Virgin Galactic Holdings (NYSE:SPCE) Reports Reduced Net Loss in Q1 2025

Virgin Galactic Holdings (NYSE:SPCE) reported a reduced net loss and an improvement in earnings per share for Q1 2025, despite a significant decline in sales. These financial announcements coincide with a striking 90% rise in the company's share price over the last month. During this period, the broader market also showed strong growth, climbing by 5.3% over the past week and 12% over the last 12 months, with earnings forecasts growing annually by 14%. While Virgin Galactic's financial results would have added weight to the broader market trend, the substantial share price increase stands out significantly against the general market movements.

Virgin Galactic Holdings' shares have experienced a challenging longer-term trajectory, resulting in a 76.24% decline over the past year. This substantial decrease contrasts starkly with the company's recent remarkable 90% rise in share price over the last month. Over the past year, Virgin Galactic's performance also falls short compared to the US market's return of 11.9% and the Aerospace & Defense industry's return of 27.5%. This disparity suggests significant volatility and risk in the company's stock behavior over the long term.

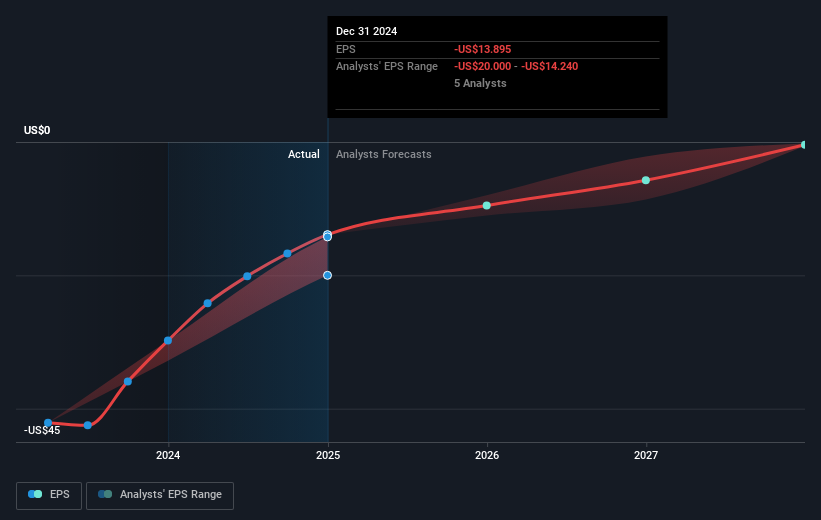

The detailed financial results and strategic developments have potential implications for Virgin Galactic's revenue and earnings forecasts. The improvement in net losses and loss per share figures indicate some progression toward financial stability, yet the overall sales decline could dampen revenue growth prospects. Despite a positive sentiment from recent share price increases, the discrepancy between the current share price and the analysts' consensus target suggests market skepticism regarding future value realization. With analysts' target price substantially higher than the current stock price, there is a considerable gap suggesting varying opinions on the company's outlook. This balance of optimism and risk underscores the complexity investors face in evaluating Virgin Galactic's long-term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal