SensorTower: Global short drama in-app purchase revenue of nearly US$700 million in the first quarter increased threefold year-on-year

The Zhitong Finance App learned that SensorTower published an article stating that in the first quarter of 2025, global in-app purchase revenue for short dramas was close to 700 million US dollars, an increase of nearly four times that of the first quarter of 2024. Short drama apps with a first-mover advantage, such as “ReelShort” and “DramaBox,” continue to lead the way, while many skit rookies released in the second half of 2024, such as “DramaWave,” “NetShort,” and “FlickReels,” grew rapidly.

The cumulative revenue of the global skit app's internal purchases is approaching US$2.3 billion

Since 2024, global in-app revenue for short dramas has grown rapidly, from US$178 million in Q1 2024 to nearly US$700 million in Q1 2025, and the market size has increased nearly fourfold. As of March 2025, the cumulative revenue of global short drama apps is approaching 2.3 billion US dollars.

The number of downloads of skit apps is also rising rapidly. The number of global downloads in Q1 2025 exceeded 370 million times, 6.2 times that of Q1 2024. As of March 2025, the cumulative number of global short drama apps has been downloaded close to 950 million times.

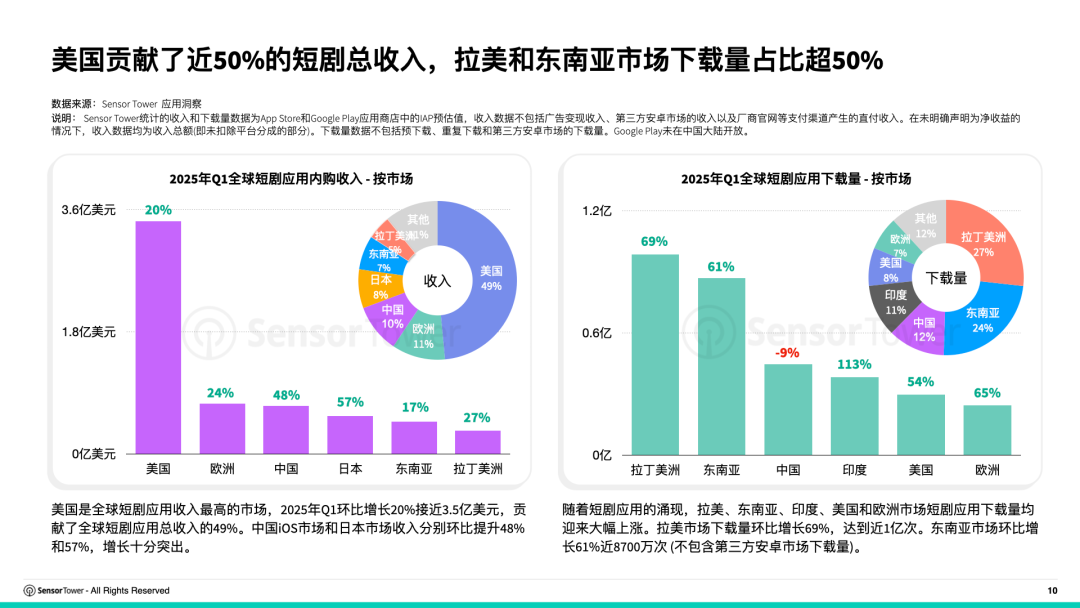

The US market contributed the most to revenue, and download growth was outstanding in emerging markets such as Latin America, Southeast Asia, and India

The US is the market with the highest revenue for skit apps in the world. The Q1 quarter of 2025 increased 20% to nearly 350 million US dollars, contributing 49% of the total revenue of global skit apps in the quarter. It is a must-compete place for skits to go overseas, and competition is fierce.

Meanwhile, in emerging markets such as Latin America, Southeast Asia, and India, mobile users are huge, and the skit market is booming, becoming a key incremental opportunity for new players. In the first quarter of 2025, the number of downloads of short drama apps in the Latin American market increased 69% month-on-month, reaching nearly 100 million times (not including third-party Android market downloads). The number of downloads of “DramaWave” surged 27 times in the Latin American market, surpassing the top ranking of the most established skit airborne download list. The market also provides broad room for growth for skit rookies such as “RapidTV,” “MeloShort,” “FlickReels,” and “Swift Drama.”

The Southeast Asian market also saw significant growth, rising 61% month-on-month in Q1 of 2025, approaching 87 million downloads (not including third-party Android market downloads). The number of downloads of skit apps such as “DramaWave,” “FreeReels,” and “Melolo” surged 16 times, 11 times, and 21 times, ranking 2nd, 4th, and 6th in the Southeast Asian skit download list.

“ReelShort” and “DramaBox” lead the way, and skit rookies such as “DramaWave” rise rapidly

In the first quarter of 2025, internal purchase revenue for “ReelShort” and “DramaBox” increased by 31% and 29%, respectively, to reach US$130 million and US$120 million, taking the top and runner-up in the overseas short drama application revenue list and growth list. As of March 2025, the cumulative global revenue of “ReelShort” and “DramaBox” reached 490 million and 450 million US dollars, respectively.

Various short drama rookie “NetShort,” “Dramawave,” and “FlickReels”, which went on sale in the second half of 2024, saw impressive revenue growth, making it into the top ten overseas skit revenue lists.

In March 2025, “NetShort” frequently launched the hit skit “Evil Bride vs. CEO's Secret Mom”, etc., and then entered a rapid growth channel. In 2025Q1, revenue increased 171% month-on-month, making it the 5th place in the overseas skit revenue list. According to Sensor Tower data, “NetShort” revenue and downloads have continued to grow since its launch in July 2024, with cumulative revenue exceeding US$57 million as of April 2025.

“FlickReels”'s revenue surged 375% this quarter, ranking 7th in the overseas short drama revenue list. “FlickReels” performed very well in the US market. With the launch of the hit short drama “The Reunion of Genius Baby”, “FlickReels” rose to 3rd place in the US iOS download list on March 8, and continued to rank 2nd in the US iOS download list from March 9 to 11.

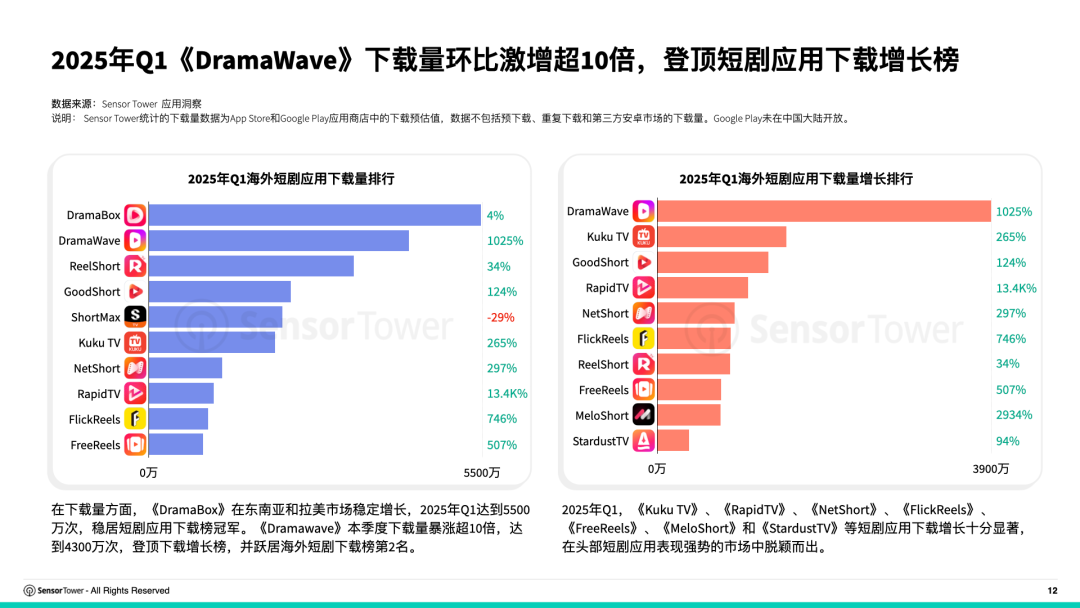

In terms of download volume, “DramaWave” quickly broke through in the Southeast Asian and Latin American markets. The number of downloads in Q1 skyrocketed more than tenfold in 2025, ranking 2nd in the overseas skit download list, and became the skit app with the biggest increase in downloads in the 2025Q1.

Rookie skit shows such as “Kuku TV,” “RapidTV,” “NetShort,” “FlickReels,” “FreeReels,” “MeloShort,” and “StardustTV” saw a significant increase in downloads in Q1 in 2025, standing out in a market where top skit apps are still strong.

DramaWave's Q1 downloads skyrocketed more than tenfold in 2025

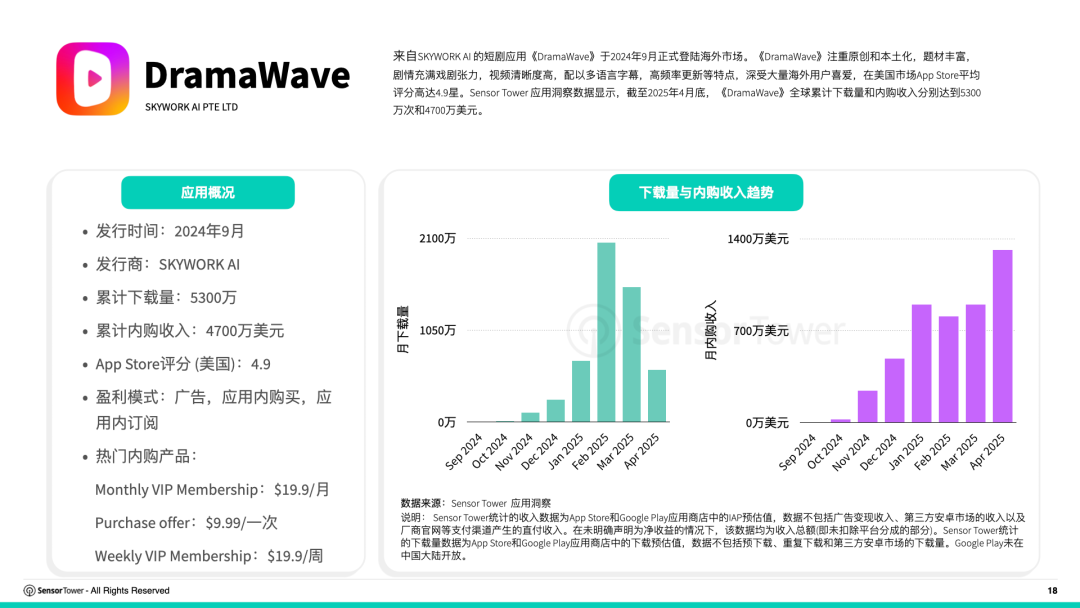

In September 2024, SKYWORK's AI short drama application “DramaWave” officially landed in overseas markets. It received an average rating of 4.9 stars on the US App Store for its rich themes, high-definition smooth video, multi-language subtitles, and high-frequency updates.

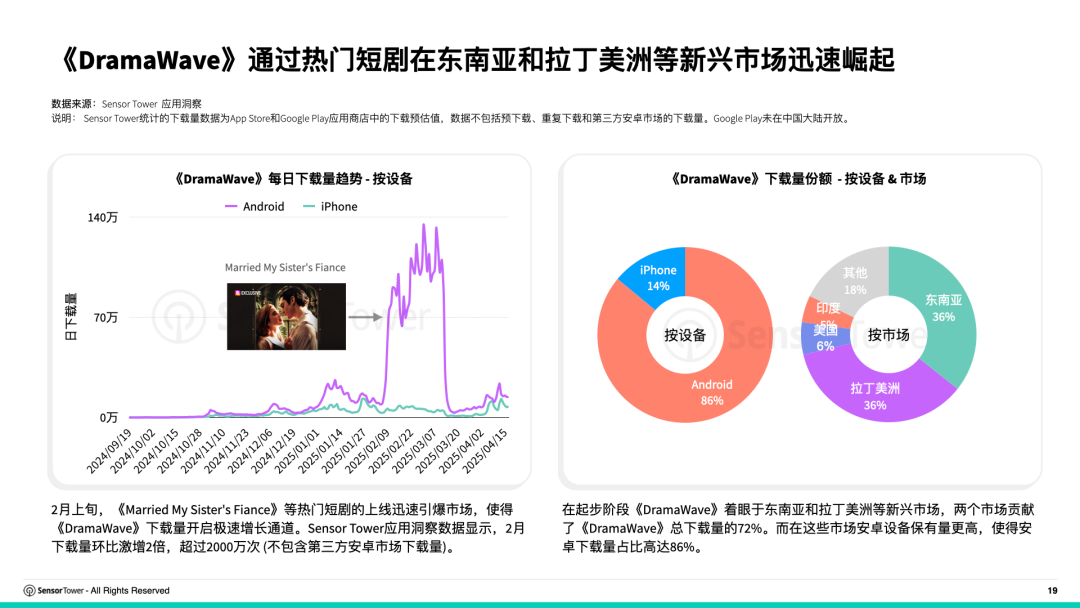

In early February, the launch of popular skits such as “Married My Sister's Fiance” quickly exploded the market, opening a channel of rapid growth in the number of downloads of “DramaWave”. According to Sensor Tower application insight data, the number of global downloads of “DramaWave” skyrocketed more than tenfold in the first quarter of 2025. By the end of April 2025, the cumulative number of global downloads and internal purchase revenue reached 53 million times and 47 million US dollars, respectively.

“DramaWave” initially focused on emerging markets such as Southeast Asia and Latin America, which contributed 72% of total downloads. However, the number of Android devices in these markets is even higher, making it account for up to 86% of Android downloads. With the rapid growth of the Latin American and Southeast Asian markets, the average number of monthly active users of “DramaWave” increased dramatically. In April 2025, it became the runner-up, second only to the champion “DramaBox”.

“DramaWave” has rapidly risen thanks to localized advertising and social media such as TikTok

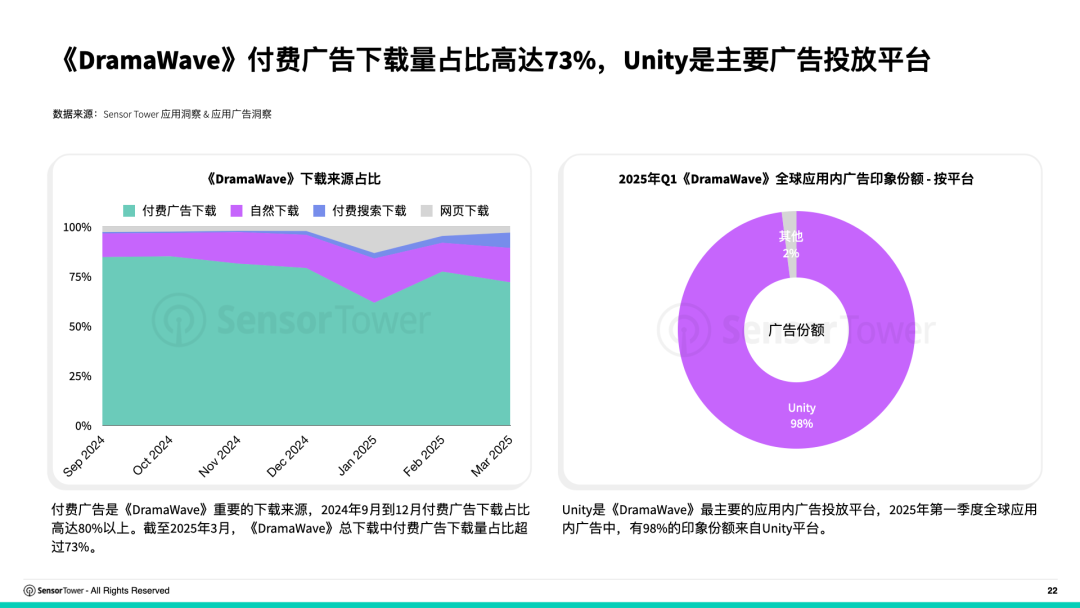

Paid ads are an important download source for “DramaWave,” with paid ads accounting for more than 80% of downloads from September to December 2024. Unity is the main in-app advertising platform for “DramaWave”.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal