3 Penny Stocks With Market Caps As Low As $70M To Watch

As the U.S. market experiences a slight rebound from recent sell-offs, investors are keeping a close eye on federal deficit concerns and fluctuating bond yields. For those interested in exploring smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area with potential value. By focusing on those with solid financial foundations and clear growth trajectories, investors can uncover promising opportunities among these under-the-radar stocks poised for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| SideChannel (OTCPK:SDCH) | $0.052 | $11.47M | ✅ 4 ⚠️ 2 View Analysis > |

| Perfect (NYSE:PERF) | $1.79 | $184.35M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.05 | $188.36M | ✅ 4 ⚠️ 1 View Analysis > |

| CureVac (NasdaqGM:CVAC) | $3.19 | $963.67M | ✅ 4 ⚠️ 0 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.35 | $56.66M | ✅ 1 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.54 | $87.41M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.70 | $22.12M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.812625 | $5.88M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.16 | $72.4M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.9001 | $28.87M | ✅ 3 ⚠️ 6 View Analysis > |

Click here to see the full list of 735 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Intellicheck (NasdaqGM:IDN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Intellicheck, Inc. is a technology company that provides on-demand digital identity validation solutions for KYC, fraud prevention, and age verification in North America, with a market cap of approximately $78.47 million.

Operations: Intellicheck does not report distinct revenue segments.

Market Cap: $78.47M

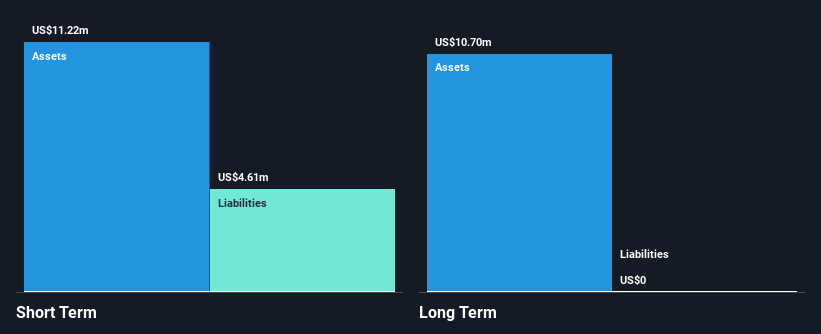

Intellicheck, Inc., with a market cap of US$78.47 million, offers digital identity validation solutions and has recently signed a significant three-year agreement with a top financial customer. This contract is expected to be one of the company's top revenue generators, indicating potential growth in its business operations. Despite being unprofitable and having negative return on equity (-4.51%), Intellicheck has managed to reduce losses over the past five years at an 18.1% annual rate while maintaining no debt and covering its short-term liabilities with US$13.5 million in assets against US$7 million in liabilities.

- Navigate through the intricacies of Intellicheck with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Intellicheck's future.

Quanterix (NasdaqGM:QTRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quanterix Corporation is a life sciences company that develops and markets digital immunoassay platforms to enhance precision health for research and diagnostics across various global regions, with a market cap of $193.76 million.

Operations: The company's revenue primarily comes from its Diagnostic Kits and Equipment segment, generating $135.69 million.

Market Cap: $193.76M

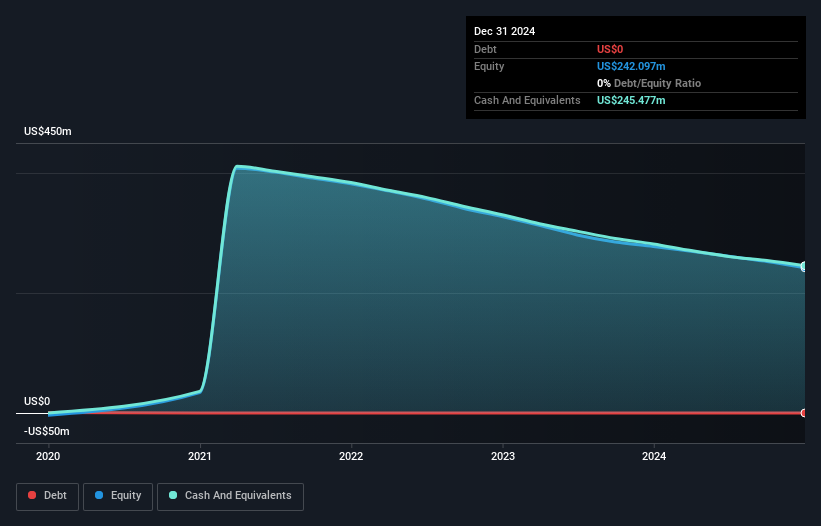

Quanterix Corporation, with a market cap of US$193.76 million, is navigating significant challenges and opportunities as a penny stock. The company reported first-quarter 2025 revenue of US$30.33 million but faced increased net losses of US$20.5 million compared to the previous year, highlighting ongoing profitability issues. Despite financial hurdles, Quanterix maintains strong liquidity with short-term assets far exceeding liabilities and remains debt-free. Recent auditor changes to KPMG and activist opposition to its proposed merger with Akoya Biosciences add uncertainty but also potential for strategic shifts that could impact its future trajectory in precision health diagnostics.

- Click here to discover the nuances of Quanterix with our detailed analytical financial health report.

- Learn about Quanterix's future growth trajectory here.

Design Therapeutics (NasdaqGS:DSGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Design Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on researching, designing, developing, and commercializing small molecule therapeutic drugs for genetic diseases in the United States with a market cap of $208.34 million.

Operations: Design Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $208.34M

Design Therapeutics, Inc., with a market cap of US$208.34 million, remains pre-revenue and is navigating its clinical-stage developments amidst financial challenges. The company reported a net loss of US$17.72 million for Q1 2025, reflecting increased losses from the previous year. Despite this, Design's strong cash position provides a runway exceeding three years without debt concerns. Recent favorable Phase 1 trial results for DT-168 suggest potential progress in treating Fuchs endothelial corneal dystrophy (FECD). However, ongoing equity offerings and high share price volatility underscore the inherent risks associated with investing in early-stage biotech ventures like Design Therapeutics.

- Dive into the specifics of Design Therapeutics here with our thorough balance sheet health report.

- Gain insights into Design Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Explore the 735 names from our US Penny Stocks screener here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal