CD Projekt S.A.'s (WSE:CDR) Popularity With Investors Is Clear

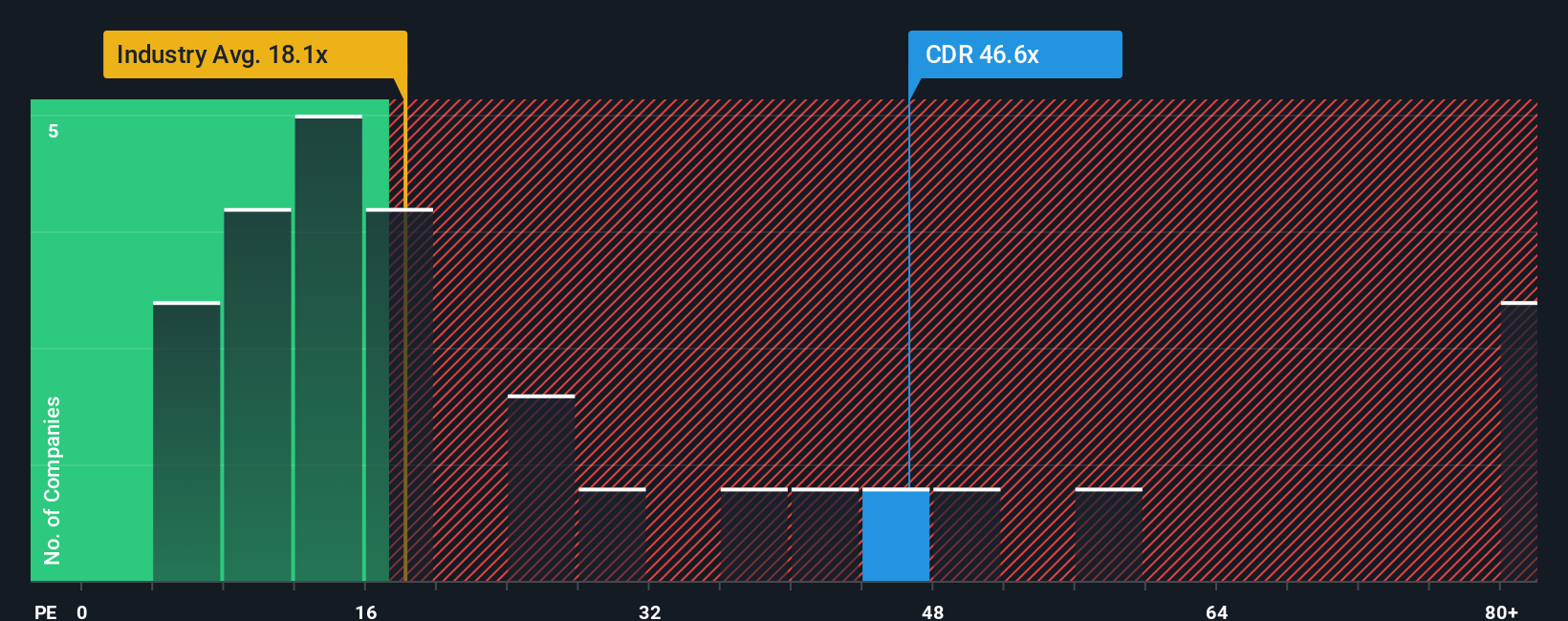

With a price-to-earnings (or "P/E") ratio of 46.6x CD Projekt S.A. (WSE:CDR) may be sending very bearish signals at the moment, given that almost half of all companies in Poland have P/E ratios under 13x and even P/E's lower than 8x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

CD Projekt's negative earnings growth of late has neither been better nor worse than most other companies. It might be that many expect the company's earnings to strengthen positively despite the tough market conditions, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for CD Projekt

How Is CD Projekt's Growth Trending?

In order to justify its P/E ratio, CD Projekt would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.0%. Even so, admirably EPS has lifted 127% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 39% each year over the next three years. With the market only predicted to deliver 12% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why CD Projekt is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of CD Projekt's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for CD Projekt with six simple checks.

If you're unsure about the strength of CD Projekt's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal