Dillistone Group Plc's (LON:DSG) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- Dillistone Group to hold its Annual General Meeting on 4th of June

- CEO Jason Starr's total compensation includes salary of UK£129.0k

- The overall pay is 49% below the industry average

- Dillistone Group's EPS grew by 113% over the past three years while total shareholder loss over the past three years was 58%

Performance at Dillistone Group Plc (LON:DSG) has been rather uninspiring recently and shareholders may be wondering how CEO Jason Starr plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 4th of June. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Dillistone Group

How Does Total Compensation For Jason Starr Compare With Other Companies In The Industry?

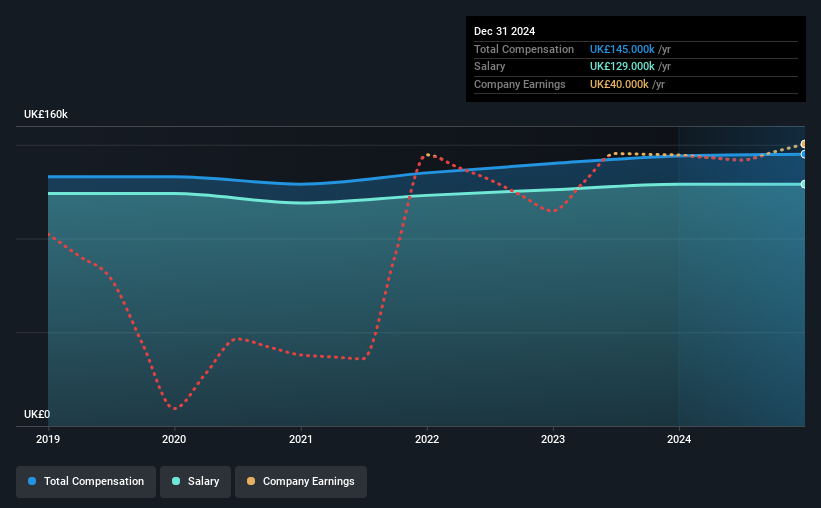

At the time of writing, our data shows that Dillistone Group Plc has a market capitalization of UK£1.8m, and reported total annual CEO compensation of UK£145k for the year to December 2024. That is, the compensation was roughly the same as last year. Notably, the salary which is UK£129.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the British Software industry with market capitalizations below UK£149m, we found that the median total CEO compensation was UK£283k. Accordingly, Dillistone Group pays its CEO under the industry median. Furthermore, Jason Starr directly owns UK£313k worth of shares in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | UK£129k | UK£129k | 89% |

| Other | UK£16k | UK£15k | 11% |

| Total Compensation | UK£145k | UK£144k | 100% |

Speaking on an industry level, nearly 73% of total compensation represents salary, while the remainder of 27% is other remuneration. According to our research, Dillistone Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Dillistone Group Plc's Growth Numbers

Over the past three years, Dillistone Group Plc has seen its earnings per share (EPS) grow by 113% per year. Its revenue is down 12% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Dillistone Group Plc Been A Good Investment?

Few Dillistone Group Plc shareholders would feel satisfied with the return of -58% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders are sitting on a loss is certainly disheartening. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key focus for the board and management will be how to align the share price with fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for Dillistone Group (1 is potentially serious!) that you should be aware of before investing here.

Important note: Dillistone Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal