3 Asian Stocks That May Be Trading Below Their Estimated Value

As Asian markets navigate a complex landscape marked by trade tensions and economic shifts, investors are increasingly on the lookout for opportunities that may be undervalued amidst the volatility. Identifying stocks trading below their estimated value can offer potential for growth, especially when market conditions create discrepancies between intrinsic value and market price.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pansoft (SZSE:300996) | CN¥14.42 | CN¥28.31 | 49.1% |

| Darbond Technology (SHSE:688035) | CN¥38.89 | CN¥76.99 | 49.5% |

| H.U. Group Holdings (TSE:4544) | ¥3056.00 | ¥6057.10 | 49.5% |

| Polaris Holdings (TSE:3010) | ¥222.00 | ¥440.49 | 49.6% |

| Brangista (TSE:6176) | ¥595.00 | ¥1177.43 | 49.5% |

| Kanto Denka Kogyo (TSE:4047) | ¥835.00 | ¥1646.30 | 49.3% |

| Devsisters (KOSDAQ:A194480) | ₩38800.00 | ₩76155.13 | 49.1% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.79 | NZ$1.58 | 50% |

| Dive (TSE:151A) | ¥920.00 | ¥1821.73 | 49.5% |

| TLB (KOSDAQ:A356860) | ₩17760.00 | ₩34911.45 | 49.1% |

Let's explore several standout options from the results in the screener.

NIHON CHOUZAILtd (TSE:3341)

Overview: NIHON CHOUZAI Co., Ltd. operates a chain of health insurance dispensing pharmacies in Japan, with a market cap of ¥94.70 billion.

Operations: The company's revenue segments include ¥321.95 billion from its Dispensing Pharmacy Business, ¥40.16 billion from Pharmaceutical Manufacturing Sales, and ¥11.37 billion from Medical Professional Staffing and Placement.

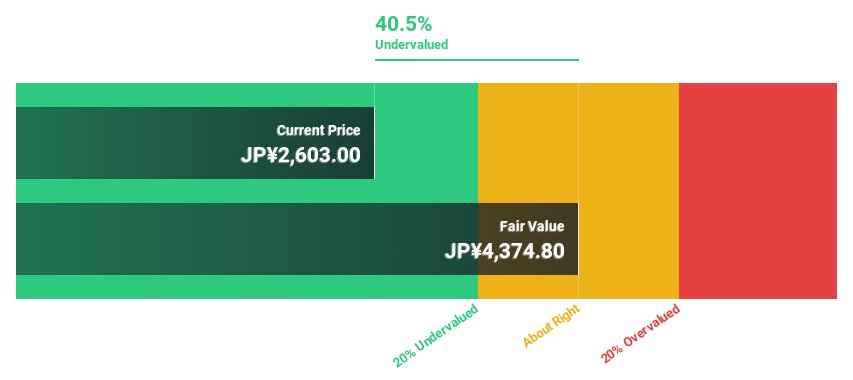

Estimated Discount To Fair Value: 29.6%

NIHON CHOUZAI is trading at ¥3,170, significantly below its estimated fair value of ¥4,502.32. Despite a low return on equity forecast and declining profit margins (currently 0.4%), the company is expected to achieve significant earnings growth of 27.5% annually over the next three years, outpacing the Japanese market's average growth rate. However, its debt coverage by operating cash flow remains a concern amidst high share price volatility recently observed in the market.

- Our comprehensive growth report raises the possibility that NIHON CHOUZAILtd is poised for substantial financial growth.

- Take a closer look at NIHON CHOUZAILtd's balance sheet health here in our report.

Plus Alpha ConsultingLtd (TSE:4071)

Overview: Plus Alpha Consulting Co., Ltd. offers marketing solutions and has a market capitalization of approximately ¥81.37 billion.

Operations: Revenue Segments (in millions of ¥): null

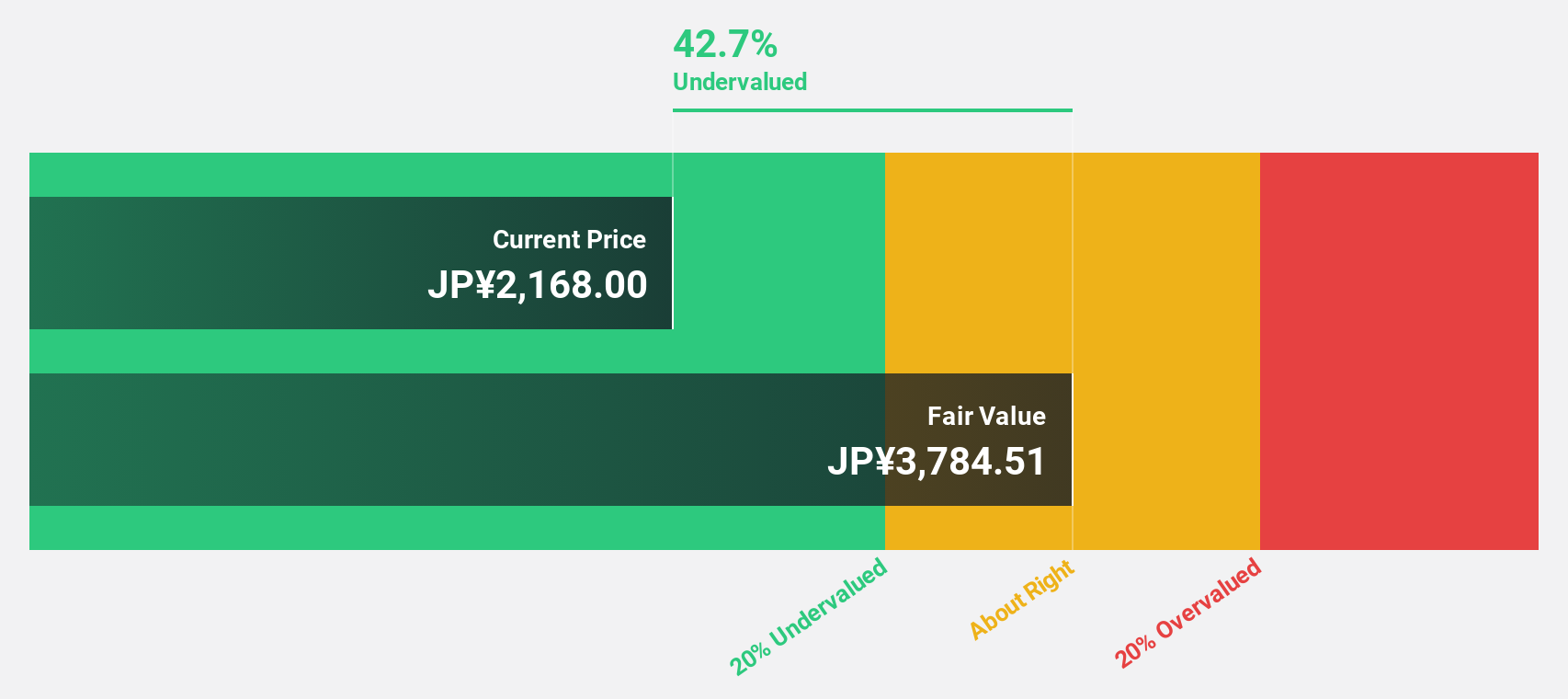

Estimated Discount To Fair Value: 48.7%

Plus Alpha Consulting Ltd. is trading at ¥1,996, significantly below its estimated fair value of ¥3,894.03, suggesting it is undervalued based on cash flows. The company's earnings are projected to grow 18.1% annually, surpassing the Japanese market's average growth rate of 7.6%. However, recent share price volatility and an acquisition by Plus Energy LLC for a combined 10.77% stake may impact investor sentiment in the short term.

- According our earnings growth report, there's an indication that Plus Alpha ConsultingLtd might be ready to expand.

- Unlock comprehensive insights into our analysis of Plus Alpha ConsultingLtd stock in this financial health report.

Future (TSE:4722)

Overview: Future Corporation offers IT consulting and services primarily in Japan, with a market cap of ¥183.90 billion.

Operations: The company's revenue is primarily derived from IT Consulting & Services, which includes package software and services, amounting to ¥63.38 billion, along with Business Innovation contributing ¥8.85 billion.

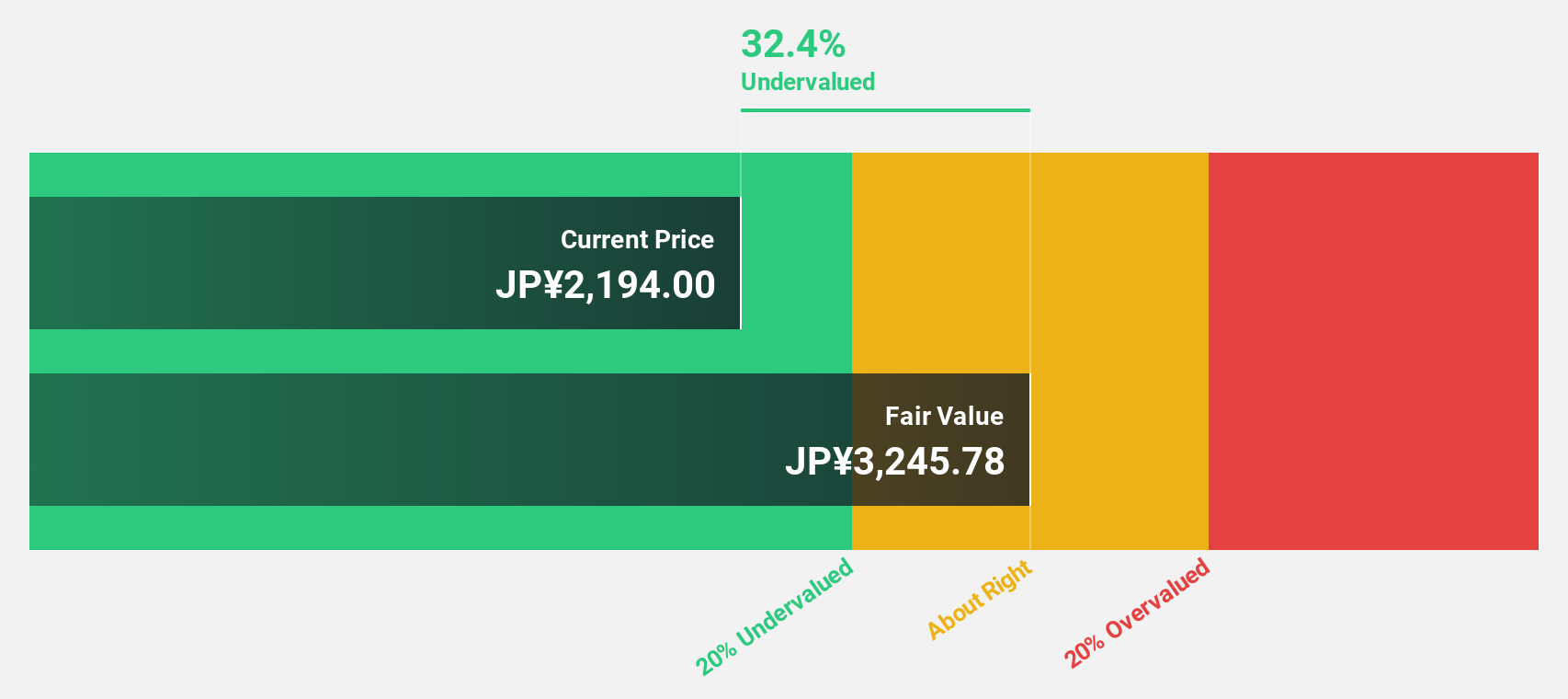

Estimated Discount To Fair Value: 37.7%

Future Corporation is trading at ¥2,075, significantly below its estimated fair value of ¥3,329.51, highlighting its undervaluation based on cash flows. Earnings are forecast to grow 13.5% annually, outpacing the Japanese market average of 7.6%. Recent guidance for 2025 projects net sales of ¥76 billion and an increased dividend payout of ¥23 per share for the year. The company’s strategic disposal of treasury stock may enhance shareholder value further.

- Our earnings growth report unveils the potential for significant increases in Future's future results.

- Get an in-depth perspective on Future's balance sheet by reading our health report here.

Where To Now?

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 303 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal