Stitch Fix And Two Other Penny Stocks To Watch Closely

Over the last 7 days, the market has remained flat, but it is up 11% over the past year with earnings forecasted to grow by 14% annually. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still present significant opportunities when built on solid financials. We've selected three penny stocks that combine balance sheet strength with potential for outsized gains, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.77 | $184.35M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.06 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.25 | $58.05M | ✅ 1 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.77 | $364.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $95.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.51 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.811 | $6.02M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.41 | $72.17M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.8601 | $28.94M | ✅ 3 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.07 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 729 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Stitch Fix (NasdaqGS:SFIX)

Simply Wall St Financial Health Rating: ★★★★★★

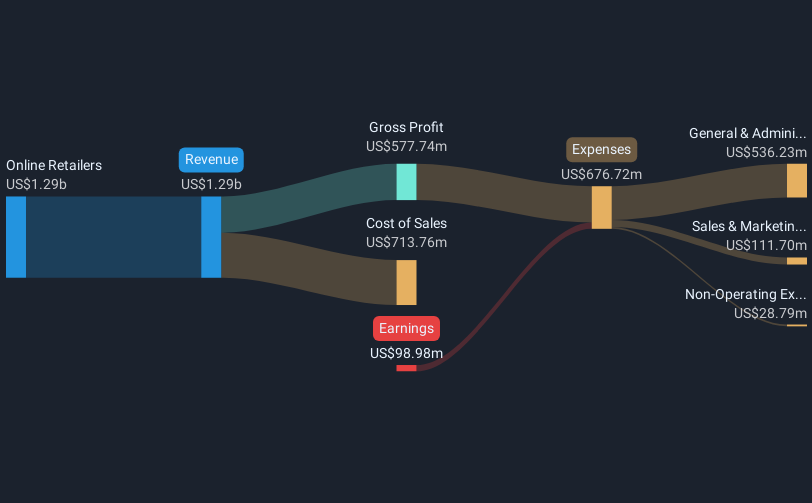

Overview: Stitch Fix, Inc. operates an online platform offering a variety of apparel, shoes, and accessories for different demographics in the United States, with a market cap of $537.08 million.

Operations: The company generates revenue primarily through its online retail segment, which accounted for $1.27 billion.

Market Cap: $537.08M

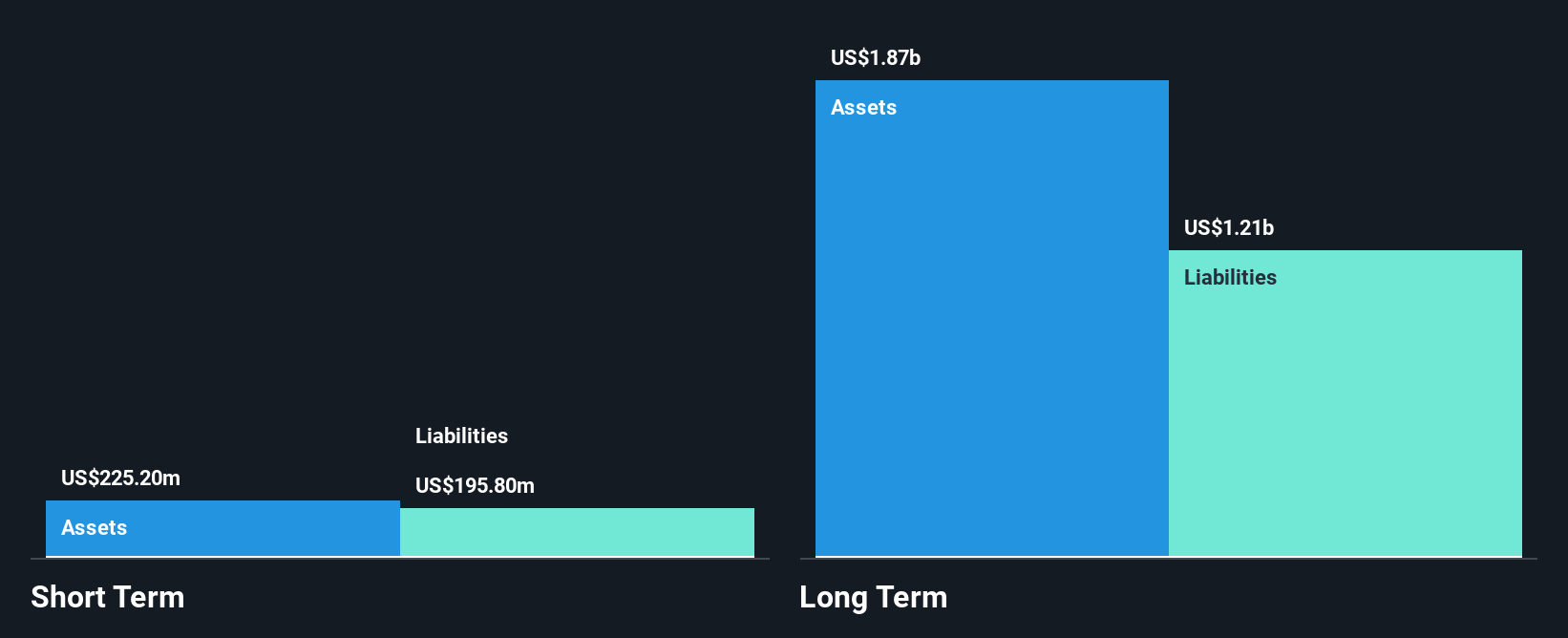

Stitch Fix, Inc. presents a mixed picture as a penny stock investment. The company is trading significantly below its estimated fair value and remains debt-free, with short-term assets exceeding both short and long-term liabilities, indicating financial stability despite ongoing unprofitability. Recent earnings guidance suggests declining revenue trends for 2025, but the company has managed to reduce net losses compared to the previous year. While it boasts an experienced management team and board of directors, Stitch Fix's negative return on equity and lack of profitability forecast over the next three years highlight potential risks for investors seeking growth in this sector.

- Take a closer look at Stitch Fix's potential here in our financial health report.

- Gain insights into Stitch Fix's future direction by reviewing our growth report.

Braemar Hotels & Resorts (NYSE:BHR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Braemar Hotels & Resorts Inc. is a Maryland-based company that invests in luxury hotels and resorts with high revenue per available room, and has a market cap of approximately $147.85 million.

Operations: The company's revenue is primarily generated from its direct hotel investments, totaling $723.59 million.

Market Cap: $147.85M

Braemar Hotels & Resorts Inc. offers a complex scenario within the penny stock landscape, balancing potential and risk. The company's seasoned management and board provide stability, yet it remains unprofitable with a high net debt to equity ratio of 161.1%. Despite reducing losses by 4.3% annually over five years, profitability is not expected soon. Recent investor activism highlights governance concerns linked to Ashford's external management agreement, potentially affecting market credibility and share performance. The company's short-term assets cover immediate liabilities but fall short against long-term obligations, while dividends remain unsupported by earnings despite positive free cash flow growth.

- Dive into the specifics of Braemar Hotels & Resorts here with our thorough balance sheet health report.

- Assess Braemar Hotels & Resorts' future earnings estimates with our detailed growth reports.

Tuya (NYSE:TUYA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tuya Inc. operates in the Internet of Things (IoT) sector, providing products and services both in China and globally, with a market cap of approximately $1.45 billion.

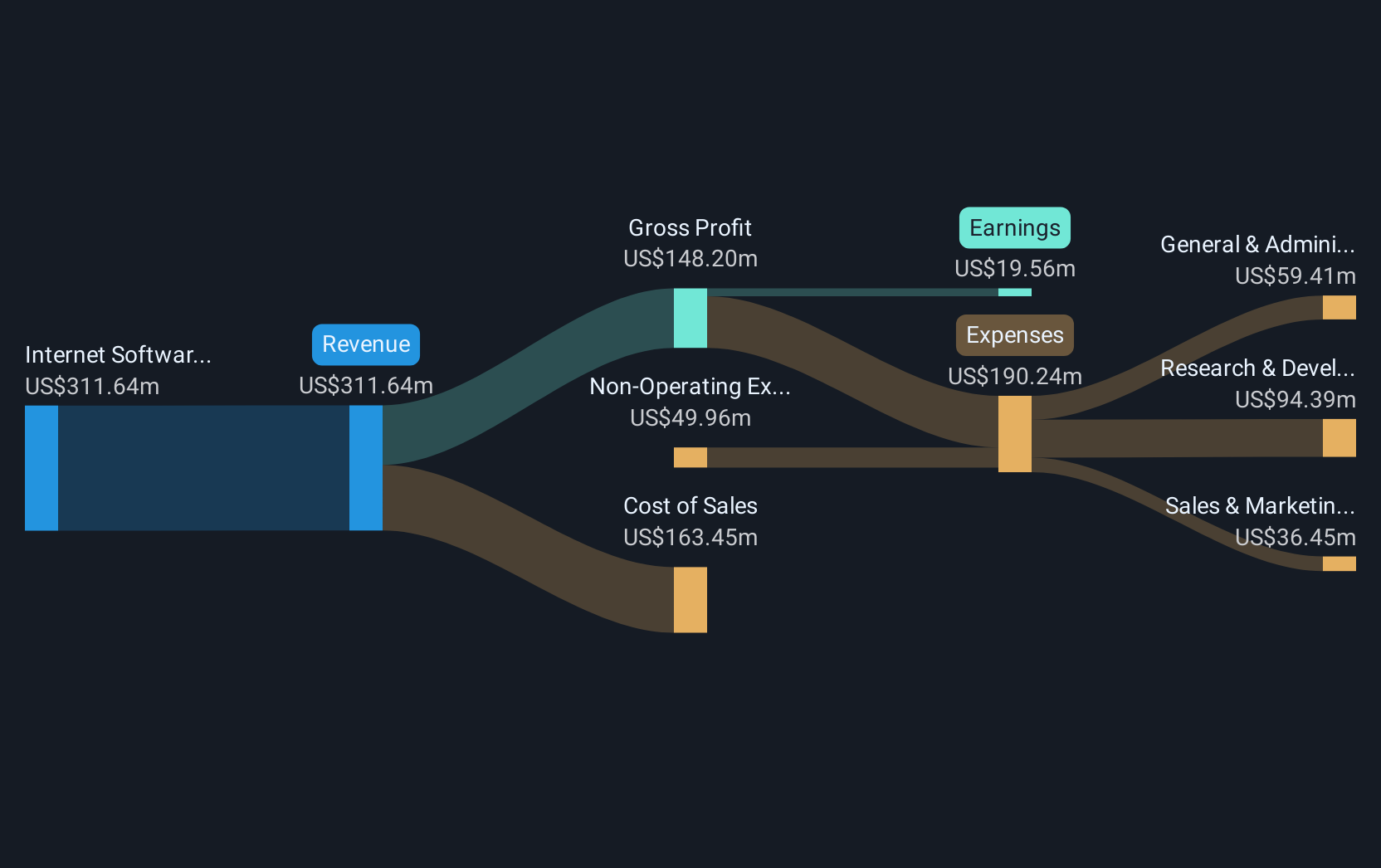

Operations: The company generates revenue of $311.64 million from its Internet Software & Services segment.

Market Cap: $1.45B

Tuya Inc. presents a compelling yet volatile opportunity in the penny stock realm, having recently achieved profitability with net income of US$11.02 million for Q1 2025. The company operates debt-free, showcasing strong short-term asset coverage over liabilities and a seasoned management team averaging 11.3 years of tenure. Despite its stable weekly volatility, Tuya's return on equity remains low at 2%. Recent technological advancements, including AI-driven solutions and strategic partnerships like that with Viettel Telecom, highlight Tuya's focus on innovation in the IoT sector but underscore the challenges of maintaining sustainable dividends amid rapid growth efforts.

- Click here to discover the nuances of Tuya with our detailed analytical financial health report.

- Examine Tuya's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Get an in-depth perspective on all 729 US Penny Stocks by using our screener here.

- Contemplating Other Strategies? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal