Frontier Developments plc (LON:FDEV) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

The Frontier Developments plc (LON:FDEV) share price has done very well over the last month, posting an excellent gain of 30%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.2% over the last year.

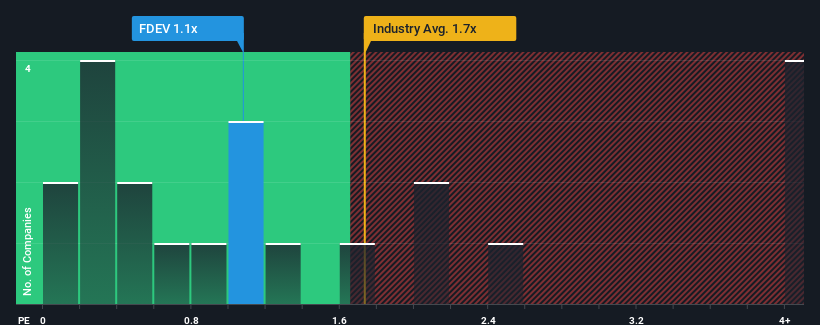

Although its price has surged higher, there still wouldn't be many who think Frontier Developments' price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in the United Kingdom's Entertainment industry is similar at about 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Frontier Developments

What Does Frontier Developments' Recent Performance Look Like?

Frontier Developments could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Frontier Developments' future stacks up against the industry? In that case, our free report is a great place to start.How Is Frontier Developments' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Frontier Developments' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.6%. The last three years don't look nice either as the company has shrunk revenue by 14% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 2.1% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 6.5% per annum, which paints a poor picture.

With this information, we find it concerning that Frontier Developments is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Its shares have lifted substantially and now Frontier Developments' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that Frontier Developments currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It is also worth noting that we have found 1 warning sign for Frontier Developments that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal