Market Might Still Lack Some Conviction On Zevia PBC (NYSE:ZVIA) Even After 29% Share Price Boost

Those holding Zevia PBC (NYSE:ZVIA) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 168% following the latest surge, making investors sit up and take notice.

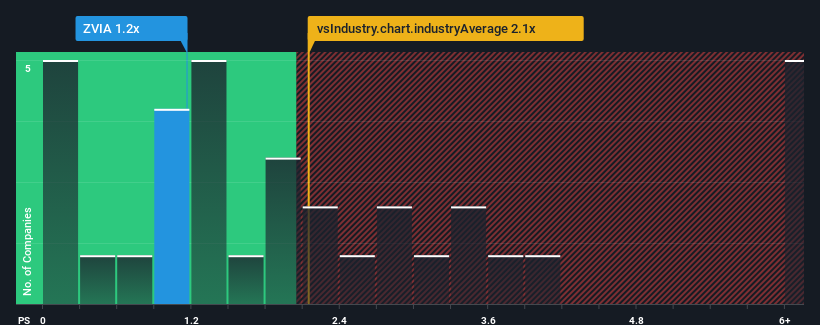

In spite of the firm bounce in price, when close to half the companies operating in the United States' Beverage industry have price-to-sales ratios (or "P/S") above 2.2x, you may still consider Zevia PBC as an enticing stock to check out with its 1.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Our free stock report includes 3 warning signs investors should be aware of before investing in Zevia PBC. Read for free now.View our latest analysis for Zevia PBC

How Zevia PBC Has Been Performing

Zevia PBC could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zevia PBC.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Zevia PBC would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 6.0% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 5.9% as estimated by the six analysts watching the company. With the industry predicted to deliver 4.5% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Zevia PBC's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Zevia PBC's P/S

Despite Zevia PBC's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Zevia PBC's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Zevia PBC you should be aware of, and 1 of them shouldn't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal