Snap (NYSE:SNAP) Sees 14% Price Increase Over The Past Month

Snap (NYSE:SNAP) experienced a price increase of 14% over the past month, amidst a broader upward trend in technology stocks. This movement aligns with the prevailing market upswing, where indices like the Nasdaq Composite have seen consecutive gains. Snap's stock trajectory might have been supported by this general tech sector rally, given that mega-cap tech stocks have been a significant driver of recent market momentum. While the specific events affecting Snap directly were not detailed, the consistent market rally, buoyed by easing trade tensions and positive economic data, likely played a crucial role in its share price elevation.

Looking at Snap's performance over a longer timeframe reveals a total return decline of 44.29% over the past year. This contrasts sharply with the broader US market's positive return of 10.6% and the 9.9% rise in the US Interactive Media and Services industry during the same period. Such disparity highlights the challenges Snap faces despite the recent uptick in its stock price amid a tech rally.

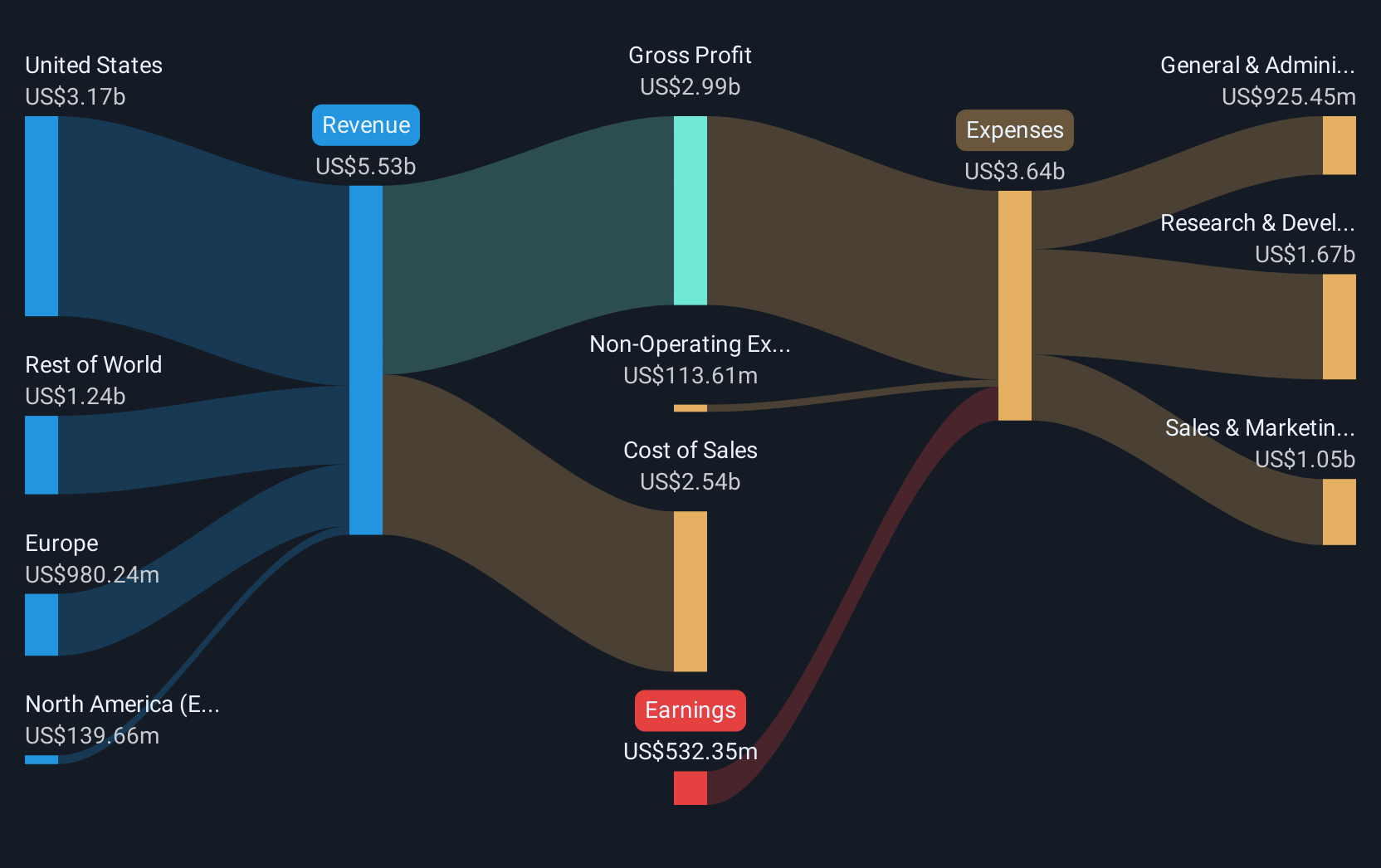

Snap's recent revenue growth, with Q4 2024 sales at US$1.56 billion, shows an improvement over the previous year. Earnings forecasts may be influenced by the tech sector's current momentum, but they remain cautious given Snap's profitability issues. The forecasted revenue growth rate of 9.4% for the coming years advances past broader market expectations, underscoring potential recovery, though tempered by ongoing non-profitability concerns.

Regarding price targets, Snap trades at US$9.03—below the consensus analyst price target of US$9.81. The modest discount suggests a cautious market outlook, considering the recent price movements and broader market performance. This difference might influence investor sentiment as Snap continues navigating market expectations and strategic challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal