Investors Holding Back On CN Energy Group. Inc. (NASDAQ:CNEY)

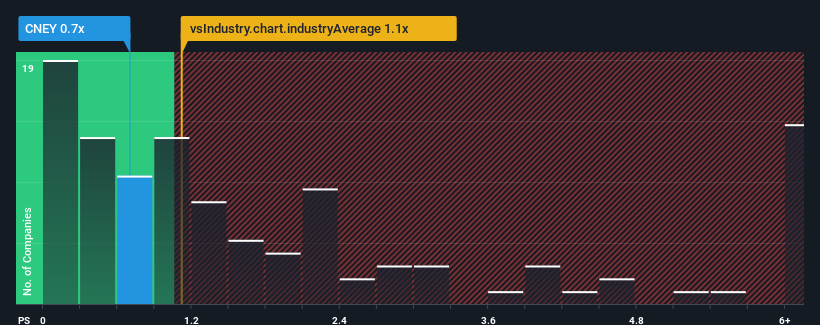

With a median price-to-sales (or "P/S") ratio of close to 1.1x in the Chemicals industry in the United States, you could be forgiven for feeling indifferent about CN Energy Group. Inc.'s (NASDAQ:CNEY) P/S ratio of 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We've discovered 4 warning signs about CN Energy Group. View them for free.View our latest analysis for CN Energy Group

What Does CN Energy Group's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at CN Energy Group over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on CN Energy Group's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For CN Energy Group?

In order to justify its P/S ratio, CN Energy Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Still, the latest three year period has seen an excellent 157% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is only predicted to deliver 10% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that CN Energy Group's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From CN Energy Group's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision CN Energy Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Having said that, be aware CN Energy Group is showing 4 warning signs in our investment analysis, and 2 of those make us uncomfortable.

If you're unsure about the strength of CN Energy Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal