Global Market Gems: 3 Penny Stocks With At Least US$700M Market Cap

Global markets have been navigating a complex landscape, with mixed performances across major indices and ongoing trade discussions influencing investor sentiment. Amid these developments, the allure of penny stocks remains significant for investors seeking opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, it continues to highlight investment areas that can offer value and growth potential when backed by strong financial health.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.40 | SGD162.12M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.20 | SGD8.66B | ✅ 5 ⚠️ 0 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR1.04 | MYR1.62B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.345 | MYR1B | ✅ 4 ⚠️ 3 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.46B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.18 | HK$744.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.30 | HK$2.25B | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.95 | £304.36M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.98 | £321.53M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.955 | £446M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,684 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Shaanxi Beiyuan Chemical Industry Group (SHSE:601568)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaanxi Beiyuan Chemical Industry Group Co., Ltd. operates in the chemical industry, focusing on the production and distribution of chemical products, with a market cap of approximately CN¥16.88 billion.

Operations: No specific revenue segments are reported for Shaanxi Beiyuan Chemical Industry Group Co., Ltd.

Market Cap: CN¥16.88B

Shaanxi Beiyuan Chemical Industry Group's recent financial performance highlights a significant improvement in earnings, with net income rising to CN¥87.8 million in Q1 2025 from CN¥16.19 million the previous year, reflecting a robust profit growth of 20.4% over the past year despite a historical decline of 33.7% annually over five years. The company's short-term assets significantly exceed both its short and long-term liabilities, indicating strong liquidity management. Although its return on equity remains low at 2.6%, debt levels are well-managed and operating cash flow coverage is substantial, showcasing solid financial health amidst stable volatility levels.

- Unlock comprehensive insights into our analysis of Shaanxi Beiyuan Chemical Industry Group stock in this financial health report.

- Assess Shaanxi Beiyuan Chemical Industry Group's previous results with our detailed historical performance reports.

Kingland TechnologyLtd (SZSE:000711)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kingland Technology Co., Ltd. offers ecological environment solutions in China and has a market cap of CN¥5.29 billion.

Operations: The company generates revenue of CN¥498.10 million from its operations within China.

Market Cap: CN¥5.29B

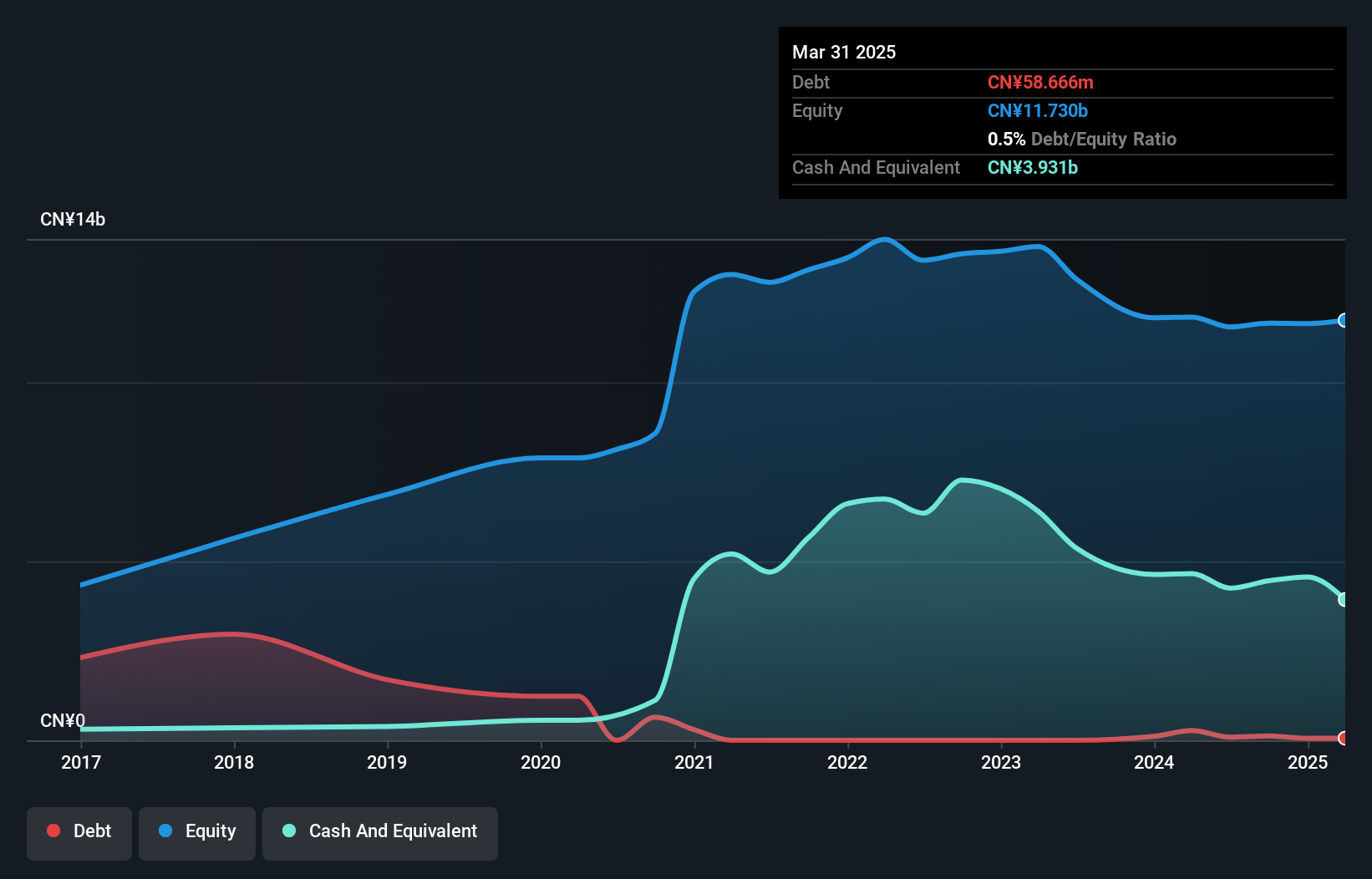

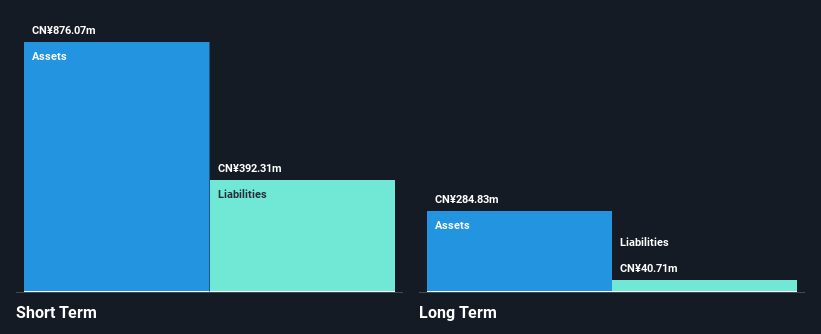

Kingland Technology Co., Ltd. is navigating financial challenges, marked by its unprofitability despite reducing losses at a significant rate over five years. The company reported a substantial revenue increase to CN¥126.33 million in Q1 2025 from CN¥6.08 million the previous year, yet net losses persist at CN¥12.95 million for the quarter. Its financial position shows short-term assets exceeding liabilities and a satisfactory net debt to equity ratio of 0.2%. However, cash runway concerns remain as it has less than a year based on current free cash flow trends, compounded by an inexperienced management team with only 1.3 years average tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of Kingland TechnologyLtd.

- Review our historical performance report to gain insights into Kingland TechnologyLtd's track record.

Yotrio Group (SZSE:002489)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yotrio Group Co., Ltd. engages in the research, development, manufacture, and sale of outdoor furniture products across China and various international markets, with a market cap of CN¥8.03 billion.

Operations: Yotrio Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥8.03B

Yotrio Group has demonstrated financial resilience with a recent increase in quarterly revenue to CN¥2.54 billion from CN¥2.27 billion year-over-year and net income rising to CN¥371.57 million. Despite a low return on equity of 13.2%, the company maintains strong liquidity, with short-term assets significantly surpassing liabilities and cash exceeding total debt, ensuring robust interest coverage. However, earnings have been influenced by a large one-off gain of CN¥348.9 million, which may not be sustainable long-term. The company's price-to-earnings ratio of 15.3x suggests it is undervalued compared to the broader Chinese market average of 38.2x.

- Dive into the specifics of Yotrio Group here with our thorough balance sheet health report.

- Examine Yotrio Group's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Discover the full array of 5,684 Global Penny Stocks right here.

- Want To Explore Some Alternatives? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal