Rail Vikas Nigam Limited's (NSE:RVNL) Shares May Have Run Too Fast Too Soon

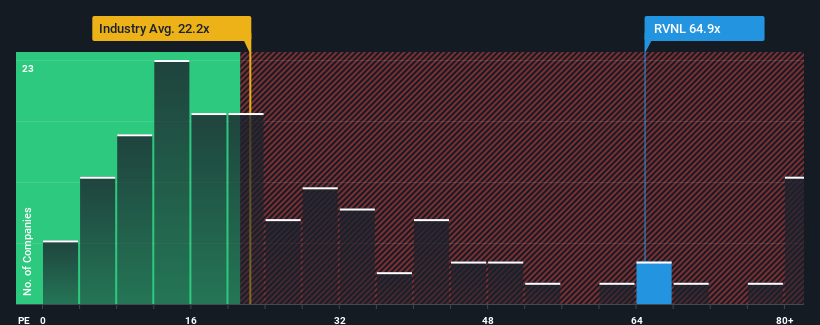

With a price-to-earnings (or "P/E") ratio of 64.9x Rail Vikas Nigam Limited (NSE:RVNL) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 27x and even P/E's lower than 15x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Our free stock report includes 1 warning sign investors should be aware of before investing in Rail Vikas Nigam. Read for free now.While the market has experienced earnings growth lately, Rail Vikas Nigam's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Rail Vikas Nigam

What Are Growth Metrics Telling Us About The High P/E?

Rail Vikas Nigam's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 19%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 15% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 8.9% as estimated by the sole analyst watching the company. With the market predicted to deliver 23% growth , the company is positioned for a weaker earnings result.

In light of this, it's alarming that Rail Vikas Nigam's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Rail Vikas Nigam currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Rail Vikas Nigam that you should be aware of.

If you're unsure about the strength of Rail Vikas Nigam's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal