Exploring 3 Undervalued Small Caps With Insider Buying Across Regions

The United States market has remained flat over the past week but has shown an 11% increase over the past year, with earnings projected to grow by 14% annually. In this context, identifying small-cap stocks with insider buying can offer insights into potential opportunities that align with these growth forecasts.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 34.89% | ★★★★★★ |

| Barrett Business Services | 20.7x | 0.9x | 47.22% | ★★★★☆☆ |

| Shore Bancshares | 9.9x | 2.4x | -72.70% | ★★★☆☆☆ |

| Niagen Bioscience | 59.3x | 7.8x | 21.84% | ★★★☆☆☆ |

| Columbus McKinnon | 54.4x | 0.5x | 29.94% | ★★★☆☆☆ |

| MVB Financial | 13.4x | 1.8x | 37.02% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -60.74% | ★★★☆☆☆ |

| BlueLinx Holdings | 14.2x | 0.2x | -78.95% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.5x | -2871.87% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -380.59% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Matthews International (NasdaqGS:MATW)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Matthews International is a diversified company operating in the memorialization, brand solutions, and industrial technologies sectors with a market cap of approximately $0.81 billion.

Operations: The company generates revenue primarily from Memorialization, SGK Brand Solutions, and Industrial Technologies. Over recent periods, the gross profit margin has shown a trend of fluctuation, reaching 33.87% in December 2024 and 34.06% in March 2025. Operating expenses are substantial with significant allocations to General & Administrative and Sales & Marketing expenses.

PE: -8.6x

Matthews International, a smaller company in the U.S. market, faces challenges with declining sales and recent losses, reporting a net loss of US$8.92 million for Q2 2025. Despite this, earnings are projected to grow significantly at 127% annually. Recent insider confidence is evident with share repurchases totaling 5,866 shares from January to March 2025. The company's external borrowing poses higher risk funding but offers potential growth opportunities through strategic moves like dividend declarations and shelf registrations worth US$32.22 million and US$70.92 million respectively.

- Navigate through the intricacies of Matthews International with our comprehensive valuation report here.

Gain insights into Matthews International's past trends and performance with our Past report.

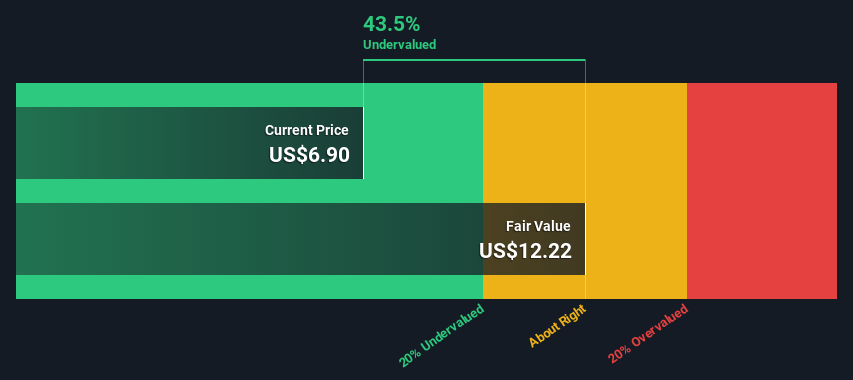

Century Communities (NYSE:CCS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Century Communities is a home construction and real estate company operating across various U.S. regions, including the West, Texas, Mountain, Southeast, and through its Century Complete division, with a market cap of approximately $2.38 billion.

Operations: Century Communities generates revenue primarily from its regional segments, with the Mountain and Century Complete segments contributing significantly. The company's gross profit margin showed an upward trend, peaking at 27.42% in June 2022 before experiencing a decline to 21.43% by March 2025. Operating expenses are mainly driven by general and administrative costs, which have consistently increased over the periods observed.

PE: 5.5x

Century Communities, a company known for its diverse housing projects, is currently trading at levels suggesting potential value. Recent insider confidence is evident with share purchases in April 2025. The company has been expanding aggressively, launching new communities across the U.S., including Rosemont Hill and Katy Reserve. Despite financial challenges like a forecasted decline in earnings by 17.6% annually over the next three years and debt not fully covered by operating cash flow, their strategic expansion into high-demand areas may offer growth opportunities.

- Dive into the specifics of Century Communities here with our thorough valuation report.

Assess Century Communities' past performance with our detailed historical performance reports.

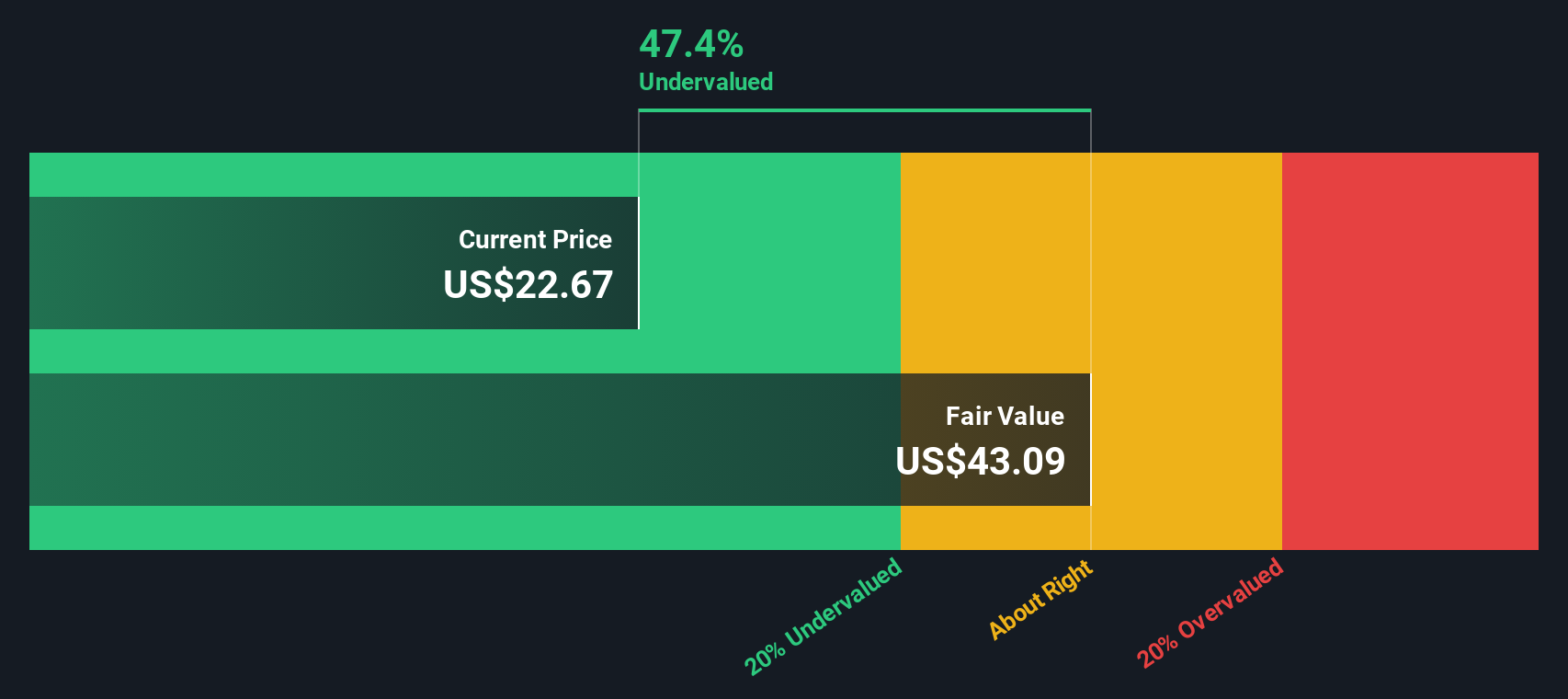

Herbalife (NYSE:HLF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Herbalife is a global nutrition company that develops and sells dietary supplements, weight management products, sports nutrition, and personal care items with a market capitalization of approximately $1.95 billion.

Operations: Herbalife's revenue is primarily derived from key markets such as India ($850.60 million), the United States ($1.015 billion), and Mexico ($524.20 million). The company's gross profit margin has shown a declining trend, moving from 53.32% in late 2018 to 44.06% by mid-2024, indicating changes in cost structure or pricing strategies over time. Operating expenses are consistently significant, with general and administrative expenses being a major component, reaching $1.801 billion by early 2024.

PE: 2.8x

Herbalife's financials present a mixed picture for investors considering undervalued opportunities. Despite reporting Q1 2025 net income of US$50.4 million, up from US$24.3 million the previous year, earnings are projected to decline by 9.2% annually over the next three years. The company faces challenges with high-risk funding and large one-off items affecting results, but insider confidence is evident through recent share purchases in April 2025, suggesting belief in future potential despite current hurdles.

- Delve into the full analysis valuation report here for a deeper understanding of Herbalife.

Gain insights into Herbalife's historical performance by reviewing our past performance report.

Make It Happen

- Click this link to deep-dive into the 106 companies within our Undervalued US Small Caps With Insider Buying screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal