Asian Market Stocks Estimated Below Intrinsic Value In May 2025

As global markets react positively to the recent U.S.-China tariff suspension, Asian stock indices have experienced a boost, reflecting improved investor sentiment across the region. In this climate of cautious optimism, identifying stocks that are potentially undervalued can provide opportunities for investors seeking assets that may be trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PixArt Imaging (TPEX:3227) | NT$220.50 | NT$439.50 | 49.8% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥22.87 | CN¥44.96 | 49.1% |

| People & Technology (KOSDAQ:A137400) | ₩36650.00 | ₩73186.71 | 49.9% |

| Boditech Med (KOSDAQ:A206640) | ₩16100.00 | ₩31125.58 | 48.3% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.72 | CN¥34.57 | 48.7% |

| ONE CAREER (TSE:4377) | ¥2218.00 | ¥4394.74 | 49.5% |

| Dive (TSE:151A) | ¥912.00 | ¥1813.62 | 49.7% |

| Cosmax (KOSE:A192820) | ₩210000.00 | ₩409710.85 | 48.7% |

| BalnibarbiLtd (TSE:3418) | ¥1166.00 | ¥2321.81 | 49.8% |

| True Corporation (SET:TRUE) | THB12.40 | THB24.64 | 49.7% |

Here's a peek at a few of the choices from the screener.

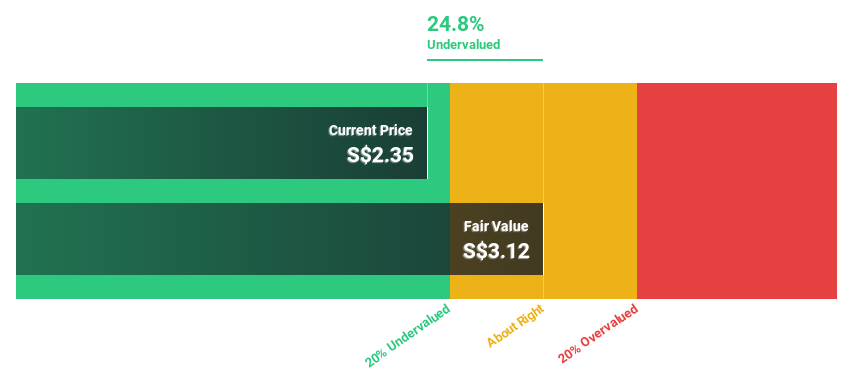

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD8.66 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which generated CN¥25.22 billion, followed by the shipping segment with CN¥1.24 billion.

Estimated Discount To Fair Value: 21.8%

Yangzijiang Shipbuilding (Holdings) appears undervalued, trading 21.8% below its estimated fair value of SGD 2.81, with a current price of SGD 2.20. The company reported significant net income growth to CNY 6.63 billion in 2024 and offers a reliable dividend yield of 5.44%. Its earnings are forecast to grow at an annual rate of 12.2%, outpacing the Singapore market's growth rate, while revenue is expected to increase by 14.9% annually.

- Our earnings growth report unveils the potential for significant increases in Yangzijiang Shipbuilding (Holdings)'s future results.

- Unlock comprehensive insights into our analysis of Yangzijiang Shipbuilding (Holdings) stock in this financial health report.

Toray Industries (TSE:3402)

Overview: Toray Industries, Inc. operates globally in the manufacturing and sale of fibers and textiles, performance chemicals, carbon fiber composite materials, environment and engineering products, and life science products with a market cap of approximately ¥1.54 trillion.

Operations: Toray Industries generates revenue through its diverse operations in fibers and textiles, performance chemicals, carbon fiber composite materials, environment and engineering products, and life science products across Japan, China, North America, Europe, and other international markets.

Estimated Discount To Fair Value: 16.1%

Toray Industries trades at ¥996.1, 16.1% below its estimated fair value of ¥1186.99, suggesting potential undervaluation based on cash flows. The company forecasts earnings growth of 20.14% annually over the next three years, outpacing the Japanese market's average growth rate of 7.6%. Recent dividend affirmations and increases reflect stable financial health, while revenue is projected to grow at a modest pace of 4.5% per year, slightly above the market average.

- Upon reviewing our latest growth report, Toray Industries' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Toray Industries with our detailed financial health report.

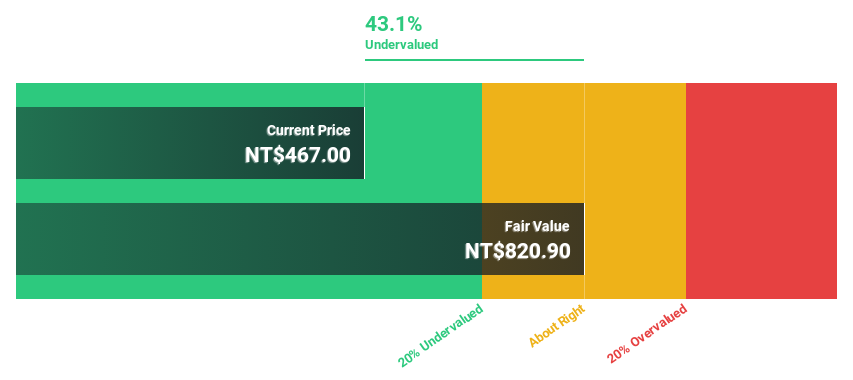

Lai Yih Footwear (TWSE:6890)

Overview: Lai Yih Footwear Co., Ltd. produces and sells vulcanized shoes, athletic footwear, cold-pressed shoes, and specialized functional footwear with a market cap of NT$80.31 billion.

Operations: Lai Yih Footwear Co., Ltd. generates revenue through the production and sale of vulcanized shoes, athletic footwear, cold-pressed shoes, and specialized functional footwear.

Estimated Discount To Fair Value: 39.3%

Lai Yih Footwear, trading at NT$322, is valued 39.3% below its estimated fair value of NT$530.46, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow at 19.5% annually, surpassing the Taiwan market's growth rate of 13.5%. Despite a volatile share price and dividends not fully covered by free cash flow, recent financial results show significant revenue and net income increases compared to the previous year.

- Insights from our recent growth report point to a promising forecast for Lai Yih Footwear's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Lai Yih Footwear.

Seize The Opportunity

- Gain an insight into the universe of 290 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal