Global Dividend Stocks: 3 Top Picks

In the current global market landscape, investors are navigating a complex environment marked by volatility in U.S. Treasury yields, renewed tariff threats, and fluctuating economic indicators across major regions like the U.S., Europe, and Japan. Amid these challenges, dividend stocks can offer a measure of stability and income potential for investors seeking to balance risk with reward.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.32% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.37% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.22% | ★★★★★★ |

| Daicel (TSE:4202) | 4.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.71% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.00% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.48% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.40% | ★★★★★★ |

Click here to see the full list of 1572 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

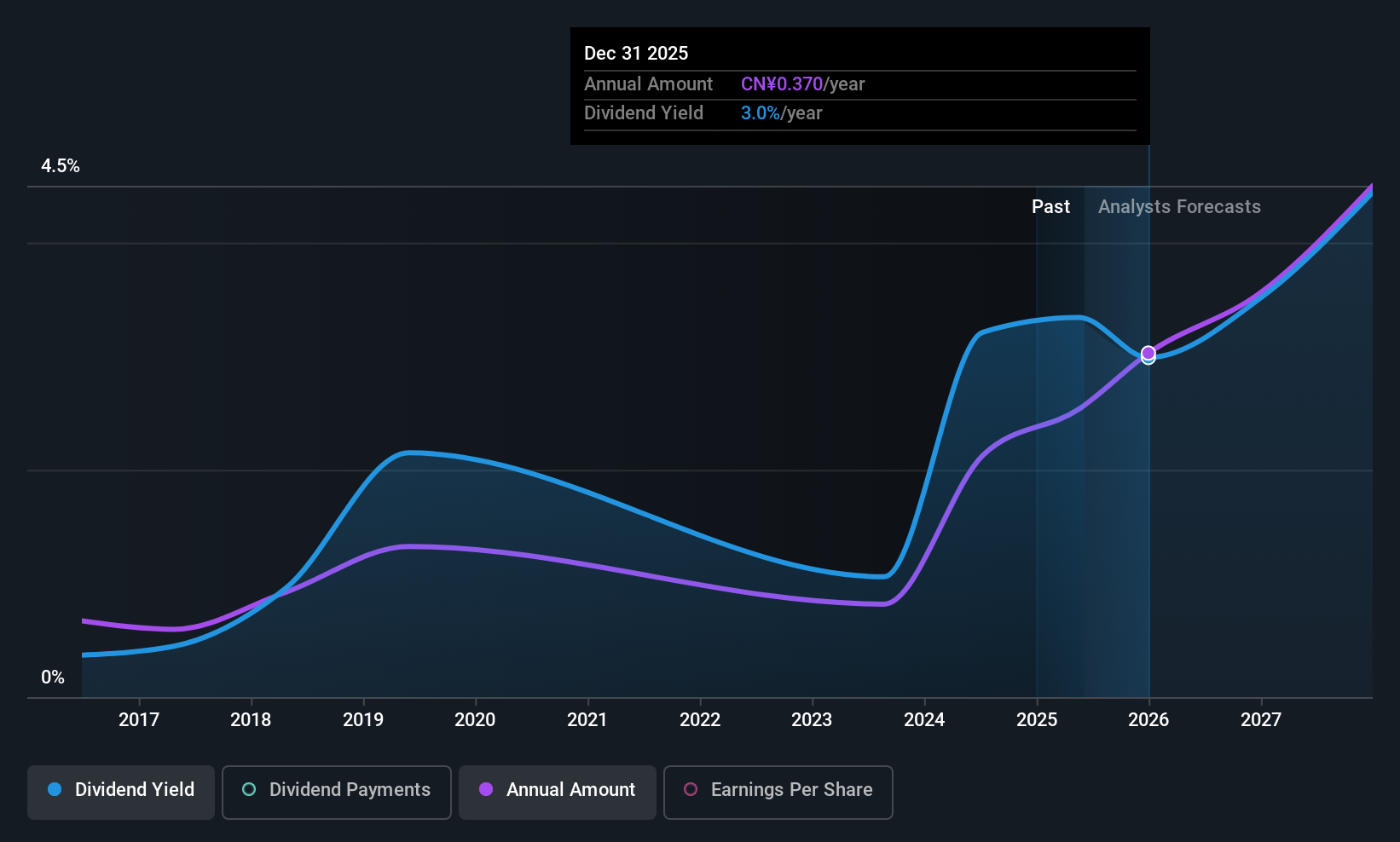

Jinhong Fashion GroupLtd (SHSE:603518)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinhong Fashion Group Co., Ltd. designs, develops, manufactures, and sells apparel and accessories for women, men, and children in China with a market cap of CN¥2.86 billion.

Operations: Jinhong Fashion Group Co., Ltd. generates revenue through its apparel and accessories segments for women, men, and children in China.

Dividend Yield: 3.4%

Jinhong Fashion Group Ltd. has a dividend yield of 3.41%, placing it in the top 25% of CN market payers, though its dividends have been volatile over the past decade. The company's dividends are well-covered by earnings (payout ratio: 37.9%) and cash flows (cash payout ratio: 18.4%), suggesting sustainability despite an unstable track record. Recent Q1 earnings reported a decline in net income to CNY 89 million from CNY 116 million year-over-year, highlighting potential challenges ahead.

- Unlock comprehensive insights into our analysis of Jinhong Fashion GroupLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that Jinhong Fashion GroupLtd is trading behind its estimated value.

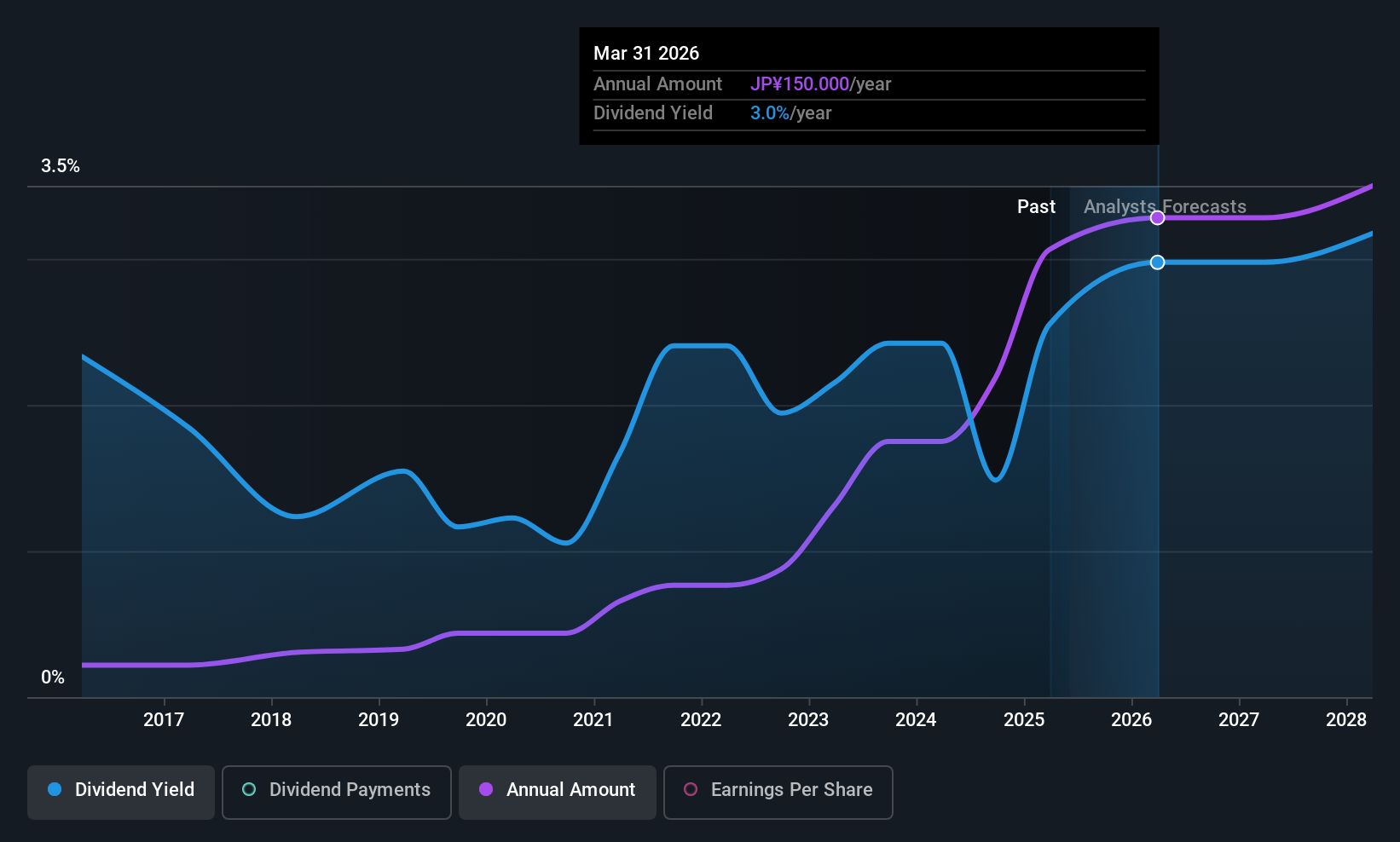

santec Holdings (TSE:6777)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: santec Holdings Corporation develops, manufactures, and sells components for fiber optic telecommunication systems with a market cap of ¥54.74 billion.

Operations: The company's revenue is primarily derived from its Optical Measuring Instrument Related Business, which accounts for ¥17.95 billion, followed by the Optical Components Related Business at ¥4.50 billion.

Dividend Yield: 3.2%

santec Holdings offers a dividend yield of 3.21%, below the top 25% in the JP market. Despite this, dividends have grown and remained stable over the past decade, with a payout ratio of 25.8% and a cash payout ratio of 41.4%, indicating sustainability supported by earnings and cash flows. However, its share price has been highly volatile recently, which may concern some investors ahead of its upcoming fiscal year results announcement on May 9, 2025.

- Get an in-depth perspective on santec Holdings' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of santec Holdings shares in the market.

Yuan Jen EnterprisesLtd (TWSE:1725)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yuan Jen Enterprises Co., Ltd. is a petrochemical trading company with a market capitalization of approximately NT$5.53 billion.

Operations: Yuan Jen Enterprises Ltd. generates revenue primarily from its petrochemicals segment, amounting to NT$8.56 billion.

Dividend Yield: 3.7%

Yuan Jen Enterprises Ltd. has maintained stable and reliable dividends over the past decade, with recent increases despite a low yield of 3.74% compared to top-tier payers in Taiwan. The payout ratio of 69.4% suggests coverage by earnings, but the high cash payout ratio of 153.1% raises sustainability concerns due to insufficient free cash flow coverage. Recent earnings growth and a price-to-earnings ratio below the market average may appeal to some investors seeking value amidst these challenges.

- Take a closer look at Yuan Jen EnterprisesLtd's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Yuan Jen EnterprisesLtd shares in the market.

Turning Ideas Into Actions

- Click here to access our complete index of 1572 Top Global Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal