MSA Safety Incorporated's (NYSE:MSA) Shares May Have Run Too Fast Too Soon

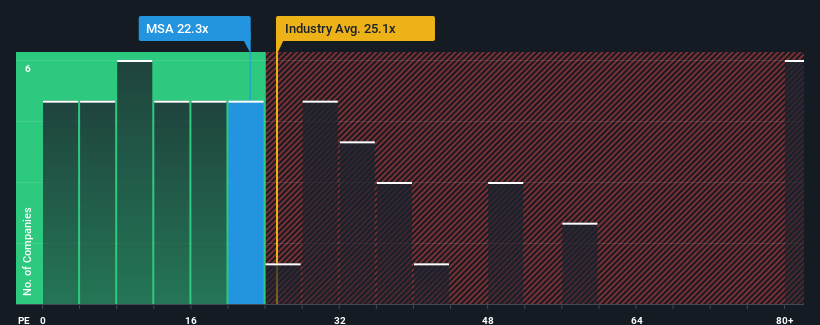

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider MSA Safety Incorporated (NYSE:MSA) as a stock to potentially avoid with its 22.3x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

MSA Safety's earnings growth of late has been pretty similar to most other companies. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for MSA Safety

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as MSA Safety's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.3%. Pleasingly, EPS has also lifted 1,302% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 7.5% per year as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 10% per annum growth forecast for the broader market.

In light of this, it's alarming that MSA Safety's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that MSA Safety currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for MSA Safety that you need to be mindful of.

You might be able to find a better investment than MSA Safety. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal