ASX Penny Stocks To Watch In May 2025

As Australian shares are set to open higher, recovering from recent dips due to eased tariff tensions between the U.S. and the EU, investors are keeping a close eye on market movements. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area offering potential value. These stocks can present unique growth opportunities at lower price points, particularly when they possess strong financial foundations and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.655 | A$207.75M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.835 | A$147.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.85 | A$1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.515 | A$71.47M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.59 | A$399.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.55 | A$168.45M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.16 | A$726.11M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.715 | A$840.49M | ✅ 5 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.92 | A$683.39M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 998 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Arafura Rare Earths (ASX:ARU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arafura Rare Earths Limited focuses on the exploration and development of mineral properties in Australia, with a market capitalization of A$418.94 million.

Operations: The company has not reported any revenue segments.

Market Cap: A$418.94M

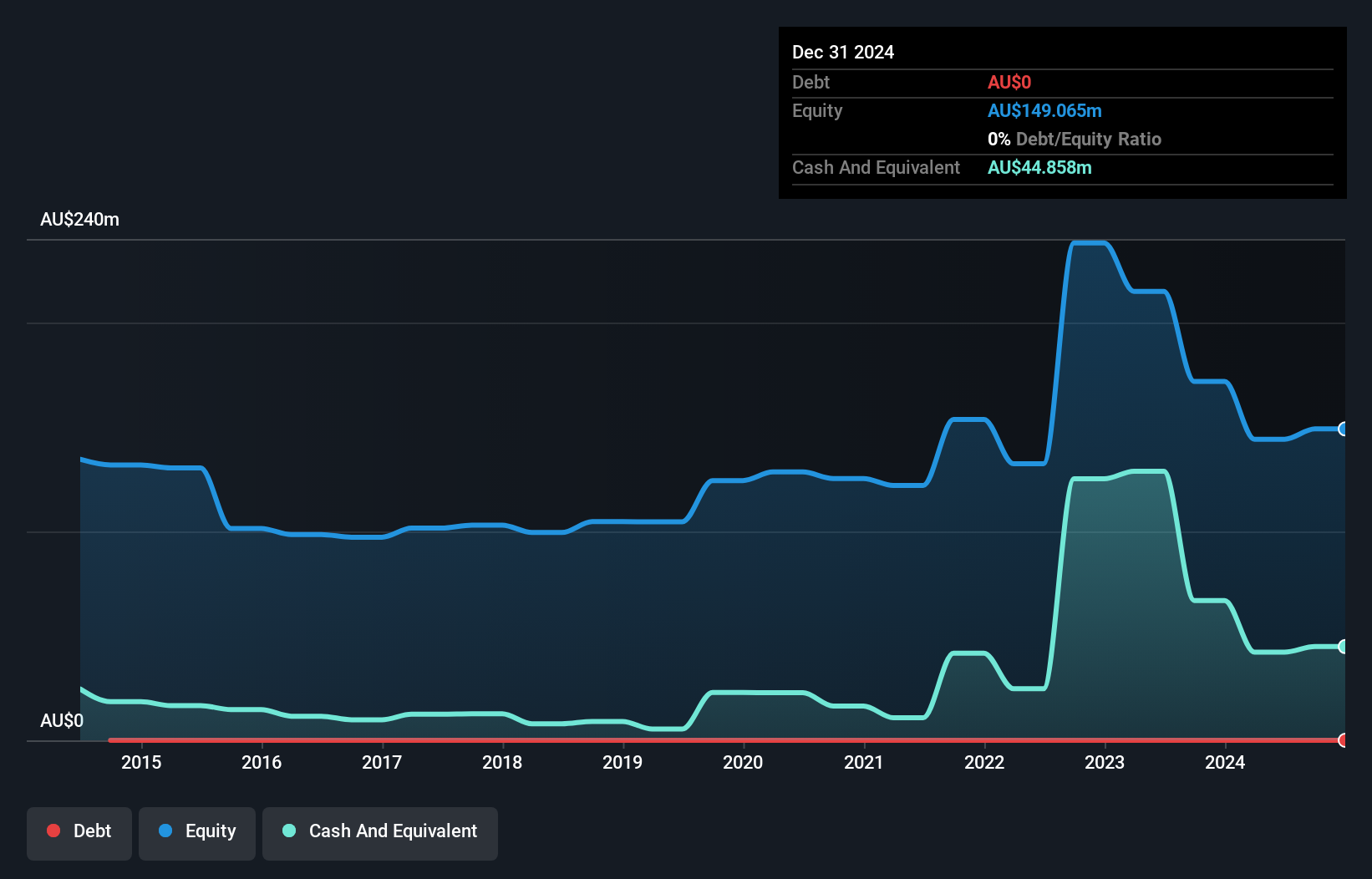

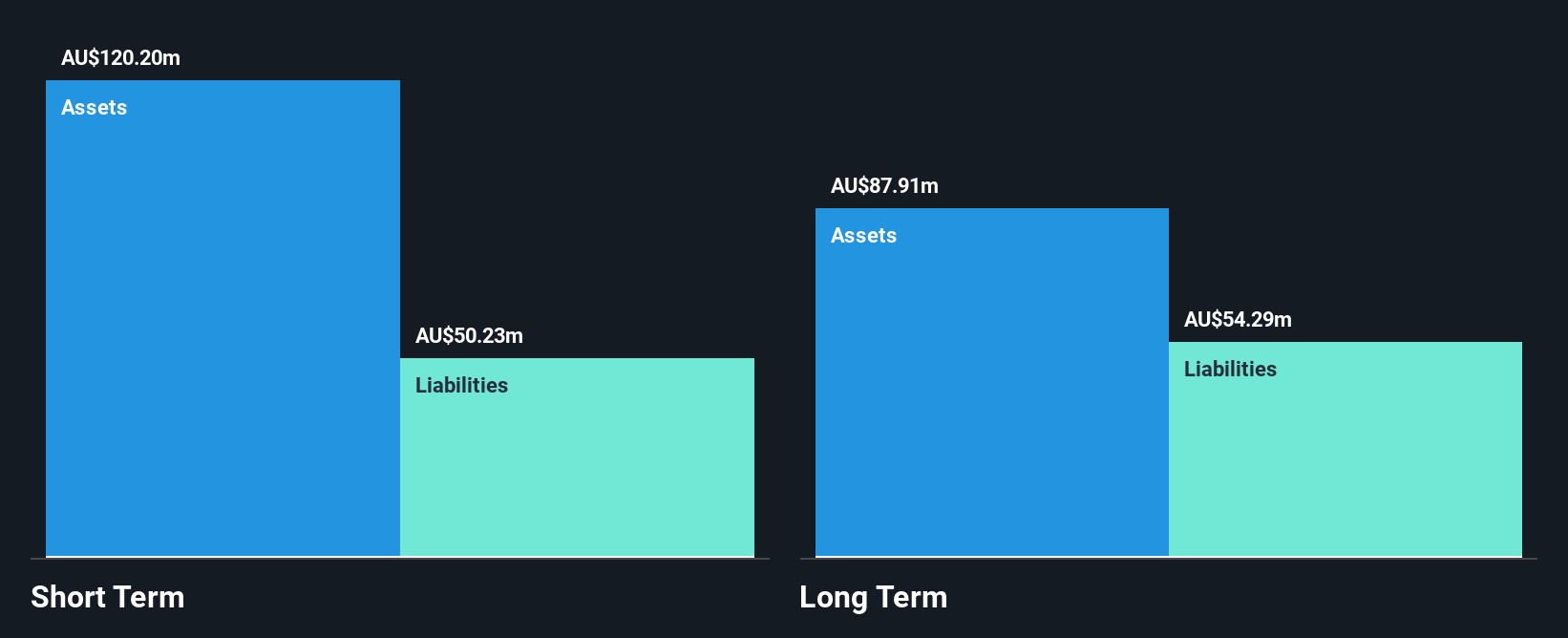

Arafura Rare Earths, with a market cap of A$418.94 million, is pre-revenue and unprofitable, having experienced increasing losses over the past five years. Despite this, the company remains debt-free and has recently raised capital through private placements to extend its cash runway beyond the previous 10-month estimate. Recent changes in company secretaries reflect ongoing organizational adjustments. While it was dropped from several indices in March 2025, it was added to the S&P/ASX Emerging Companies Index shortly after. The company's short-term assets significantly exceed its liabilities, providing some financial stability amidst volatility concerns.

- Navigate through the intricacies of Arafura Rare Earths with our comprehensive balance sheet health report here.

- Assess Arafura Rare Earths' future earnings estimates with our detailed growth reports.

MaxiPARTS (ASX:MXI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MaxiPARTS Limited, along with its subsidiaries, operates in Australia distributing and selling commercial truck and trailer parts, with a market cap of A$127.52 million.

Operations: The company generates revenue of A$269.06 million from its operations in Australia, focusing on the distribution and sale of commercial truck and trailer parts.

Market Cap: A$127.52M

MaxiPARTS Limited, with a market cap of A$127.52 million, has demonstrated financial stability through its strong balance sheet, as short-term assets surpass both short and long-term liabilities. The company has successfully reduced its debt to equity ratio over five years and maintains satisfactory net debt levels. Although earnings growth slowed to 9.5% last year compared to a robust 54.5% average over five years, the company's operating cash flow effectively covers its debt obligations. Despite recent board changes with the resignation of a Non-Executive Director, MaxiPARTS continues trading below estimated fair value while maintaining high-quality earnings and stable volatility levels.

- Get an in-depth perspective on MaxiPARTS' performance by reading our balance sheet health report here.

- Gain insights into MaxiPARTS' outlook and expected performance with our report on the company's earnings estimates.

Silex Systems (ASX:SLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silex Systems Limited is a technology commercialization company focused on the research, development, and licensing of SILEX laser enrichment technology across Australia, the United States, and the United Kingdom with a market cap of A$833.37 million.

Operations: Silex Systems generates revenue from two main segments: Translucent with A$2.40 million and Silex Systems itself contributing A$7.61 million.

Market Cap: A$833.37M

Silex Systems, with a market cap of A$833.37 million, is focused on developing its SILEX laser enrichment technology. Despite being unprofitable and having increased losses over the past five years, the company benefits from a seasoned management team and board of directors. It maintains a strong financial position with short-term assets significantly exceeding liabilities and no debt burden. The company has more than three years of cash runway due to positive free cash flow growth. However, it remains pre-revenue in terms of significant income streams beyond its reported segments, making profitability forecasts challenging within the next three years.

- Take a closer look at Silex Systems' potential here in our financial health report.

- Explore Silex Systems' analyst forecasts in our growth report.

Key Takeaways

- Access the full spectrum of 998 ASX Penny Stocks by clicking on this link.

- Curious About Other Options? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal