Increases to Eniro Group AB (publ)'s (STO:ENRO) CEO Compensation Might Cool off for now

Key Insights

- Eniro Group to hold its Annual General Meeting on 28th of May

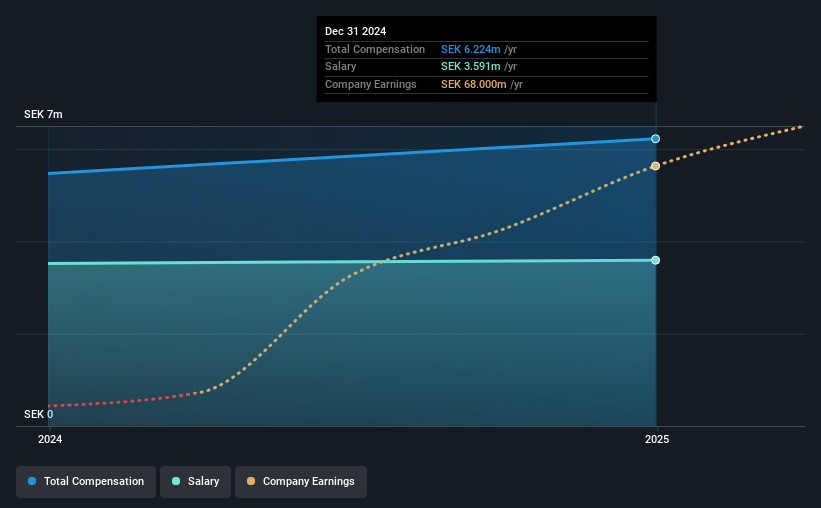

- CEO Hosni Teque-Omeirat's total compensation includes salary of kr3.59m

- The total compensation is 90% higher than the average for the industry

- Over the past three years, Eniro Group's EPS grew by 95% and over the past three years, the total loss to shareholders 47%

In the past three years, the share price of Eniro Group AB (publ) (STO:ENRO) has struggled to grow and now shareholders are sitting on a loss. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 28th of May. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Eniro Group

Comparing Eniro Group AB (publ)'s CEO Compensation With The Industry

Our data indicates that Eniro Group AB (publ) has a market capitalization of kr290m, and total annual CEO compensation was reported as kr6.2m for the year to December 2024. That's a notable increase of 14% on last year. We note that the salary of kr3.59m makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the Swedish Media industry with market capitalizations under kr1.9b, the reported median total CEO compensation was kr3.3m. Hence, we can conclude that Hosni Teque-Omeirat is remunerated higher than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr3.6m | kr3.5m | 58% |

| Other | kr2.6m | kr1.9m | 42% |

| Total Compensation | kr6.2m | kr5.5m | 100% |

On an industry level, around 58% of total compensation represents salary and 42% is other remuneration. Although there is a difference in how total compensation is set, Eniro Group more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Eniro Group AB (publ)'s Growth

Eniro Group AB (publ)'s earnings per share (EPS) grew 95% per year over the last three years. The trailing twelve months of revenue was pretty much the same as the prior period.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Eniro Group AB (publ) Been A Good Investment?

The return of -47% over three years would not have pleased Eniro Group AB (publ) shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Eniro Group that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal