Middle Eastern Penny Stocks With Market Caps Under US$80M

The Middle Eastern stock markets have been experiencing fluctuations, with Saudi Arabia's index recently closing at its lowest point since early April, highlighting the region's current market volatility. For investors willing to explore beyond the well-known giants, penny stocks—often representing smaller or newer companies—remain a relevant and intriguing investment area. Despite their historical connotations, these stocks can offer surprising value when backed by solid financials, presenting opportunities for significant returns in today's market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.71 | TRY1.84B | ✅ 2 ⚠️ 2 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.94 | SAR1.58B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.01 | ₪210.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.893 | ₪2.78B | ✅ 1 ⚠️ 2 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.289 | ₪170.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.718 | AED436.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.13 | AED346.5M | ✅ 2 ⚠️ 5 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.40 | AED10.16B | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Gulf Cement Company P.S.C (ADX:GCEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gulf Cement Company P.S.C. is engaged in the production and marketing of various types of cement both within the United Arab Emirates and internationally, with a market capitalization of AED287.38 million.

Operations: The company's revenue is primarily derived from its manufacturing segment, which generated AED506.82 million.

Market Cap: AED287.38M

Gulf Cement Company P.S.C. has demonstrated resilience in the volatile penny stock market, with its revenue from manufacturing reaching AED506.82 million despite being unprofitable. The company recently reported a net loss of AED10.68 million for Q1 2025, an increase from the previous year, yet it maintains a satisfactory net debt to equity ratio of 5.1%. Although short-term liabilities exceed short-term assets, Gulf Cement has a positive cash flow runway exceeding three years if current conditions persist. Recent executive changes and board amendments may influence future strategic directions as it navigates industry challenges and acquisition interests.

- Click to explore a detailed breakdown of our findings in Gulf Cement Company P.S.C's financial health report.

- Gain insights into Gulf Cement Company P.S.C's past trends and performance with our report on the company's historical track record.

National Investor Pr. J.S.C (ADX:TNI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The National Investor Pr. J.S.C., operating in the United Arab Emirates, offers private equity, real estate investment and consultancy, economic feasibility studies, commercial agency services, and hospitality services with a market cap of AED110.22 million.

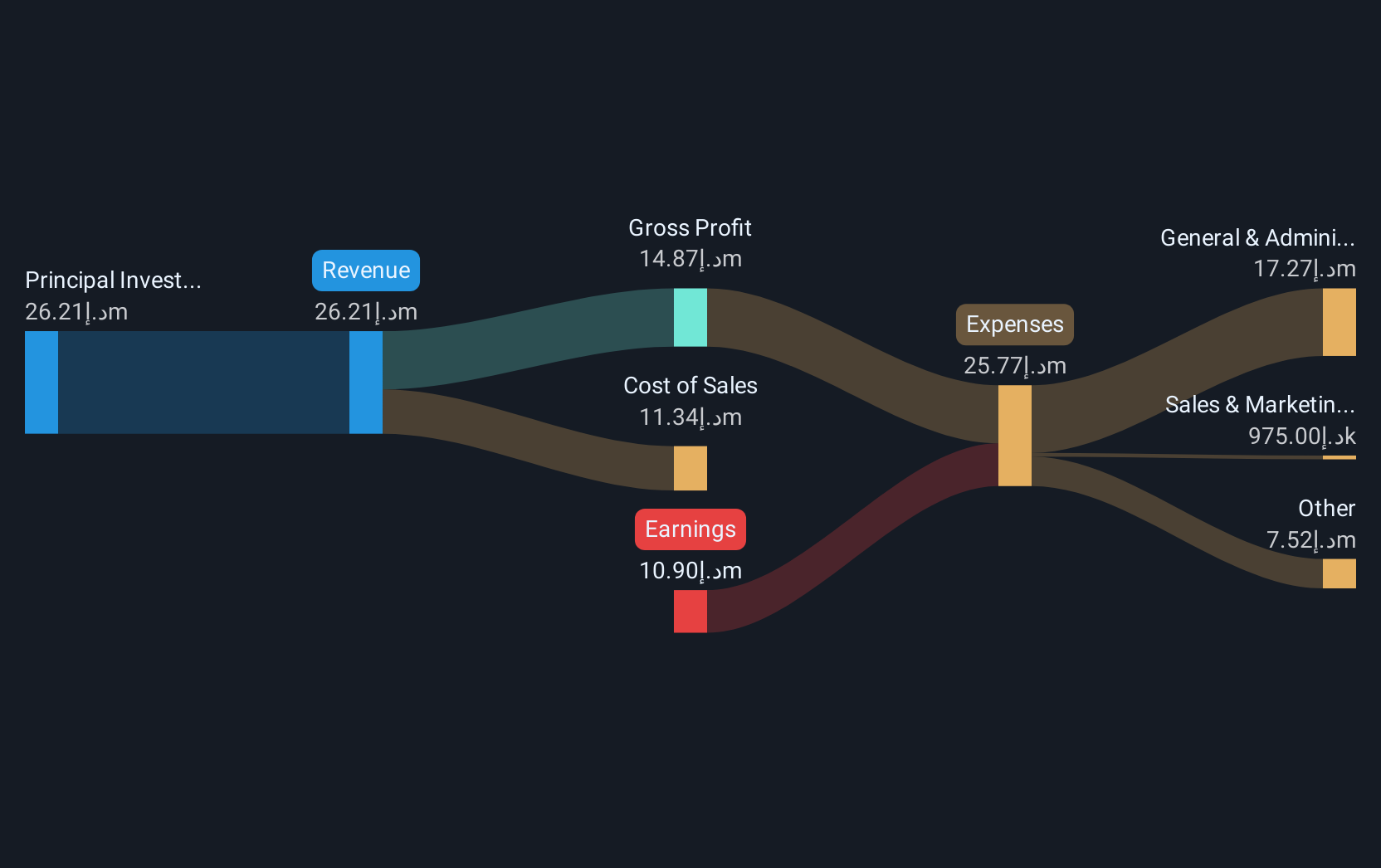

Operations: The company generates revenue from its Principal Investments segment, amounting to AED26.21 million.

Market Cap: AED110.22M

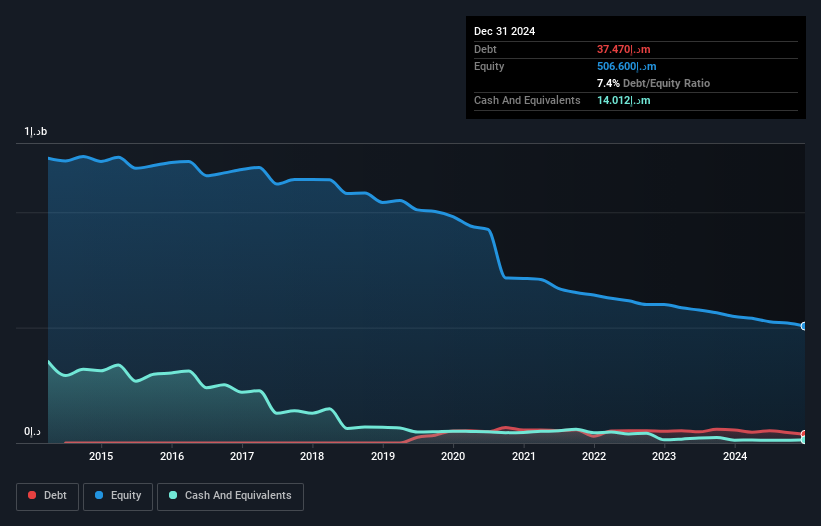

National Investor Pr. J.S.C., despite being unprofitable, has shown resilience in the penny stock market with a revenue increase to AED27.02 million for 2024, compared to AED22.78 million the previous year. The company reported a net loss of AED10.9 million, highlighting ongoing financial challenges. However, it maintains more cash than total debt and has a sufficient cash runway exceeding three years due to positive free cash flow growth of 4.7% annually. Short-term assets surpass both short- and long-term liabilities, providing some financial stability amidst its negative return on equity and increased losses over five years.

- Jump into the full analysis health report here for a deeper understanding of National Investor Pr. J.S.C.

- Assess National Investor Pr. J.S.C's previous results with our detailed historical performance reports.

Tarya Israel (TASE:TRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tarya Israel Ltd, with a market cap of ₪175.15 million, operates an internet platform in Israel through its subsidiaries.

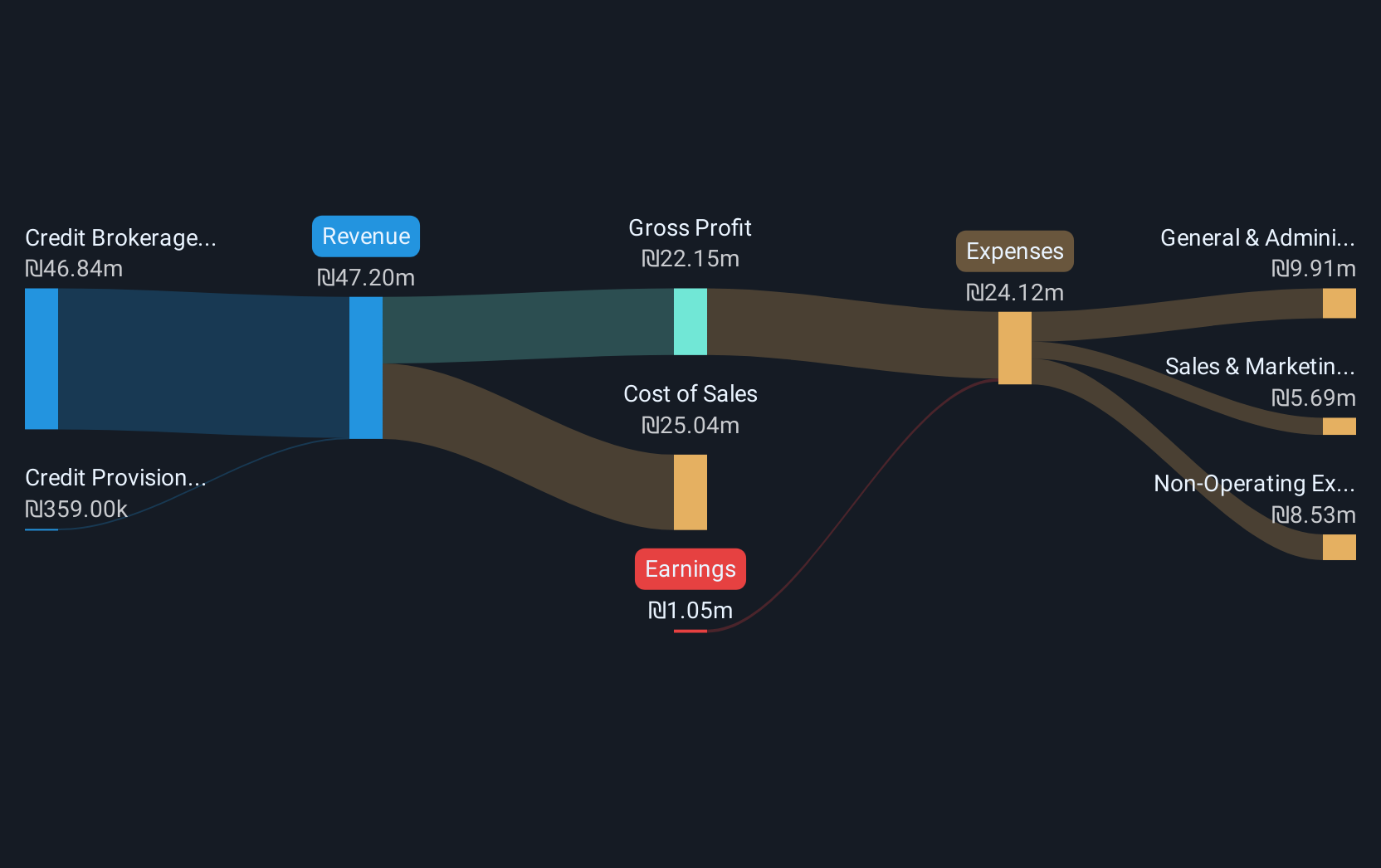

Operations: Currently, there are no reported revenue segments for Tarya Israel Ltd.

Market Cap: ₪175.15M

Tarya Israel Ltd, with a market cap of ₪175.15 million, operates an internet platform and has faced challenges typical of penny stocks. Despite being unprofitable, the company maintains a healthy financial position with short-term assets exceeding both short- and long-term liabilities. It holds more cash than total debt and benefits from a positive free cash flow trajectory, providing over three years of runway at current levels. Recent earnings reports reveal declining sales to ILS 8.46 million in Q1 2025 from ILS 14.14 million the previous year, alongside a net loss of ILS 8.51 million compared to prior net income.

- Unlock comprehensive insights into our analysis of Tarya Israel stock in this financial health report.

- Learn about Tarya Israel's historical performance here.

Taking Advantage

- Click here to access our complete index of 95 Middle Eastern Penny Stocks.

- Ready To Venture Into Other Investment Styles? The latest GPUs need a type of rare earth metal called Terbium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal