Should You Be Adding Vivara Participações (BVMF:VIVA3) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Vivara Participações (BVMF:VIVA3), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Vivara Participações Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Vivara Participações has managed to grow EPS by 29% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

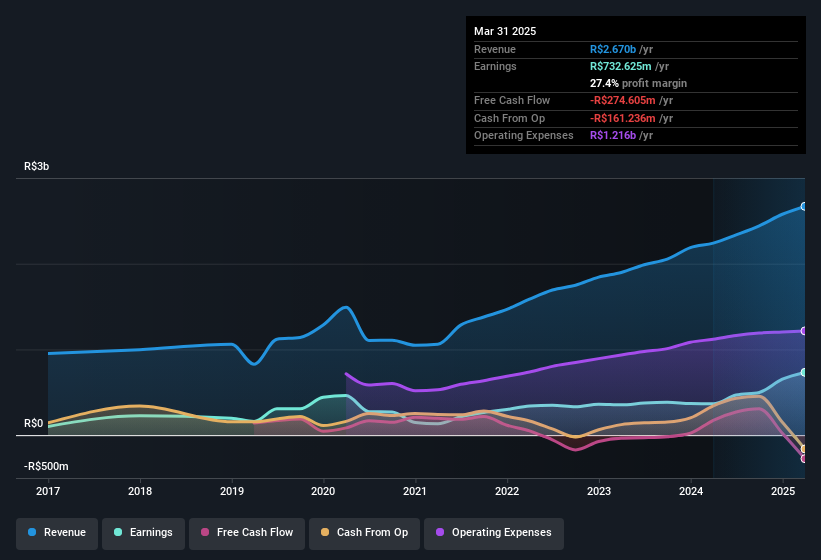

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Vivara Participações shareholders is that EBIT margins have grown from 20% to 28% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Check out our latest analysis for Vivara Participações

Fortunately, we've got access to analyst forecasts of Vivara Participações' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Vivara Participações Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Vivara Participações will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 53% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. At the current share price, that insider holding is worth a staggering R$3.2b. That level of investment from insiders is nothing to sneeze at.

Should You Add Vivara Participações To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Vivara Participações' strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Vivara Participações , and understanding this should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Brazilian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal