Hong Kong Stock Exchange: The market capitalization of the new energy sector in the Hong Kong stock market increased to US$568 billion, accounting for 12.5% of the total market value of the Hong Kong market

The Zhitong Finance App learned that recently Xu Jingwei, head of the Hong Kong Stock Exchange Global Listing Service Department, published an article saying that as China plays an increasingly important role in promoting global green transformation, the new energy ecosystem in the Hong Kong capital market continues to expand, providing more opportunities for investors to lay out new energy and green technology innovation industries. According to statistics, the market capitalization of the new energy sector in the Hong Kong stock market has more than quadrupled from 2015 to March 2025, from 125 billion US dollars to 568 billion US dollars, accounting for 12.5% of the total market value of the Hong Kong market.

Xu Jingwei introduced the advantages of the Hong Kong capital market as a financing center from five aspects.

1 The Hong Kong Stock Exchange is the world's leading financial center

In the ten years from 2014 to 2024, HKEx's IPO amount reached US$305 billion, ranking first in the world, establishing Hong Kong's international status as the preferred listing destination for companies.

The Hong Kong market performed steadily in 2024, completing the second-largest IPO in the world. Five of the world's top ten stock refinancing transactions were also carried out in the Hong Kong market. In 2025, the Hong Kong market continued to be active, with many active IPOs, driving financing in the first quarter of 2025 to reach US$20.5 billion, a new quarterly high since the second quarter of 2021.

New energy companies are a major source of financing. Recently, two leaders in the new energy industry have completed large-scale refinancing in Hong Kong. This also reflects the Hong Kong market's mature and efficient refinancing mechanism, which can support the refinancing of large enterprises and meet the continuous development needs of capital-intensive industries such as electric vehicles and renewable energy.

2 Diverse investors gather in the Hong Kong market

The Hong Kong market has a diverse investor structure, which allows new energy companies to access a large number of local and international individual and institutional investors in Hong Kong, as well as a large and rapidly growing investor base in mainland China, which can help new energy companies achieve business development through multi-channel financing.

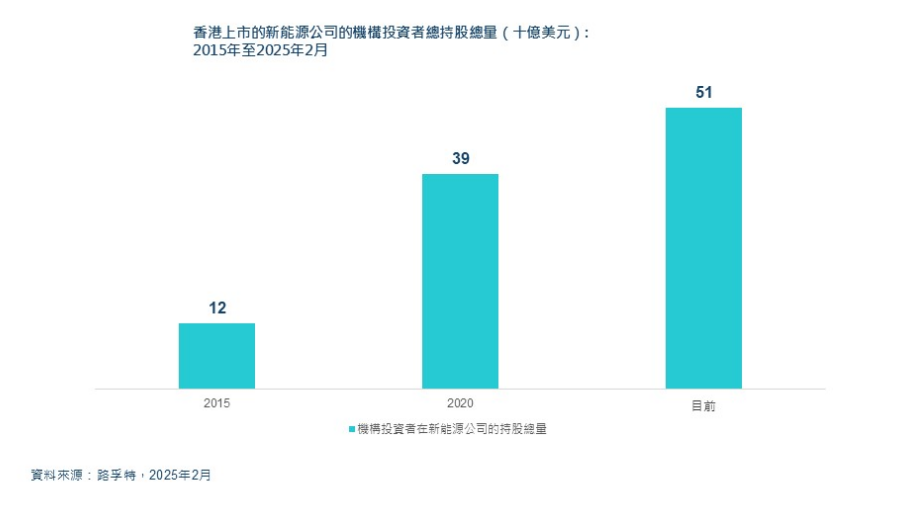

International institutional investors are increasingly interested in participating in the Hong Kong market, which is reflected in the layout of the new energy sector in the Hong Kong market.

According to Lufter statistics, institutional investors' holdings in NEV companies listed in Hong Kong surged more than quadrupled from US$12 billion at the end of 2015 to US$51 billion in February 2025. Among them, Asian institutions were particularly active, increasing their holdings from US$4 billion in 2015 to approximately US$18 billion in February 2025. As of February 2025, Chinese capital accounted for about 15% of total institutional investment.

The participation of mainland Chinese capital in the Hong Kong market (especially in the field of new energy) is increasing day by day. Since the launch of Hong Kong Stock Connect in 2014, its product coverage and market participation have steadily increased — its turnover accounted for 17.3% of total Hong Kong market turnover in 2024. By the end of 2024, Southbound Capital's holdings in Hong Kong Stock Connect's new energy targets accounted for about 20% of Hong Kong Stock Connect's total shareholding.

3. Continued optimization of the Listing Rules to keep pace with the times

Over the past decade, HKEx has continuously optimized its listing system to meet the financing needs of innovative industry companies, many of which are new energy companies. In 2018, the Hong Kong Stock Exchange added several new sections to the Listing Rules. For the first time, biotechnology companies with no income and companies with different rights structures with the same shares were allowed to go public in Hong Kong, and overseas issuers were welcome to go public in Hong Kong for a second listing.

In 2023, the Hong Kong Stock Exchange added Chapter 18C to the Listing Rules to specifically develop exclusive listing channels for specialty technology companies (including companies engaged in the new energy, advanced materials, energy saving and environmental protection industries).

Chapter 18C listing rules are tailored for new energy industry companies with breakthrough technology and other companies that meet the special technology industry categories to meet the actual needs of such companies.

In formulating Chapter 18C listing rules, the Hong Kong Stock Exchange fully took into account the long R&D cycle and high capital investment characteristics of companies in the specialty technology industry, and allowed them to apply for listing through the targeted rules of Chapter 18C when they had no revenue or in the early stages of development.

This listing system allows innovative companies to obtain public funding at an early stage of development and speed up the commercialization process, thereby promoting their research and development of transformative energy technologies and supporting the global achievement of green transformation goals. By connecting global capital, Hong Kong is becoming the preferred financing platform for new energy companies to achieve strategic upgrades.

Over the past year, we have seen many innovative companies in the technological phase successfully achieve financing in Hong Kong, covering cutting-edge fields such as robotics, autonomous driving systems, artificial intelligence drug development, and new energy technologies.

4 Continued improvement in mobility and vitality

In recent years, the HKSAR Government, HKEx and all parties in the market have collaborated to promote a series of market optimization measures to effectively enhance the liquidity and vitality of the Hong Kong market.

Core measures include lowering stamp duty on stocks, lowering fees for market data services, implementing normal market opening in bad weather, optimizing position limits for derivatives products, introducing a new treasury stock repurchase mechanism, and implementing a number of connectivity optimization measures.

With the implementation of various optimization measures, the activity of the Hong Kong market has increased significantly. According to HKEx statistics, the average daily turnover of the Hong Kong stock market in 2024 was HK$131.8 billion, up 26% year on year. The daily turnover for the first quarter of 2025 reached HK$242.7 billion, an increase of over 144% year on year.

5 Diversified Product Ecosystems

HKEx's diverse product ecosystem can provide issuers with comprehensive support from listing financing to investor interaction. This is of great value to new energy companies that are growing rapidly and need to cope with a constantly changing market environment.

After successfully listing in Hong Kong, issuers can issue a range of derivative or structured products, including stock options, index futures and derivative warrants. These tools help improve issuers' stock liquidity, promote price discovery, and attract more investors.

Companies in the new energy industry often need to cope with the iteration of industrial technology and rapid changes in the market pattern. Through diversified financing instruments in the Hong Kong market, listed issuers can manage capital more effectively, help investors manage risk, and enhance investor confidence.

New energy prospects

In the long run, whether it is the new energy industry or the new energy sector of the Hong Kong capital market, the development prospects are very broad. Global trends such as industry carbon reduction, energy efficiency improvement, and the spread of electric vehicles are reshaping the industrial landscape, creating plenty of opportunities for innovative enterprises focusing on the development and application of sustainable technology.

We are in an era of innovation. Industries such as solar cells, photovoltaic technology, and smart grid construction have achieved breakthrough development. In the future, key areas such as the application of green hydrogen, new energy storage systems, vertical industries related to electric vehicles, artificial intelligence energy management and exploration of controlled nuclear fusion technology will continue to drive industrial technological innovation.

In this context, the Hong Kong Capital Market is committed to building an effective platform for connecting green technology with global capital, promoting the development of a sustainable and innovative global economy, and enhancing the vitality of Hong Kong's financial market.

Wall Street Journal

Wall Street Journal