What 4 Analyst Ratings Have To Say About Ultragenyx Pharmaceutical

Ratings for Ultragenyx Pharmaceutical (NASDAQ:RARE) were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

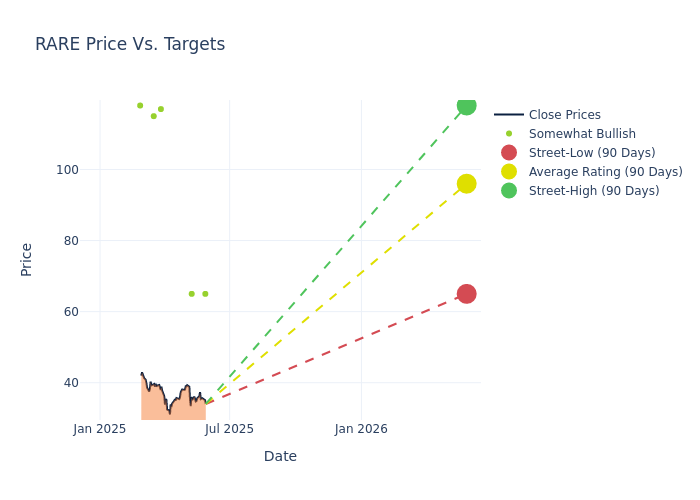

Insights from analysts' 12-month price targets are revealed, presenting an average target of $90.5, a high estimate of $117.00, and a low estimate of $65.00. This current average has decreased by 11.85% from the previous average price target of $102.67.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Ultragenyx Pharmaceutical. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sami Corwin | William Blair | Announces | Outperform | $65.00 | - |

| Jeffrey Hung | Morgan Stanley | Raises | Overweight | $65.00 | $64.00 |

| Anupam Rama | JP Morgan | Raises | Overweight | $117.00 | $104.00 |

| Allison Bratzel | Piper Sandler | Lowers | Overweight | $115.00 | $140.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Ultragenyx Pharmaceutical. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Ultragenyx Pharmaceutical compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Ultragenyx Pharmaceutical's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Ultragenyx Pharmaceutical's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Ultragenyx Pharmaceutical analyst ratings.

Unveiling the Story Behind Ultragenyx Pharmaceutical

Ultragenyx Pharmaceutical Inc is a USA-based biopharmaceutical company. It identifies, acquires, develops, and commercializes novel products for the treatment of serious rare and ultra-rare diseases, with a focus on serious, debilitating genetic diseases. The company's medicine portfolio includes Crysvita, Dojolvi and Mepsevii. Crysvita is indicated for the treatment of X-linked hypophosphatemia (XLH) in adult and pediatric patients 1 year of age and older. Mepsevii is indicated in pediatric and adult patients for the treatment of Mucopolysaccharidosis VII.

Breaking Down Ultragenyx Pharmaceutical's Financial Performance

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Ultragenyx Pharmaceutical displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 27.99%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -108.46%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Ultragenyx Pharmaceutical's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -75.63%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Ultragenyx Pharmaceutical's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -10.73%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.27, caution is advised due to increased financial risk.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal