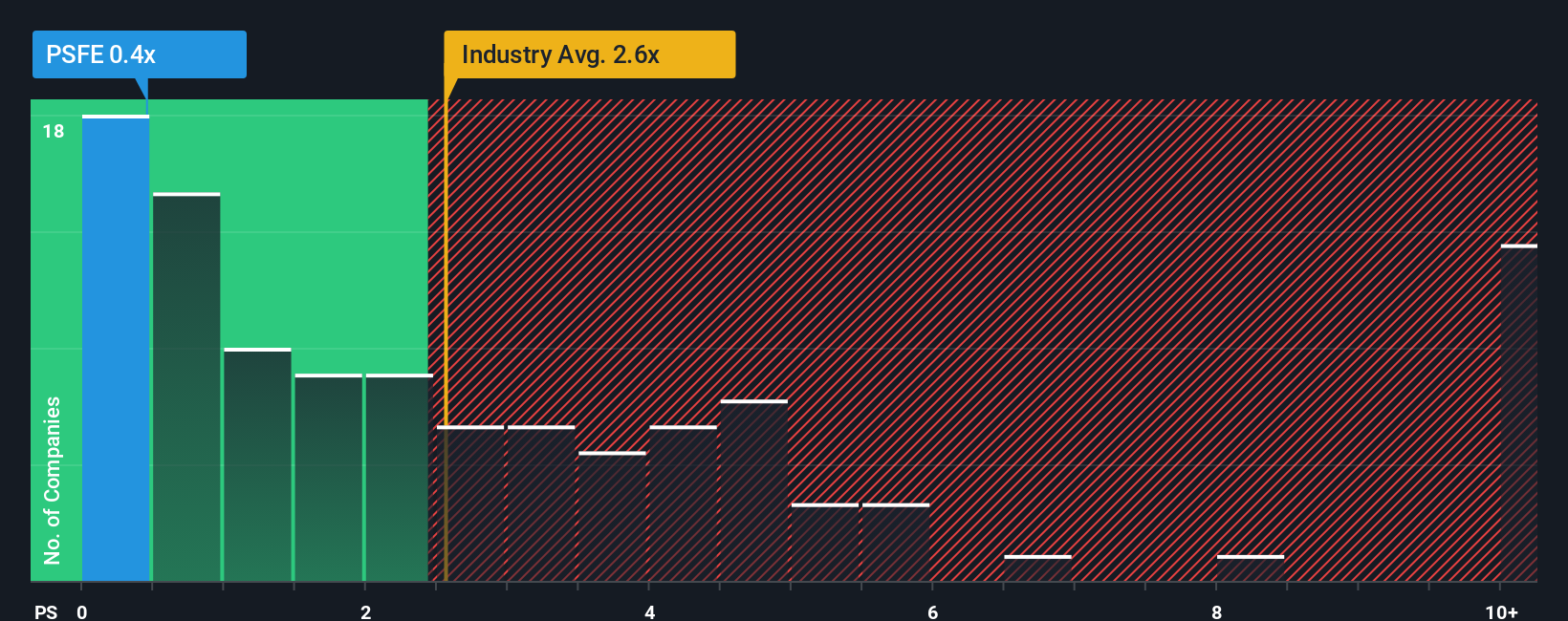

Paysafe Limited's (NYSE:PSFE) price-to-sales (or "P/S") ratio of 0.4x might make it look like a strong buy right now compared to the Diversified Financial industry in the United States, where around half of the companies have P/S ratios above 2.6x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Paysafe

What Does Paysafe's P/S Mean For Shareholders?

Paysafe could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Paysafe's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Paysafe's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 3.5%. The latest three year period has also seen a 14% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 3.6% during the coming year according to the six analysts following the company. With the industry predicted to deliver 5.1% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Paysafe's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Paysafe remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Paysafe with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal