Breaking Down Magnolia Oil & Gas: 7 Analysts Share Their Views

In the latest quarter, 7 analysts provided ratings for Magnolia Oil & Gas (NYSE:MGY), showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 4 | 0 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 1 | 1 | 0 | 1 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

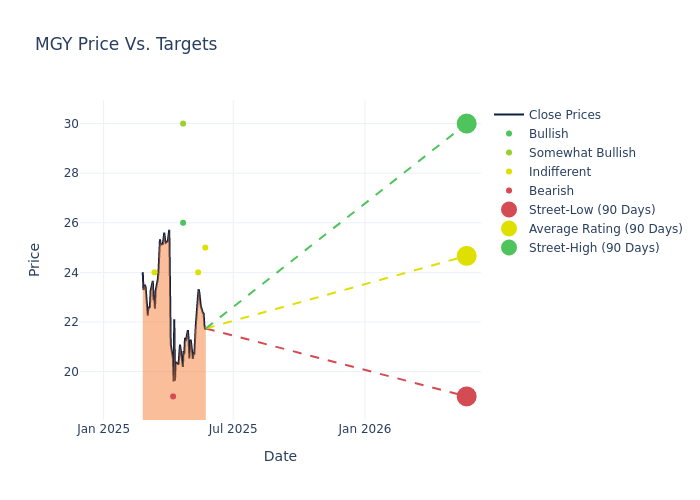

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $24.71, with a high estimate of $30.00 and a low estimate of $19.00. A decline of 4.34% from the prior average price target is evident in the current average.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Magnolia Oil & Gas. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Noah Hungness | B of A Securities | Raises | Neutral | $25.00 | $23.00 |

| Mark Lear | Piper Sandler | Lowers | Neutral | $24.00 | $25.00 |

| Biju Perincheril | Susquehanna | Lowers | Positive | $30.00 | $31.00 |

| Mark Lear | Piper Sandler | Lowers | Neutral | $25.00 | $26.00 |

| Peyton Dorne | UBS | Announces | Buy | $26.00 | - |

| Paul Diamond | Citigroup | Lowers | Sell | $19.00 | $22.00 |

| Zach Parham | JP Morgan | Lowers | Neutral | $24.00 | $28.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Magnolia Oil & Gas. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Magnolia Oil & Gas compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Magnolia Oil & Gas's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Magnolia Oil & Gas's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Magnolia Oil & Gas analyst ratings.

Unveiling the Story Behind Magnolia Oil & Gas

Magnolia Oil & Gas Corp is an independent oil and natural gas company engaged in the acquisition, development, exploration, and production of oil, natural gas, and natural gas liquid (NGL) reserves. The company's oil and natural gas properties are located in Karnes County and the Giddings area in South Texas, where the Company targets the Eagle Ford Shale and Austin Chalk formations. Its objective is to generate stock market value over the long term through consistent organic production growth, high full-cycle operating margins, and an efficient capital program with short economic paybacks. The company's operating segment is acquisition, development, exploration, and production of oil and natural gas properties located in the United States.

Understanding the Numbers: Magnolia Oil & Gas's Finances

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Positive Revenue Trend: Examining Magnolia Oil & Gas's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 9.67% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Energy sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Magnolia Oil & Gas's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 28.92% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Magnolia Oil & Gas's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.27% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Magnolia Oil & Gas's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.56% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Magnolia Oil & Gas's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.21.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal