Roku (NasdaqGS:ROKU) Shares Rise 19% Over the Past Month Following Q1 2025 Earnings Improvement

Roku (NasdaqGS:ROKU) recently experienced significant developments, including guidance for improved financial results and the release of new products. The company's Q1 2025 earnings showed notable improvements with increased sales and reduced net losses compared to the previous year, providing a positive outlook. Furthermore, the expansion of its product lineup and updates to existing offerings likely boosted investor confidence. Over the month, Roku's share price increased by 19%, moving in alignment with the broader market's rise of 4% over the week but significantly outperforming on a longer timeline, suggesting these internal factors added weight to its performance.

Buy, Hold or Sell Roku? View our complete analysis and fair value estimate and you decide.

Roku's recent developments, including improved financial guidance and product line expansion, are poised to influence its growth strategy positively. These efforts help support the company's narrative of harnessing home screen integration and international expansion to unlock revenue potential. The current financial momentum is reflected in Roku's share price increase of 19% over the past month. This is contrasted against a broader market uptick of 4% over the same period, underscoring the weight of its internal improvements.

For a longer-term perspective, Roku achieved a total return of 14.68% over the last year. This performance demonstrates a strong recovery phase, especially when compared to the broader U.S. market return of 11.6% and the U.S. Entertainment industry return of 52.7% over the same period. While Roku outperformed the market, it lagged behind its industry counterparts, indicating sector-specific pressures and opportunities.

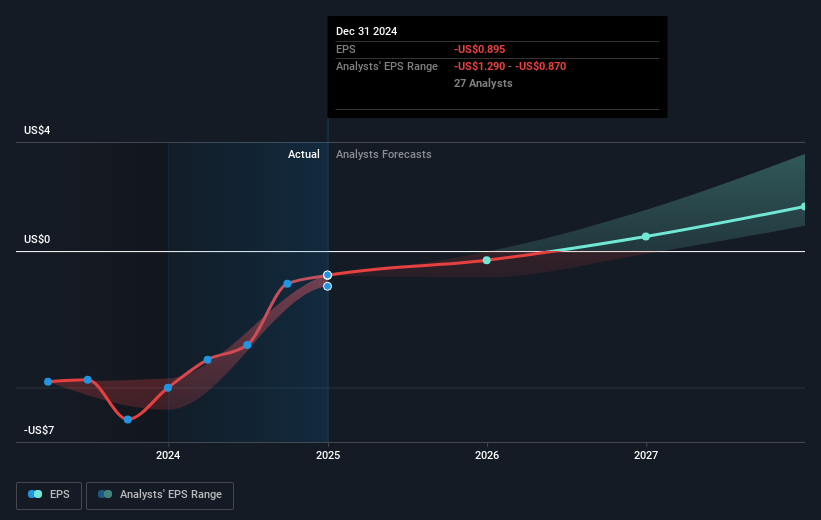

The enhancements in product offerings and amplified advertising partnerships are expected to bolster revenue and earnings forecasts. Projections suggest significant growth reaching US$5.6 billion in revenues and US$237.3 million in earnings by 2028. However, estimates on future performance vary among analysts, with revenue growth expected at 9.9% per year and earnings projected to grow at 55.92% annually until profitability is achieved in the next three years.

In light of these developments, it's important to consider Roku's recent share price of US$69.28 in relation to the analysts’ price target of US$90.79, which is 23.7% higher. The consensus price target highlights investor expectations for continued positive performance, despite market challenges and forecasting disagreements. Investors should evaluate these factors carefully, considering both the risks and opportunities that accompany technological advancement and market expansion.

Our valuation report unveils the possibility Roku's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal