What to Expect from Intuit's Earnings

Intuit (NASDAQ:INTU) is gearing up to announce its quarterly earnings on Thursday, 2025-05-22. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Intuit will report an earnings per share (EPS) of $10.90.

The market awaits Intuit's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

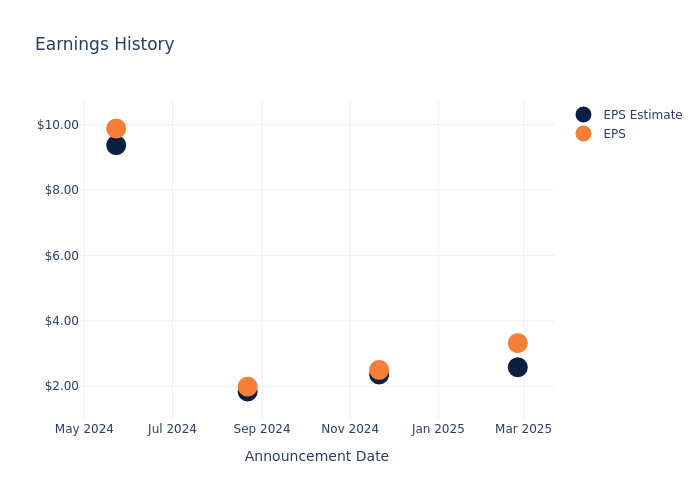

Earnings Track Record

Last quarter the company beat EPS by $0.74, which was followed by a 12.58% increase in the share price the next day.

Here's a look at Intuit's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.58 | 2.36 | 1.84 | 9.37 |

| EPS Actual | 3.32 | 2.50 | 1.99 | 9.88 |

| Price Change % | 13.0% | -6.0% | -7.000000000000001% | -8.0% |

Market Performance of Intuit's Stock

Shares of Intuit were trading at $671.16 as of May 20. Over the last 52-week period, shares are up 0.76%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Intuit

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Intuit.

Analysts have provided Intuit with 12 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $708.08, suggesting a potential 5.5% upside.

Analyzing Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Adobe, AppLovin and Strategy, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Adobe, with an average 1-year price target of $500.5, suggesting a potential 25.43% downside.

- Analysts currently favor an Outperform trajectory for AppLovin, with an average 1-year price target of $435.38, suggesting a potential 35.13% downside.

- Analysts currently favor an Buy trajectory for Strategy, with an average 1-year price target of $510.8, suggesting a potential 23.89% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Adobe, AppLovin and Strategy, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Intuit | Outperform | 17.04% | $3.03B | 2.61% |

| Adobe | Outperform | 10.27% | $5.09B | 13.32% |

| AppLovin | Outperform | 40.25% | $1.21B | 69.21% |

| Strategy | Buy | -3.63% | $77.09M | -16.76% |

Key Takeaway:

Intuit ranks at the top for Revenue Growth with 17.04%, outperforming peers. It also leads in Gross Profit at $3.03B. However, it has the lowest Return on Equity at 2.61% among the group. Overall, Intuit stands out for its strong revenue growth and gross profit performance compared to its peers.

Delving into Intuit's Background

Intuit serves small and midsize businesses with accounting software QuickBooks and online marketing platform Mailchimp. The company also operates retail tax filing tool TurboTax, personal finance platform Credit Karma, and a suite of professional tax offerings for accountants. Founded in the mid-1980s, Intuit enjoys a dominant market share for small business accounting and do-it-yourself tax filing in the US.

Understanding the Numbers: Intuit's Finances

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Over the 3 months period, Intuit showcased positive performance, achieving a revenue growth rate of 17.04% as of 31 January, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: Intuit's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 11.88% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.61%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Intuit's ROA excels beyond industry benchmarks, reaching 1.45%. This signifies efficient management of assets and strong financial health.

Debt Management: Intuit's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.38.

To track all earnings releases for Intuit visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal