The yield on 30-year Japanese treasury bonds is approaching an all-time high, and the central bank's policy is in a dilemma

The Zhitong Finance App learned that Japan's 7.8 trillion US dollar treasury bond market is undergoing historic drastic changes. After a long period of deflation, Japan's long-term treasury bond yield climbed at an alarming rate. The yield on 30-year treasury bonds hit 2.985% this Friday, only one step away from the historical high of 3.03%, and the 40-year yield hit a record high of 3.47%. In this wave of steeper yield curves, long-term interest rates rose twice as much as short-term interest rates, creating a rare trend of inversion.

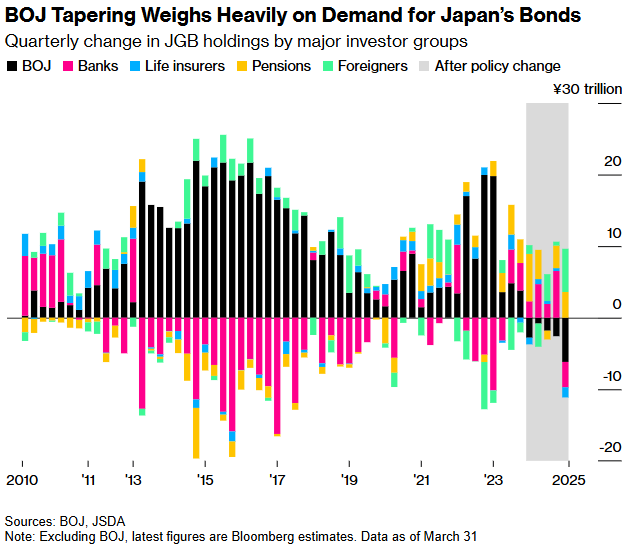

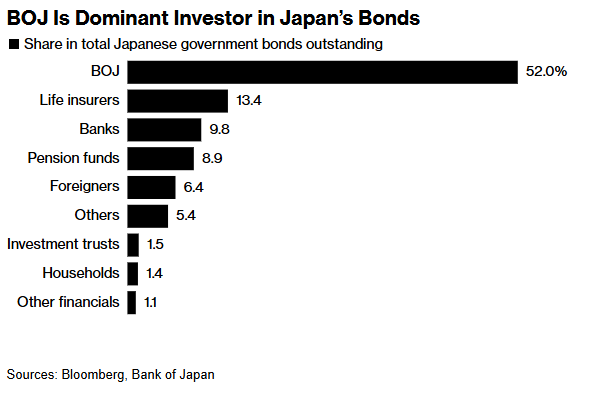

The Bank of Japan is in the midst of a policy shift. As the economy got rid of deflation, the central bank has reduced the scale of bond purchases, but local institutional investors have yet to take over. Traditional buyers such as Japan Life Insurance, the largest life insurance company in Japan, still hold coins on the sidelines, worried about the turmoil in the global market caused by the Trump administration's tariff policy. Shoki Omori, chief strategist at Mizuho Securities, stated, “This is not only an inclination in the yield curve, but also a sign of a shift in Japan's monetary and fiscal paradigm.”

Figure 1

According to information, Japan, which has the largest amount of government debt among developed countries, is facing a double squeeze of soaring debt repayment costs and weak economic growth. Japanese Prime Minister Ishiwari Shigeru needs to balance the need for fiscal stimulus and defense spending before the July Senate election, and the risk of trade friction between the US and Japan further complicates the situation. Naomi Fink, a global strategist at Nikko Asset Management, warned: “The Bank of Japan must be wary of household inflation expectations becoming unanchored, and fiscal expansion also needs to be restrained; otherwise, it will trigger a credit rating alarm.”

Figure 2

Currently, the market is extremely divided: Sumitomo Mitsui Trust asset management strategist Inadome Katsutoshi predicts that the 30-year yield will break through the 3% psychological barrier, while Takeda Fuji, the chief fund manager of Resona Asset Management, believes in the principle that ultra-long-term bonds have been sold off due to exhaustion of liquidity, and yields have peaked. It is worth noting that Pioneer Group and other foreign-funded institutions have begun to reverse bottom. Alex Kourtney, head of international interest rates, said, “The easing of trade tension will pave the way for the central bank to tighten its policy, and long-term yields will bottom out in the 2.5%-3% range.”

In fact, Japan's steeper yield curve is part of a global trend. Global investors, particularly participants in the US Treasury bond market, are struggling to cope with the uncertainty of the “new world order” and the Trump administration's policies. Germany's long-term interest rates are also under upward pressure due to landmark spending plans. However, the situation is particularly prominent in Japan, where some bondholders are facing losses.

Since April, the difference in yield between Japan's 10-year and 30-year bonds has widened by about 50 basis points, far exceeding that of the US, Germany, and the UK. The yield on Japan's benchmark 10-year bond may even surpass China, which faces so-called “Japanization” concerns.

Bloomberg strategist Mark Cranfield pointed out that interest costs on Japanese debt are rising and may face negative scrutiny from credit rating companies in the future. The government wanted treasury yields to plummet, but the shift of capital from fixed income portfolios to equities made that hope difficult to fulfill for the time being.

Continued rise in ultra-long-term yields is likely to drive up the costs of corporate loans and mortgages. But on the other hand, bank profits may increase as interest spreads on deposits and loans widen. Some market participants believe that the steeper yield curve is only a temporary phenomenon. It is expected that as tension subsides, ultra-long-term yields will decline somewhat.

Figure 3

It is worth mentioning that Japan's net supply of ultra-long-term treasury bonds has increased significantly in this fiscal year, yet the purchase demand from life insurance companies continues to be absent, leading to a worsening imbalance between supply and demand in the market.

In response, Shinichiro Kadota, head of Japan's foreign exchange and interest rate strategy at Barclays Securities Japan Ltd., said, “Life insurance companies' demand is the key to the ultimate stability of 30-year bonds, but we haven't heard any purchase intentions.” Recently, foreign investors have entered the Japanese stock market in large numbers and increased their stock holdings by a record in the first quarter. However, their share of the stock market is still small.

Toshiaki Todo, a senior yen interest rate strategist at Nomura Securities, said, “Overseas investors and pension funds are unlikely to replace life insurance companies and become stable buyers of ultra-long-term Japanese treasury bonds, and it is difficult to completely make up for the lack of demand.” Furthermore, net supply (total supply minus redemptions) has been concentrated on ultra-long-term bonds, indicating that bonds of these matures continue to face upward pressure.

Figure 4

Overall, this bond-market storm is spilling over into the real economy. Mortgage interest rates have risen along with the market, but the widening of interest spreads on bank deposits and loans may become a rare advantage. As Shoki Omori of Mizuho Securities said, “Under the triple pressure of inflation, fiscal and global interest rate fluctuations, Japan's financial vessels are sailing into uncharted waters, and balancing economic stability with financial risk is the ultimate test.”

Wall Street Journal

Wall Street Journal