European Dividend Stocks To Consider For Your Portfolio

As European markets continue to navigate the complexities of global trade tensions, the pan-European STOXX Europe 600 Index has shown resilience, rising for a fourth consecutive week. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those looking to bolster their portfolios amidst uncertain economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.36% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.42% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.40% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.66% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.60% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.75% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.22% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

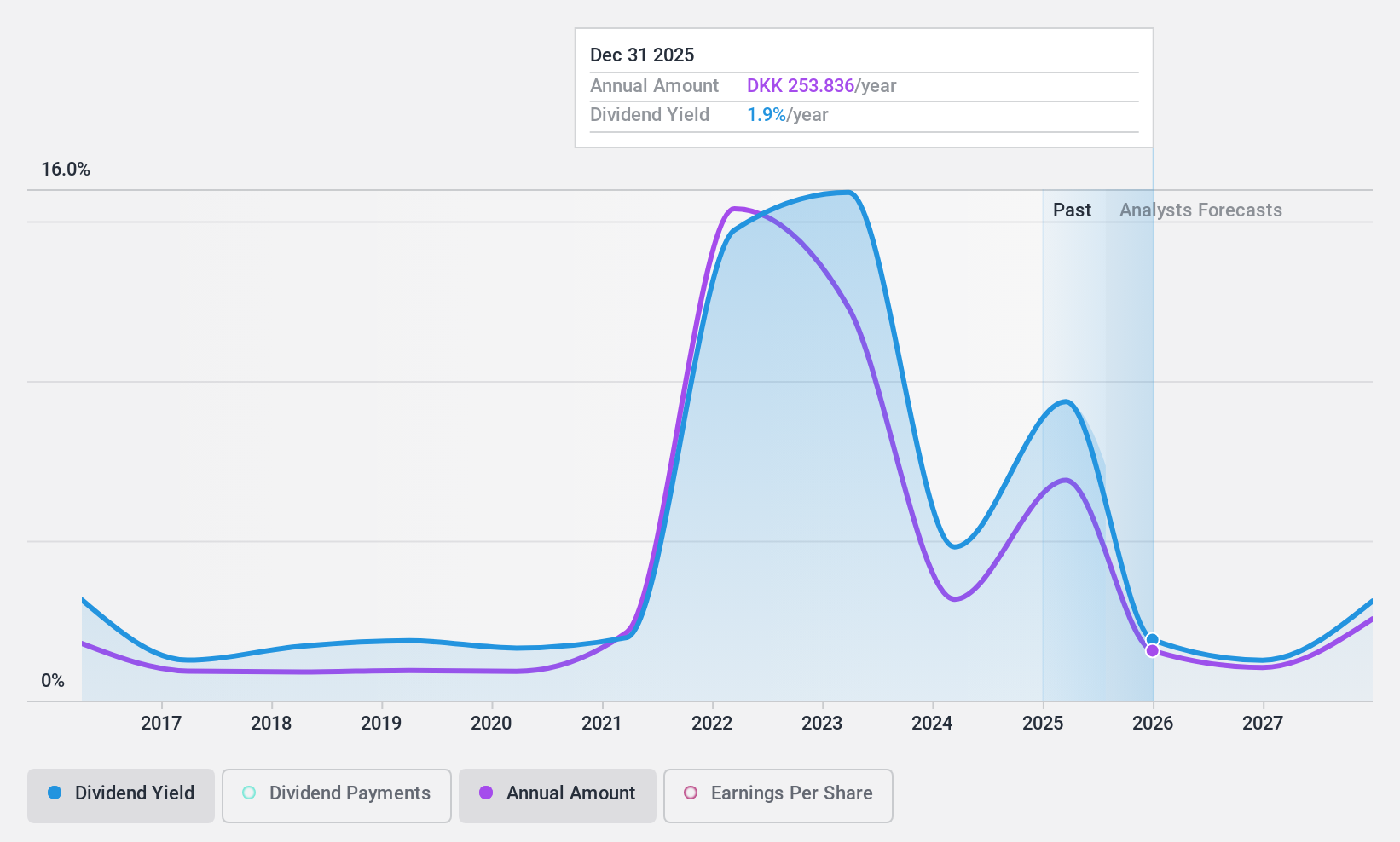

A.P. Møller - Mærsk (CPSE:MAERSK B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: A.P. Møller - Mærsk A/S operates as an integrated logistics company both in Denmark and internationally, with a market cap of DKK195.69 billion.

Operations: A.P. Møller - Mærsk A/S generates revenue through its Ocean segment at $38.29 billion, Logistics & Services at $14.90 billion, and Terminals at $4.70 billion.

Dividend Yield: 8%

A.P. Møller - Mærsk's dividend payments have been volatile over the past decade, though recent increases indicate potential growth. The company's dividends are well covered by both earnings and cash flows, with payout ratios of 34.4% and 29.1%, respectively. Despite a highly volatile share price, Maersk's dividend yield is among the top in Denmark at 8.05%. Recent strategic moves include a significant agreement with DP World to expand services in Brazil, potentially impacting future earnings stability.

- Click to explore a detailed breakdown of our findings in A.P. Møller - Mærsk's dividend report.

- Our comprehensive valuation report raises the possibility that A.P. Møller - Mærsk is priced lower than what may be justified by its financials.

HOMAG Group (DB:HG1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HOMAG Group AG, with a market cap of €470.64 million, manufactures and sells machines and solutions for the wood processing and timber construction industries worldwide through its subsidiaries.

Operations: HOMAG Group AG generates its revenue through the manufacture and sale of machinery and solutions tailored for the wood processing and timber construction sectors on a global scale.

Dividend Yield: 3.4%

HOMAG Group's dividend has been stable and reliable over the past decade, with recent increases reflecting growth. The payout ratio of 50.5% suggests dividends are covered by earnings, though cash flow coverage is unclear due to insufficient data. Despite a volatile share price recently, the dividend yield of 3.37% remains attractive but below top-tier levels in Germany. Recent financials show declining revenue and net income, potentially affecting future dividend sustainability.

- Click here to discover the nuances of HOMAG Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that HOMAG Group is trading beyond its estimated value.

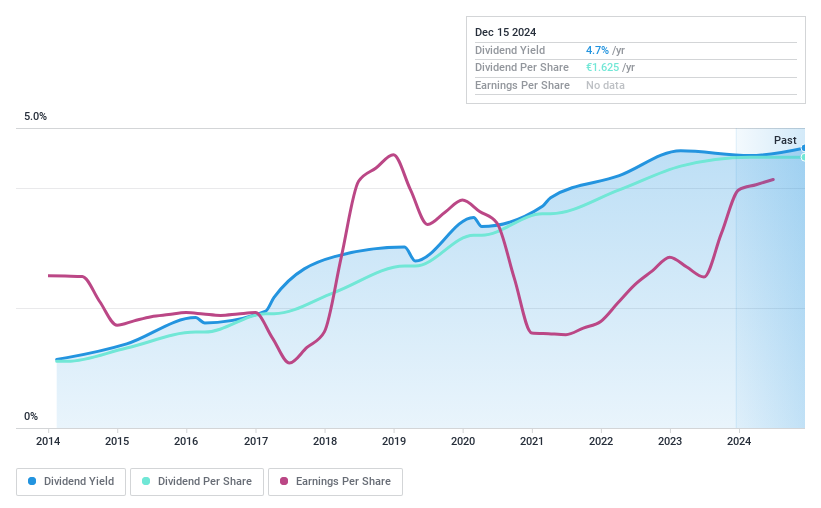

Texaf (ENXTBR:TEXF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Texaf S.A. develops, owns, and leases real estate properties in the Democratic Republic of Congo with a market cap of €126.86 million.

Operations: Texaf S.A.'s revenue is primarily derived from its real estate segment, which accounts for €27.27 million, supplemented by its quarrying operations at €5.10 million and digital activities contributing €0.56 million.

Dividend Yield: 5.1%

Texaf S.A. recently announced a dividend increase to EUR 1.23 per share, maintaining a stable and reliable dividend history over the past decade. While the payout ratio of 86.7% indicates dividends are covered by earnings, net income has decreased from EUR 11.64 million to EUR 7.43 million year-on-year, impacting profit margins significantly (from 40.1% to 23.5%). The cash payout ratio of 53.6% suggests dividends remain sustainable despite these challenges, though the yield is below Belgium's top tier at 5.08%.

- Take a closer look at Texaf's potential here in our dividend report.

- Upon reviewing our latest valuation report, Texaf's share price might be too optimistic.

Summing It All Up

- Investigate our full lineup of 229 Top European Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal