Bitcoin Depot Inc. (NASDAQ:BTM) Stock Catapults 113% Though Its Price And Business Still Lag The Industry

The Bitcoin Depot Inc. (NASDAQ:BTM) share price has done very well over the last month, posting an excellent gain of 113%. Looking back a bit further, it's encouraging to see the stock is up 59% in the last year.

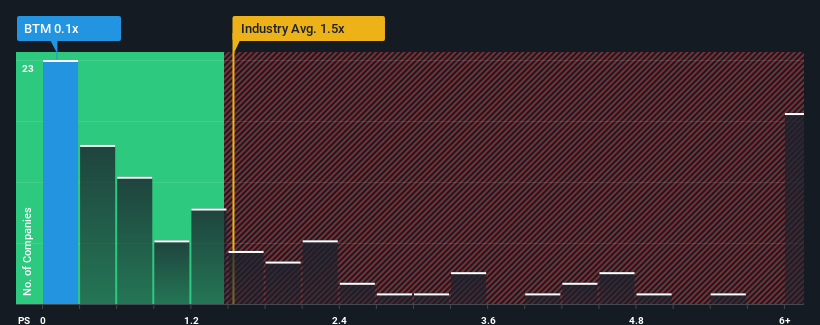

Even after such a large jump in price, Bitcoin Depot may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Commercial Services industry in the United States have P/S ratios greater than 1.5x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Bitcoin Depot

How Bitcoin Depot Has Been Performing

While the industry has experienced revenue growth lately, Bitcoin Depot's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bitcoin Depot.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Bitcoin Depot's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 3.6% as estimated by the three analysts watching the company. With the industry predicted to deliver 7.7% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Bitcoin Depot's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Bitcoin Depot's P/S?

Bitcoin Depot's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Bitcoin Depot maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Bitcoin Depot has 2 warning signs (and 1 which can't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal