European Dividend Stocks To Consider In May 2025

As European markets experience a boost in sentiment following the easing of U.S.-China trade tensions, major indices like Germany's DAX and France's CAC 40 have shown positive gains. In this environment, dividend stocks can be particularly appealing for investors seeking steady income streams amidst market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.37% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.81% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.40% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.95% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.87% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 8.91% | ★★★★★★ |

| ERG (BIT:ERG) | 5.70% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

Click here to see the full list of 239 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

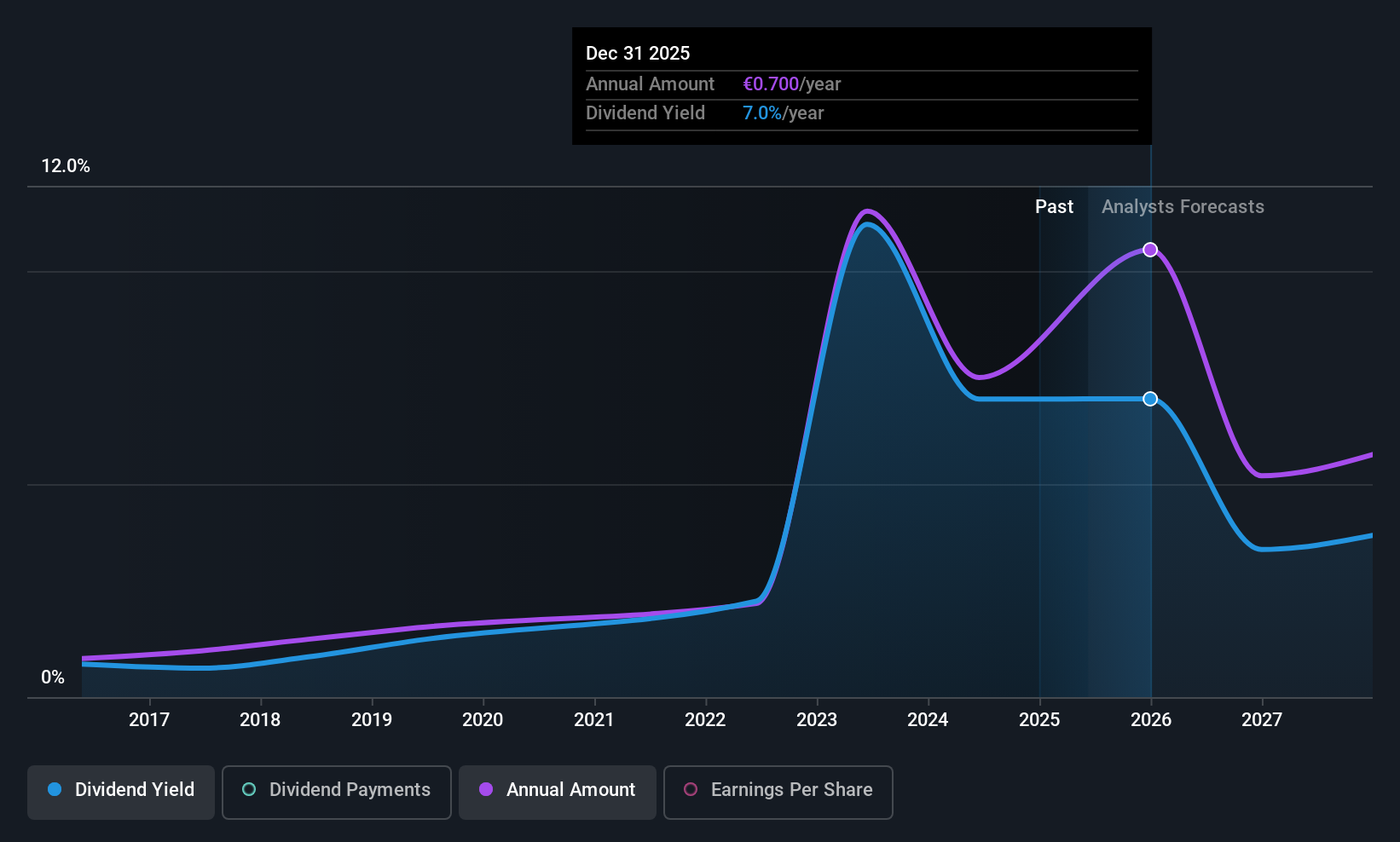

Ibersol S.G.P.S (ENXTLS:IBS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ibersol S.G.P.S. operates a network of restaurants across Portugal, Spain, and Angola, with a market cap of €396.58 million.

Operations: Ibersol S.G.P.S. generates revenue through its Counters (€186.31 million), Restaurants (€112.67 million), and Concessions, Travel and Catering (€173.88 million) segments across its operational regions.

Dividend Yield: 5.2%

Ibersol S.G.P.S. offers a dividend yield of 5.19%, placing it in the top 25% of Portuguese dividend payers, but its high payout ratio (145.9%) suggests dividends aren't well covered by earnings, although cash flow coverage is better at 48.5%. Despite a decade of increased payments, volatility remains an issue with unreliable past performance. Recent earnings show sales growth to €471.11M while net income declined to €13.85M, impacting sustainability concerns.

- Navigate through the intricacies of Ibersol S.G.P.S with our comprehensive dividend report here.

- Our expertly prepared valuation report Ibersol S.G.P.S implies its share price may be lower than expected.

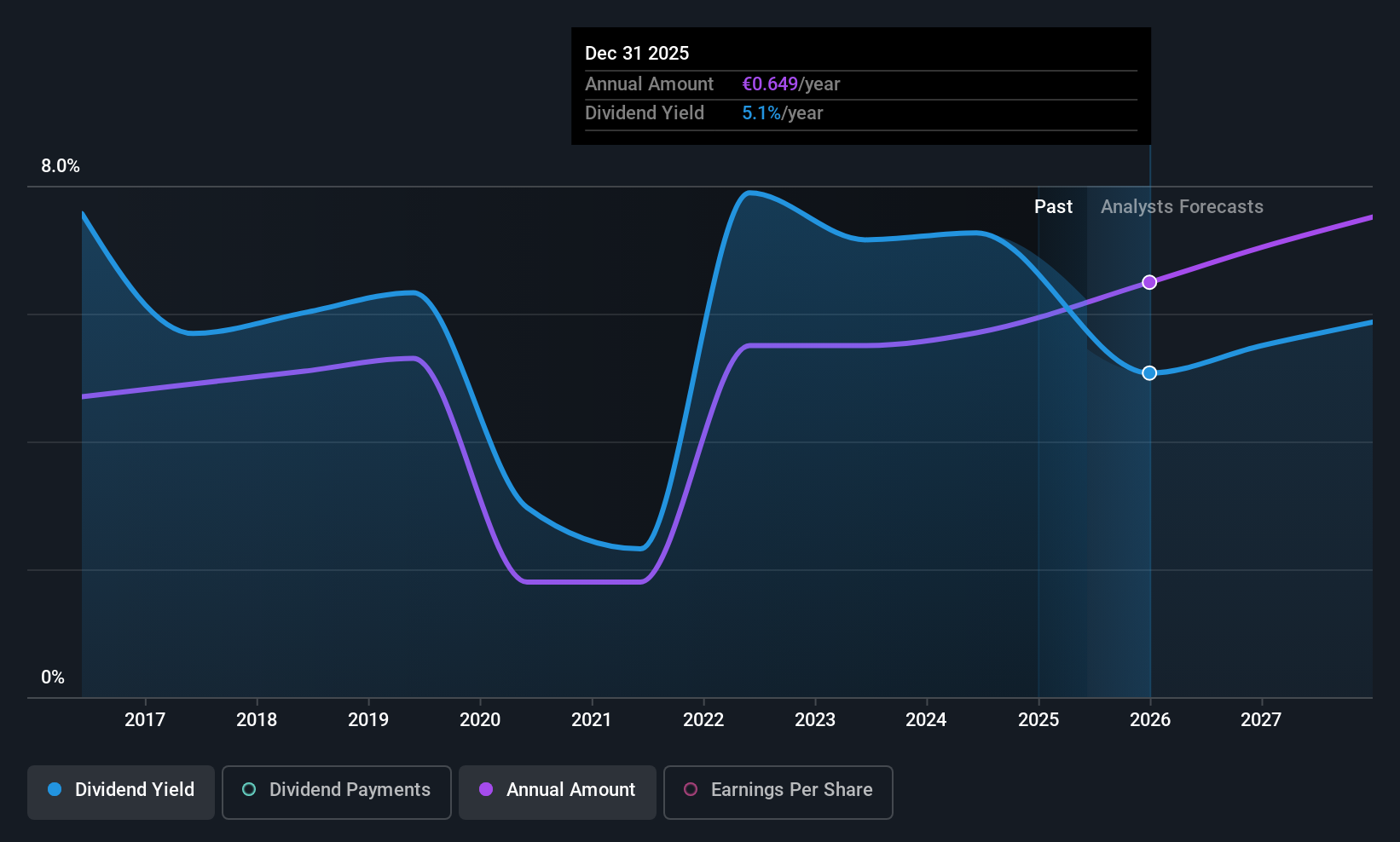

UNIQA Insurance Group (WBAG:UQA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UNIQA Insurance Group AG is an insurance company operating in Austria and Central and Eastern Europe, with a market cap of €3.62 billion.

Operations: UNIQA Insurance Group AG generates revenue from several segments, including UNIQA Austria Life (€257.38 million), UNIQA Austria Health (€1.21 billion), UNIQA International Life (€691.63 million), UNIQA International Health (€136.70 million), Property and Casualty Insurance in Reinsurance (€1.31 billion), Property and Casualty Insurance in UNIQA Austria (€2.39 billion), and Property and Casualty Insurance in UNIQA International (€2.17 billion).

Dividend Yield: 5.1%

UNIQA Insurance Group offers a dividend yield of 5.09%, ranking in the top 25% of Austrian dividend payers, with dividends well covered by earnings (payout ratio: 53.3%) and cash flows (cash payout ratio: 43.8%). Despite past volatility, recent increases include an annual dividend of €0.60 per share announced for June 2025. Earnings have grown steadily at 24.8% annually over five years, although historical payment reliability remains a concern for investors seeking stability.

- Click to explore a detailed breakdown of our findings in UNIQA Insurance Group's dividend report.

- The valuation report we've compiled suggests that UNIQA Insurance Group's current price could be quite moderate.

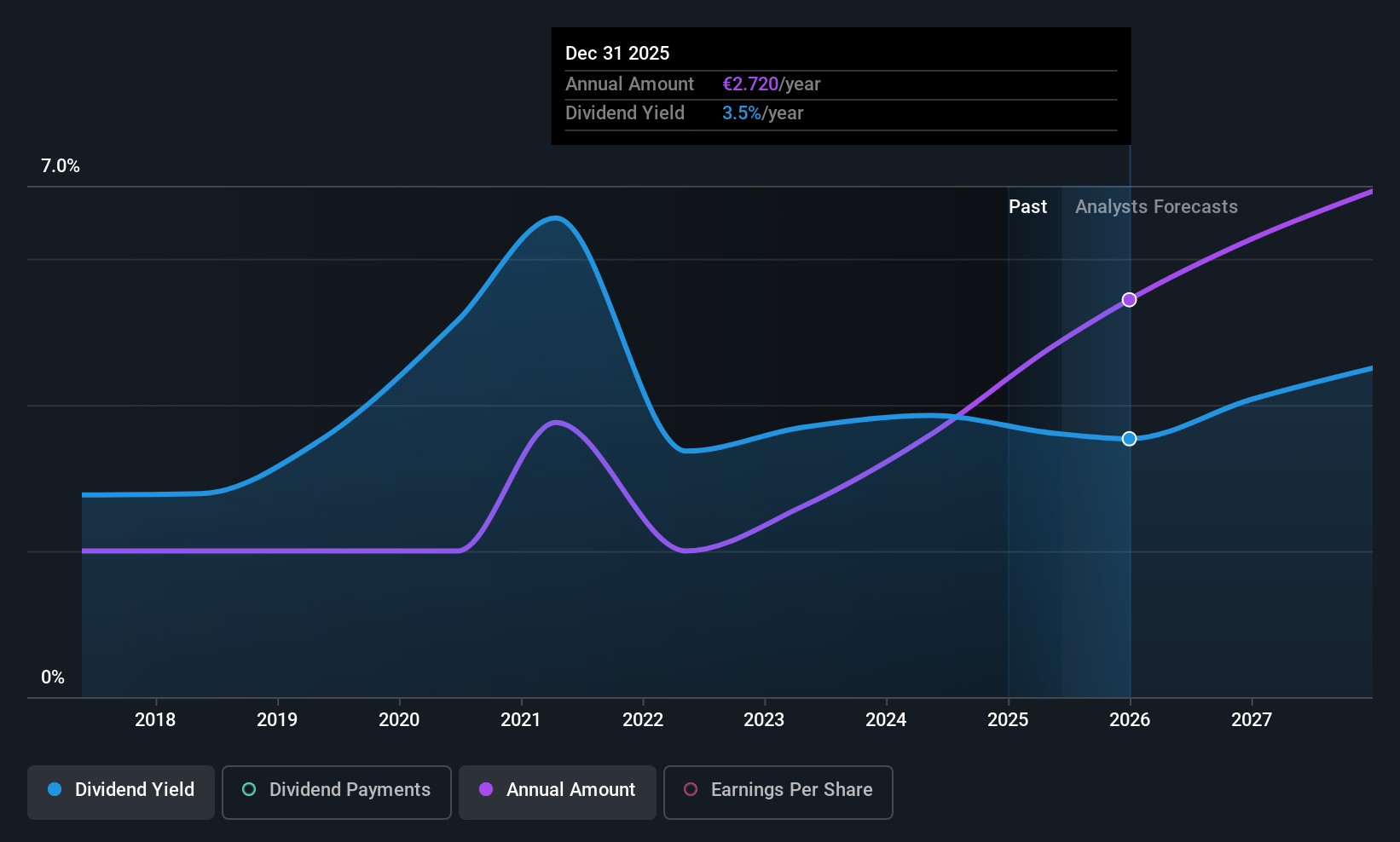

Bilfinger (XTRA:GBF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bilfinger SE is an industrial services provider catering to the process industry across Europe, North America, and the Middle East, with a market cap of €2.89 billion.

Operations: Bilfinger SE's revenue is primarily derived from its Engineering & Maintenance Europe segment at €3.64 billion, followed by Technologies at €748.10 million and Engineering & Maintenance International at €724.60 million.

Dividend Yield: 3.1%

Bilfinger SE's dividend payments are adequately supported by earnings, with a payout ratio of 50.6%, and cash flows, maintaining a low cash payout ratio of 34.3%. Despite an increase in dividends over the past decade, their reliability is questionable due to historical volatility. The recent announcement of an annual dividend of €2.40 per share reflects this growth but remains below top-tier yields in Germany at 3.12%. Earnings for Q1 2025 showed improvement with net income rising to €31.6 million from €24.9 million year-on-year.

- Take a closer look at Bilfinger's potential here in our dividend report.

- Our valuation report here indicates Bilfinger may be undervalued.

Summing It All Up

- Dive into all 239 of the Top European Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal