Tokyo Kisen Co.,Ltd. (TSE:9193) Stock Catapults 35% Though Its Price And Business Still Lag The Market

Tokyo Kisen Co.,Ltd. (TSE:9193) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 83%.

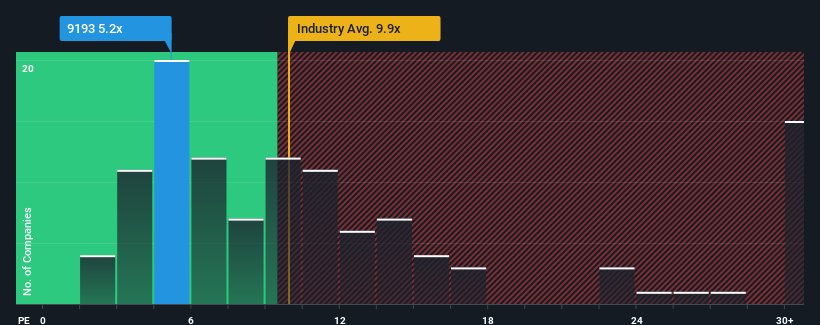

Even after such a large jump in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 13x, you may still consider Tokyo KisenLtd as a highly attractive investment with its 5.2x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Tokyo KisenLtd has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Tokyo KisenLtd

How Is Tokyo KisenLtd's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Tokyo KisenLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 257%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.1% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Tokyo KisenLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Tokyo KisenLtd's P/E

Even after such a strong price move, Tokyo KisenLtd's P/E still trails the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Tokyo KisenLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Tokyo KisenLtd (1 makes us a bit uncomfortable!) that you should be aware of.

You might be able to find a better investment than Tokyo KisenLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal